Analysis of transactions in the EUR / USD pair

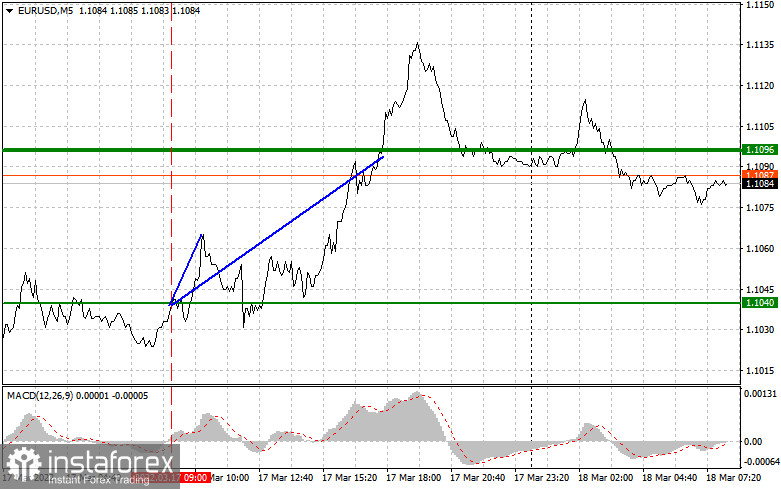

A signal to buy emerged after EUR/USD hit 1.1040. Coincidentally, the MACD line was starting to move up from zero, so the pair rose by 25 pips. Traders who remained in the market until the end of the day got more than 50 pips of profit.

Contrary to what was expected, data on building permits in the US and the number of new foundations did not affect the direction of EUR/USD. Instead, the weaker-than-expected report on industrial production completely weakened demand for dollar, prompting an upward rebound in the pair.

There are no EU statistics scheduled to be released today, so volatility will be restrained in the morning. Most likely, buyers will attempt to extend the rally, but it will be extremely difficult to do so, especially since having no progress in the negotiation in Ukraine limits the upside potential of the pair. In the afternoon, the US will release reports in the secondary real estate market and leading indicators, but there is little chance that they could affect the mood of market participants.

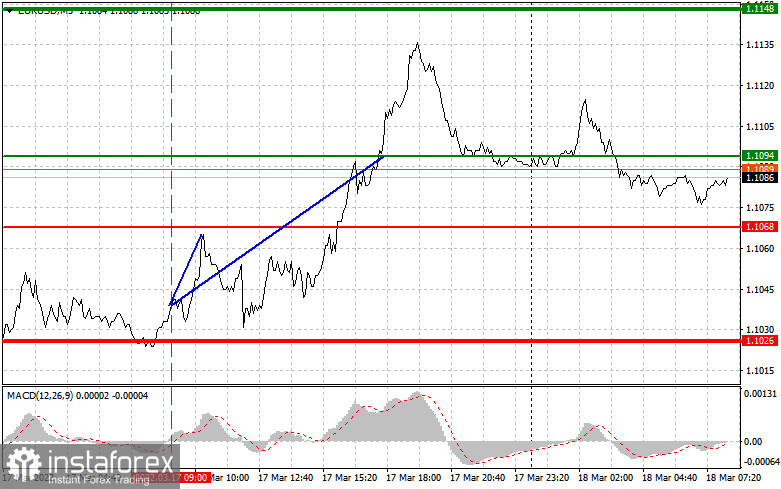

For long positions:

Buy euro when the quote reaches 1.1094 (green line on the chart) and take profit at the price of 1.1148 (thicker green line on the chart). A rally is possible today, but it will be quite difficult to trigger. Nevertheless, before buying, make sure that the MACD line is above zero or is starting to rise from it. It is also possible to buy at 1.1068, but the MACD line should be in the oversold area as only by that will the market reverse to 1.1094 and 1.1148.

For short positions:

Sell euro when the quote reaches 1.1068 (red line on the chart) and take profit at the price of 1.1026. Pressure Is likely to return at any moment because market participants prefer to take profits at the end of the week. But before selling, make sure that the MACD line is below zero, or is starting to move down from it. Euro can also be sold at 1.1094, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.1068 and 1.1026.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română