Hello, dear traders!

The euro extended gains versus the dollar yesterday. Notably, the euro is bullish amid the hawkish stance of the US Federal Reserve on monetary policy. At the March meeting, the regulator raised interest rates by 25 basis points. Moreover, the Fed plans to proceed with the tightening of monetary policy by means of hiking rates further and reducing the balance sheet. Therefore, in spite of the hawkish Fed, the dollar came under pressure versus the basket of all currencies. Generally speaking, such a scenario has long been priced in the value of the dollar by market participants.

At the same time, a fall in the greenback partially came because both the Fed and Chairman Powell might sound less hawkish than they should have. However, this is not entirely so. In the light of the pandemic and the armed conflict in Ukraine, raising interest rates only makes sense given high inflation. The Fed used to call the rising inflation rate transitory. However, it changed its rhetoric several months ago. Perhaps the Minutes of the FOMC meeting could shed any light on why the greenback reacted to monetary policy tightening with a decrease.

Speaking of macro events, yesterday's reports in the US could not trigger a sell-off of the dollar because almost all data came in the green zone, i.e. better than expected. Today, the macroeconomic calendar contains no important events whatsoever. The only reports worth paying attention to will be the eurozone balance of trade and existing home sales in the US.

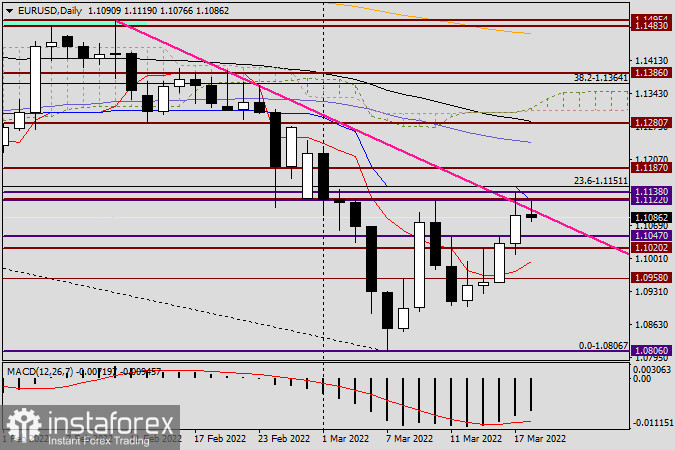

Daily

According to the daily chart, the most commonly traded pair in the forex market kept scoring gains and hit the 1.1138 high. The quote tested and broke through resistance at 1.1122 and the pink resistance line, drawn between 1.1495 and 1.1358. Nevertheless, bulls were unable to break through those barriers on the first try, and the price closed at 1.1090, well below the strong technical level of 1.1100. At the moment of writing, EUR bulls are trying to extend the uptrend. Having approached the broken level of 1.1122, the pair encountered strong resistance that got stiffer due to the blue Kijun line of the Ichimoku indicator. If EUR bulls are strong enough to close weekly trades above 1.1122 and yesterday's high of 1.1138, the uptrend will deepen. On Monday, we will analyze the situation taking account of the formed weekly candlestick and its closing price.

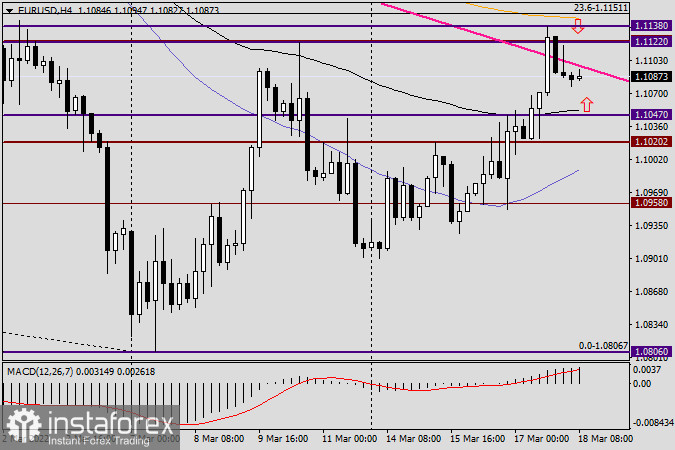

H4

Those willing to trade EUR/USD today should consider selling the pair after a rise to the orange 200-day exponential moving average at 1.1147 and buying the instrument after a fall to the black 89-day exponential moving average at 1.1052. On Monday, we will analyze the situation taking into account the weekly closing price.

All the best!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română