EUR/USD

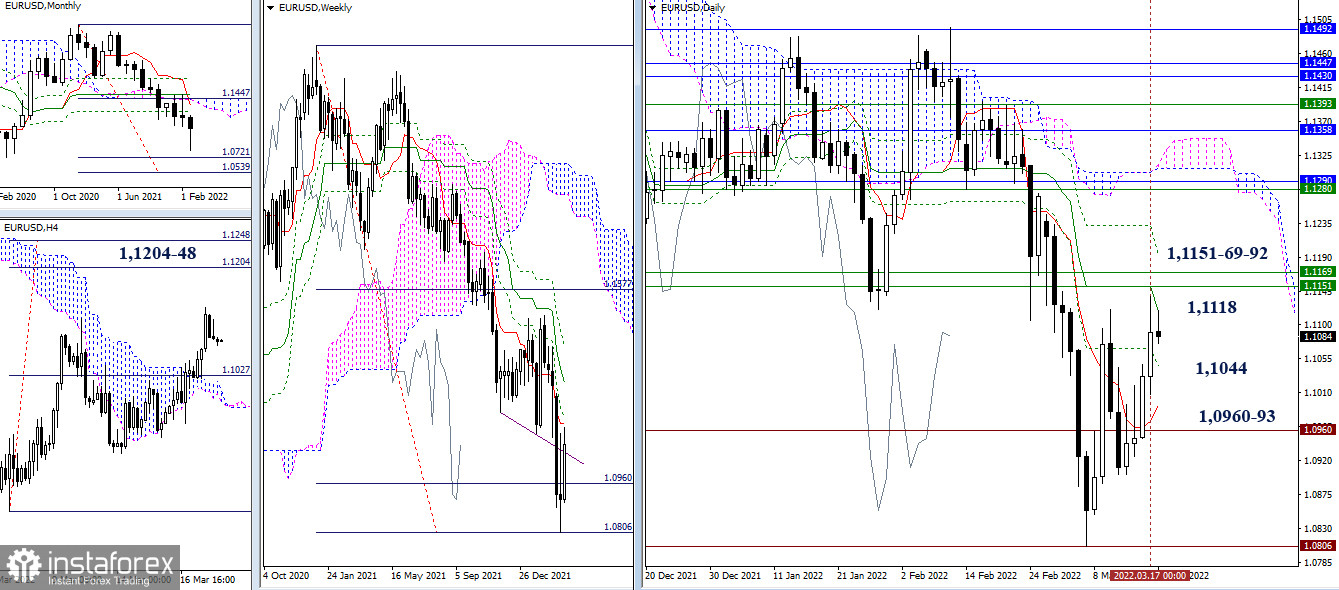

Bulls continued their rise yesterday and reached the 1.1151-69 zone. At the same time, the weekly levels here retain their location, but the daily medium-term trend today came out to meet the bulls (1.1118), thereby expanding the resistance zone. On H4 the day before, a target was formed for the breakdown of the H4 cloud (1.1204-48).

Based on all of the above, we can state that in order for new upward prospects and opportunities to appear, bulls will now need to overcome a fairly wide zone of attraction and resistance, the boundaries of which can be noted at 1.1118 - 1.1151-69 - 1.1192 - 1.1204-48. Consolidation above will fulfill the H4 target, eliminate the daily Ichimoku death cross and return short-term weekly support to bulls.

The resistance encountered is a fairly wide and fortified zone of opposition, so there are high chances of a rebound or a pullback movement. We can note today's supports at 1.1044 (daily Fibo Kijun) and 1.0993-60 (daily short-term + the first target of the daily target).

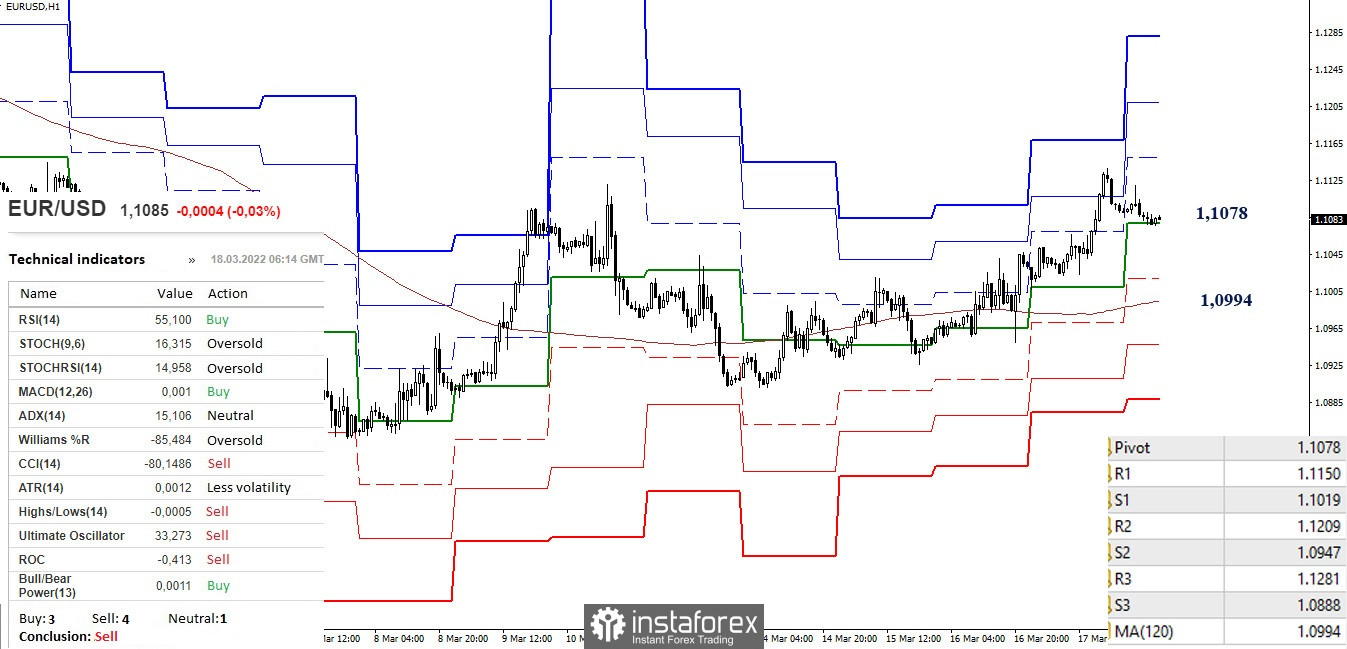

In the lower timeframes, the rise was replaced by a corrective descent. At the moment, the support of the central pivot point (1.1078) is being tested, then the key level responsible for the balance of power, the weekly long-term trend (1.0994) may come into play. Upward targets within the day, in case the correction is completed, are the resistance of the classic pivot points (1.1150 - 1.1209 - 1.1281).

***

GBP/USD

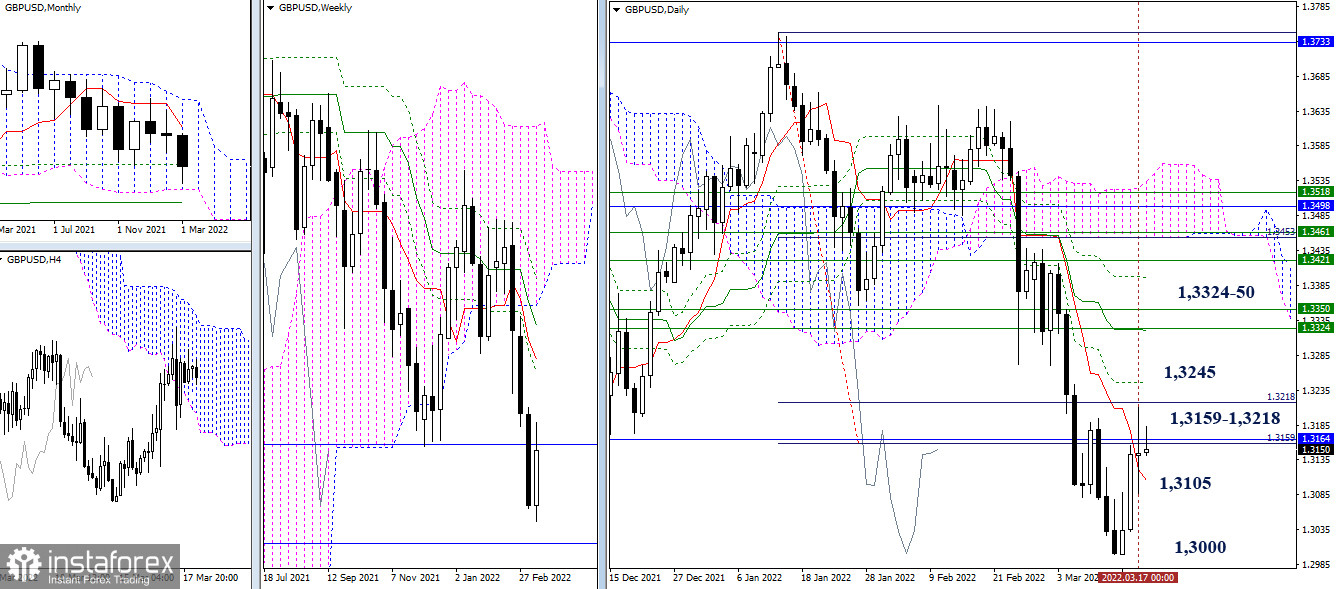

Testing of resistances in the area of 1.3159 - 1.3218 on the daily period ended with a candle of uncertainty. We are closing the week today. What is important is the weekly result and the pattern of the last two candles on this timeframe. The resistance zone 1.3159 - 1.3218 retains its significance and influence. The next resistance at the moment can be seen at 1.3245 (daily Fibo Kijun) and 1.3324-50 (weekly levels). Supports in the current situation are at 1.3105 (daily short-term trend) and 1.3000 (minimum extremum).

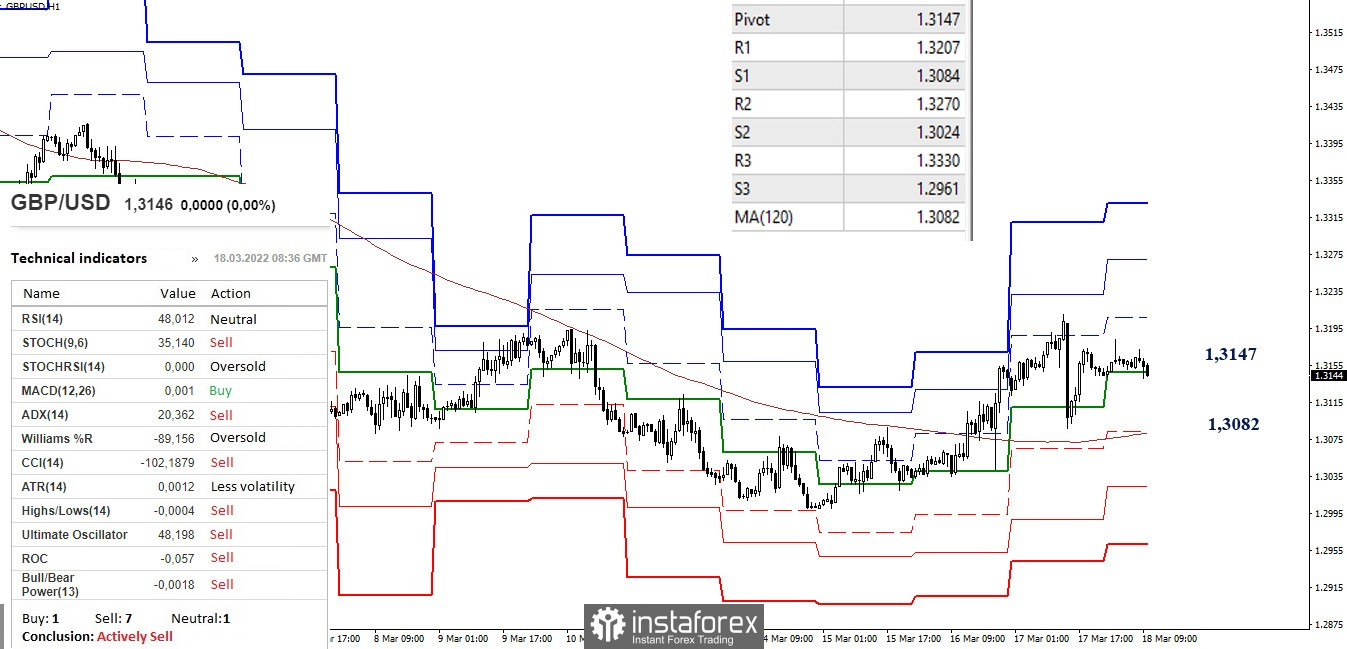

At the moment, the pair is in the correction zone on the lower timeframes. Now the support of the central pivot point of the day (1.3147) is being tested. The next major support is at 1.3082 (long-term weekly trend). Consolidation below will return bearish advantages to the market. S2 (1.3024) and S3 (1.2961) will serve as the next supports if the decline continues. If the bullish players manage to get out of the correction zone, then upward targets within the day will be 1.3207 – 1.3270 – 1.3330 (the resistance of the classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română