After we looked at why bitcoin looks more attractive locally than gold in the previous review, another confirmation of this forecast appeared today.

Well-known crypto influencer Mike McGlone, senior commodities strategist at Bloomberg Intelligence, explained in a tweeter post that BTC could outperform gold in the next few months and even years.

Bitcoin: risk aversion vs. stock market correlation

Bitcoin has been relatively stable since the end of February, while other assets have actively embraced the geopolitical turmoil. In a March 17 tweet, McGlone talked about the Fed, Bitcoin, gold, and the stock market. He stated that inflation and the geopolitical crisis could be another milestone in the development of the main cryptocurrency.

In addition, McGlone said that BTC is unlikely to stop outperforming gold and the stock market. The Fed's expected six rounds of interest rate hikes could lead to lower asset prices and a stronger U.S. dollar.

However, not everything is clear here yet. Bitcoin has traded tight to traditional financial markets in recent months and has been correlated with the stock market. What will happen to this relationship against the backdrop of tightening the Fed's monetary policy remains to be seen.

Bitcoin vs. Alternative payment methods

While Ukraine is still under attack, the use of Bitcoin as an alternative solution to traditional payment methods is growing. Nowadays, when it has become very difficult for Ukrainians to access financial solutions, Bitcoin is becoming an obvious alternative.

People have donated over $50 million using digital currencies. These funds can be used to pay for new military materials and help local communities affected by the conflict.

As McGlone says, Bitcoin may continue to outperform gold and other assets in the next few months. However, it may take some time for the main cryptocurrency to break through a new all-time high again.

Distrust in the Government Generates Demand for Bitcoin

Bitcoin is often touted as a hedge against the bad policies of centralized governments, and this narrative is not going away anytime soon. Mike Novogratz, CEO of Galaxy Digital, said that Bitcoin will become more widespread as long as governments continue to interfere with their economies.

In an interview with CNBC, Novogratz noted that bitcoin is unlikely to succeed as a transactional currency. However, its strength can be used as a store of value (SOV) or "digital gold."

The investor notes that the community of Bitcoin supporters has reached such a size that it could become the eighth country in the world in terms of the number of people. It attracts participants who have lost faith in their governments, and these sentiments continue to mount.

Novogratz cited the U.S., Turkey, and Russia as examples of growing frustration with governments. He explained that if Fed Chairman Jerome Powell or Treasury Secretary Janet Yellen can bring the U.S. economy out of inflation, U.S. citizens may no longer need to buy Bitcoin.

Similarly, Russian and Turkish citizens who own their wealth in Russian rubles or Turkish liras may be looking for ways to hedge against inflation at the moment, given the current economic situation in both countries.

Novogratz argues that when economic mismanagement takes place, Bitcoin provides a great alternative to struggling fiat currencies.

Bullish Forecast: Arguments for BTC Growth

Novogratz has remained a Bitcoin bull all this time, despite its fall. He previously stated his expectations that the "viral adoption" of the first cryptocurrency would be the catalyst needed for the asset's price to reach $500,000 in the next five years.

Galaxy Digital's CEO wasn't the only bull reiterating his stance on Bitcoin. An equally well-known crypto advocate, Michael Saylor, CEO of MicroStrategy, recently called Bitcoin the "American Dream" for its ability to stay unaffected by political tensions.

Does the technical picture confirm bullish optimism?

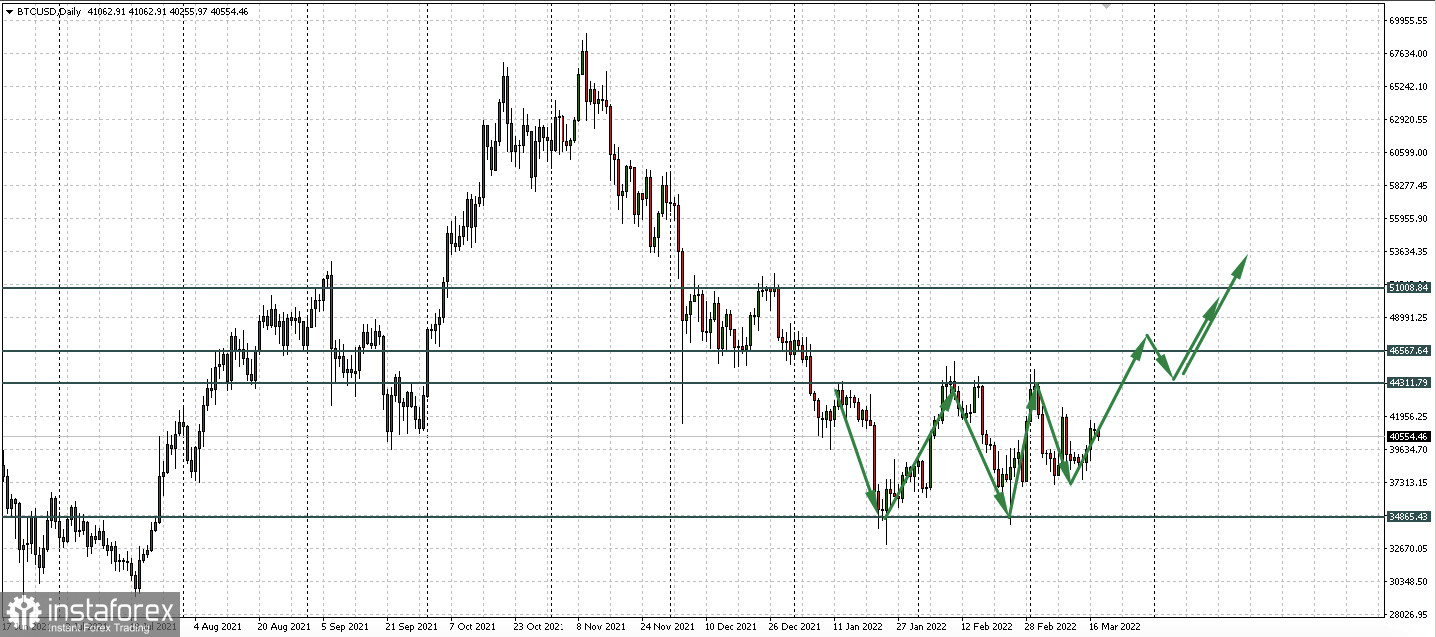

Meanwhile, Bitcoin remains within the sideways range of $34,800 - $44,300 per coin. There continues to form either a triple bottom or an inverted head and shoulders. However, both of these reversal patterns are modifications of each other.

The important thing is that the price continues to recover, which means approaching the key border at 44,300, which is the neckline for the figure. Its break and consolidation above the medium term will open the way for BTCUSD to the area of $51,000 - $53,000 per coin.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română