There is no doubt that Russia's aggression in Ukraine and harsh retaliatory sanctions between Russia and the West that followed the intrusion triggered the process of runaway inflation that still cannot be curbed by Western monetary authorities. Before the aggression, inflation had already surged to multi-year highs in advanced economies last year. Back in 2021, rampant inflation caused grave concerns. Nowadays it goes without saying that inflation is set to hit historic peaks unseen in decades. The trouble is that central banks failed to tame inflation before the hostilities in Ukraine. According to flash estimates, the annual CPI in the EU was expected to jump to 5.8% in February from 5.1% in January, being the reason for alarm. However, the actual CPI surged higher than expected to 5.9%. Market participants are stoking fears about a new CPI for March. Notably, the ECB tried to evade this burning issue at the latest policy meeting. In the policy statement last week, the message was that the ECB was braced for further acceleration of consumer prices, but inflation is likely to ease its rates by the year end. This message does not convince traders.

Yesterday, the Bank of England considerably upgraded its inflation forecast for 2022 at the policy meeting, adding that inflation would decline to the target level of 2.0% not earlier than in two years. In other words, the actual state of affairs concerning inflation in the eurozone contradicts the statements from the ECB. This fact was the culprit of why the single European currency stalled its growth against the US dollar. In parallel, the US dollar resumed its advance that has been going on since May 2021.

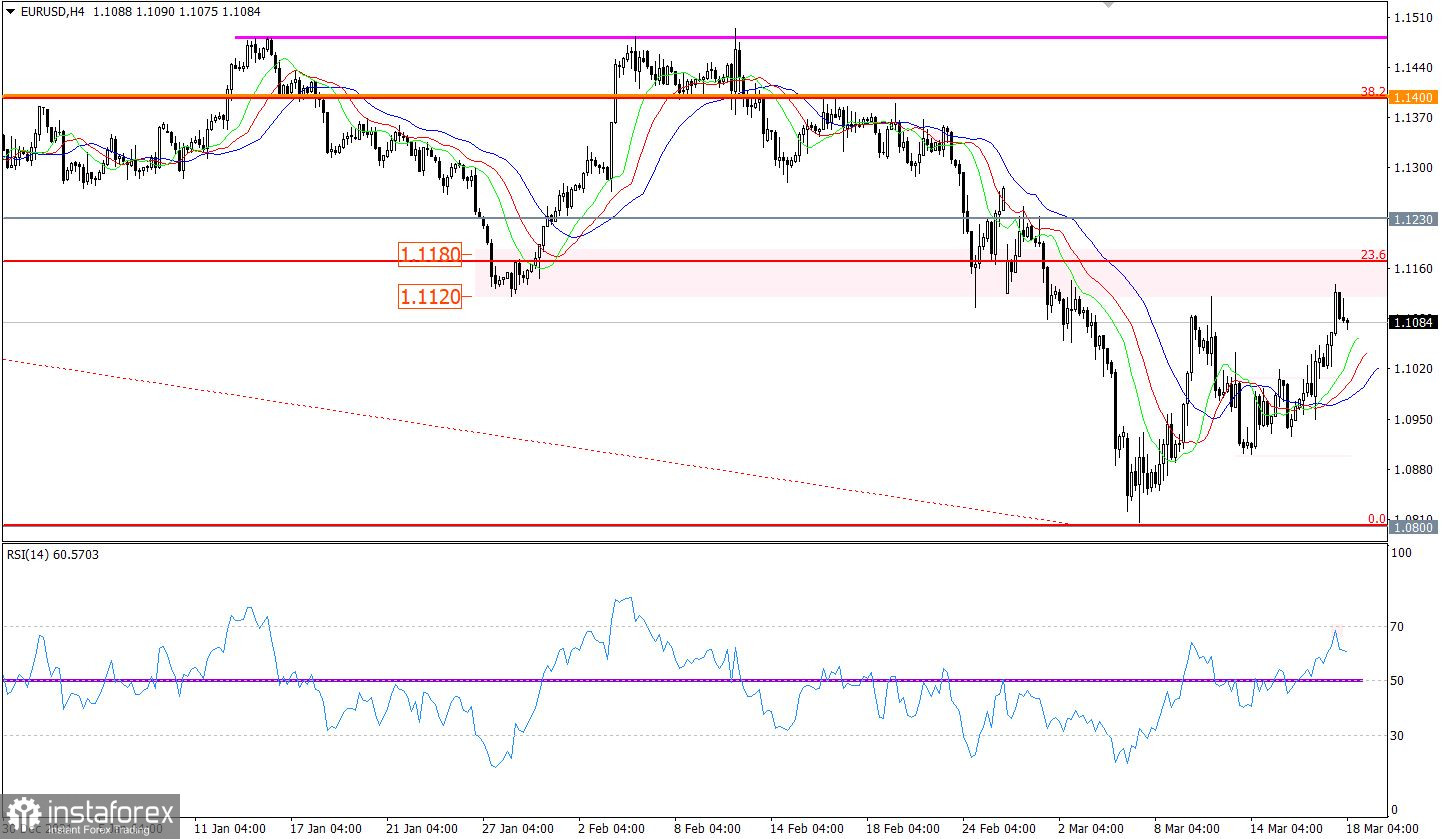

EUR/USD managed to prolong the upward correction. As a result, the price climbed higher than a swing high of the last week. Despite the buyers zeal to push the price up, the resistance area of 1.1120/1.1180 has not been broken.

On the 4-hour chart, the RSI technical instrument approached the overbought zone at the moment when the resistance area was touched. This move confirms that the upward correction is slowing down.

The Alligator also suggests a correctional move as moving averages are pointed upwards on the 4-hour chart. On the daily chart, the Alligator still indicates a downtrend in the medium term. The Alligator and moving averages are not intersected.

Outlook and trading tips

The signal of an extended upward correction can be confirmed provided that the price settles above the resistance area on the 4-hour chart. Until then, traders will stick to the strategy of selling on rallies. Due to this price action, EUR/USD might resume its downtrend following the upward correction.

Complex indictor analysis suggests selling the pair in the short term with a view to a brief price drop. Indicators provide a muted buy signal on the daily chart on the back of the ongoing upward correction. In the medium term, indicators suggest selling amid the overall downtrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română