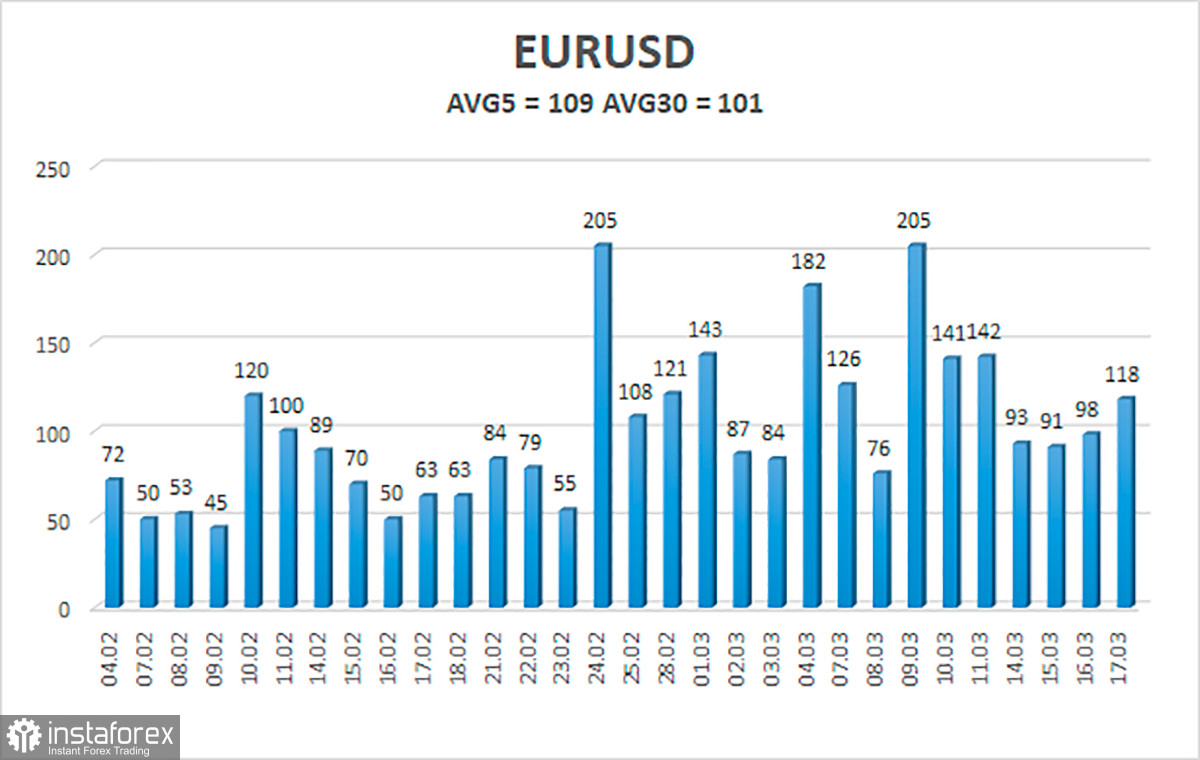

The EUR/USD currency pair continued its upward correction over the past day. Calm and relaxed. Of course, on Wednesday evening, when the results of the Fed meeting were announced, there was a surge of emotions in the foreign exchange market, and the pair made impressive somersaults for several hours, first down, then up. By the end of Wednesday, the US dollar fell in price, and by the end of Thursday, too. But at the same time, we cannot say that the market was too emotional. The volatility of the environment was only 100 points. That is, about as much as the pair goes through every day in the last few weeks. Thus, the first conclusion that can be drawn is that traders were completely unimpressed with the results of the Fed meeting.

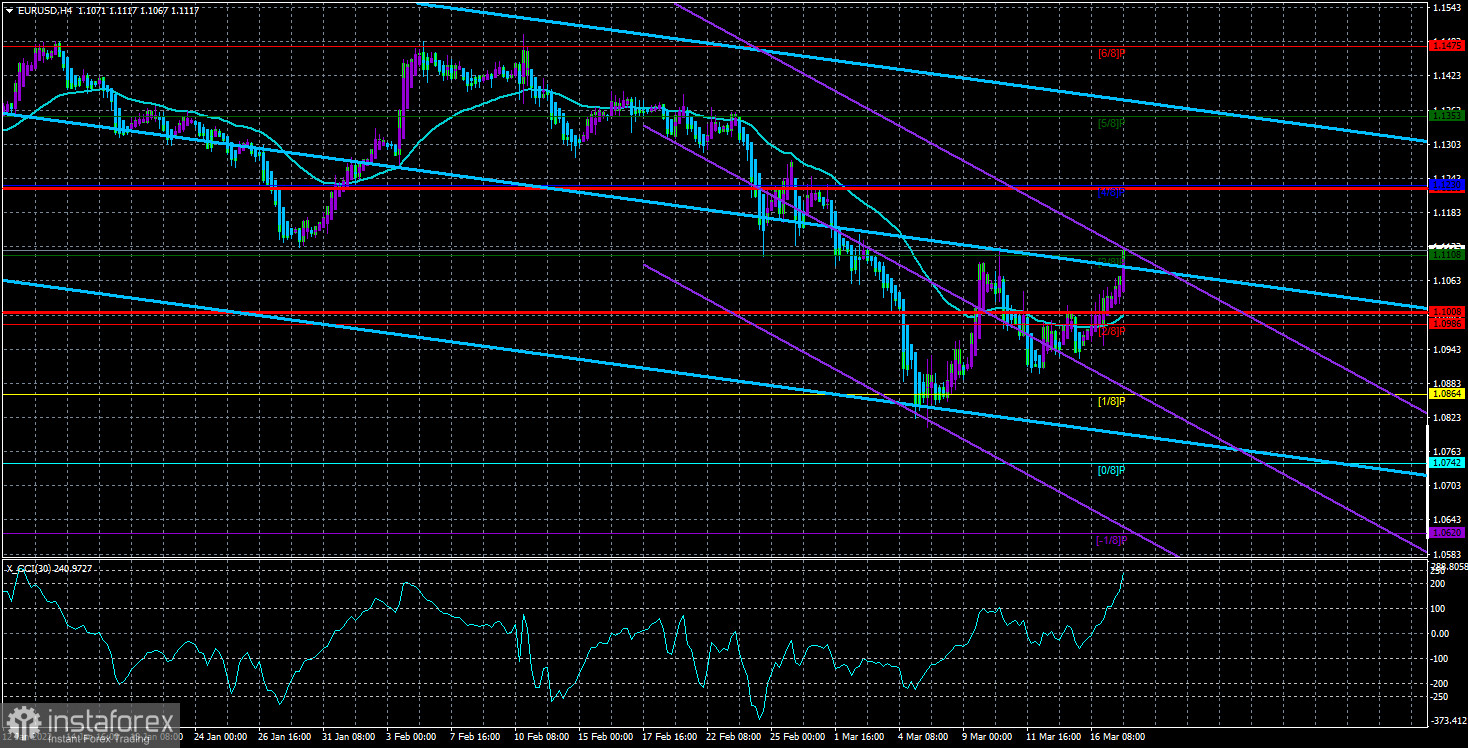

Initially, the US dollar became more expensive, because, in principle, those theses that were voiced and published can be called "hawkish". Or better to say "moderately hawkish". Recall that the Fed had only two options: raise the rate by 0.25% or raise the rate by 0.5%. A few weeks ago, the markets believed that against the background of high inflation, the Federal Reserve would decide to raise by 0.5% at once. But then the conflict between Ukraine and Russia began, so the American regulator did not decide on such a serious tightening in the conditions of the geopolitical crisis. As a result, the euro/dollar pair overcame the moving average line with great difficulty, but it has not even reached its previous local maximum yet. Both linear regression channels are directed downward, so the trend remains downward and only shows signs of its possible upward reversal. In general, the markets were ready for everything that the Fed announced, so the reaction was not strong. But still, there were a few reasons for the fall of the US currency. We believe that "technology" has taken over and the US dollar may still resume its decline.

The Fed is ready to raise the rate at every meeting in 2022.

It won't take much time to analyze all the results of the Fed meeting. The central bank raised the rate, said it was ready to raise the rate at all subsequent meetings this year, and also formed the main goal for 2022 - working with inflation. What if this was not known to traders until Wednesday evening? Recall that many experts and large banks with agencies have repeatedly stated in recent months that the Fed may raise the rate from 5 to 7 times this year. This is nothing new to anyone. Inflation is rising and forecasts for 2022 have been raised for it? Also nothing new. Jerome Powell listed a whole list of reasons why inflation is rising? Everyone has known them for a long time. Is the Fed going to do everything possible to return the consumer price index to the target level? Well, this goal was set before the regulator even when inflation was equal to 1%. From our point of view, absolutely nothing extraordinary happened on Wednesday evening and was not announced.

Nevertheless, it should be recognized that the mood that the Fed has demonstrated is still not "dovish". This means that the dollar should have received market support. But I didn't get it. Why? From our point of view, the market was somewhat disappointed that the rate was raised by only 0.25%. The second reason may be that traders have already taken into account this increase in the current rate of the pair. Recall that in the last few weeks, the dollar has strengthened quite strongly in pairs with the euro and the pound against the background of the geopolitical conflict in Eastern Europe. Consequently, traders could have worked out the Fed's rate hike in advance. Thus, now for some time, the European currency may become more expensive, but already around the level of 1.1108, it may turn down again. If this happens, we will assume that the bulls have saved again and now a new round of the downward trend begins. At the moment, the growth of the US currency still looks more promising than the growth of the euro. Recall that the ECB does not even intend to tighten its monetary policy this year.

The volatility of the euro/dollar currency pair as of March 18 is 109 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1008 and 1.1225. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair continues its upward movement. Thus, now you should stay in long positions with a target of 1.1230 until the Heiken Ashi indicator turns down. Short positions should be opened no earlier than the price-fixing below the moving average line with a target of 1.0864.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română