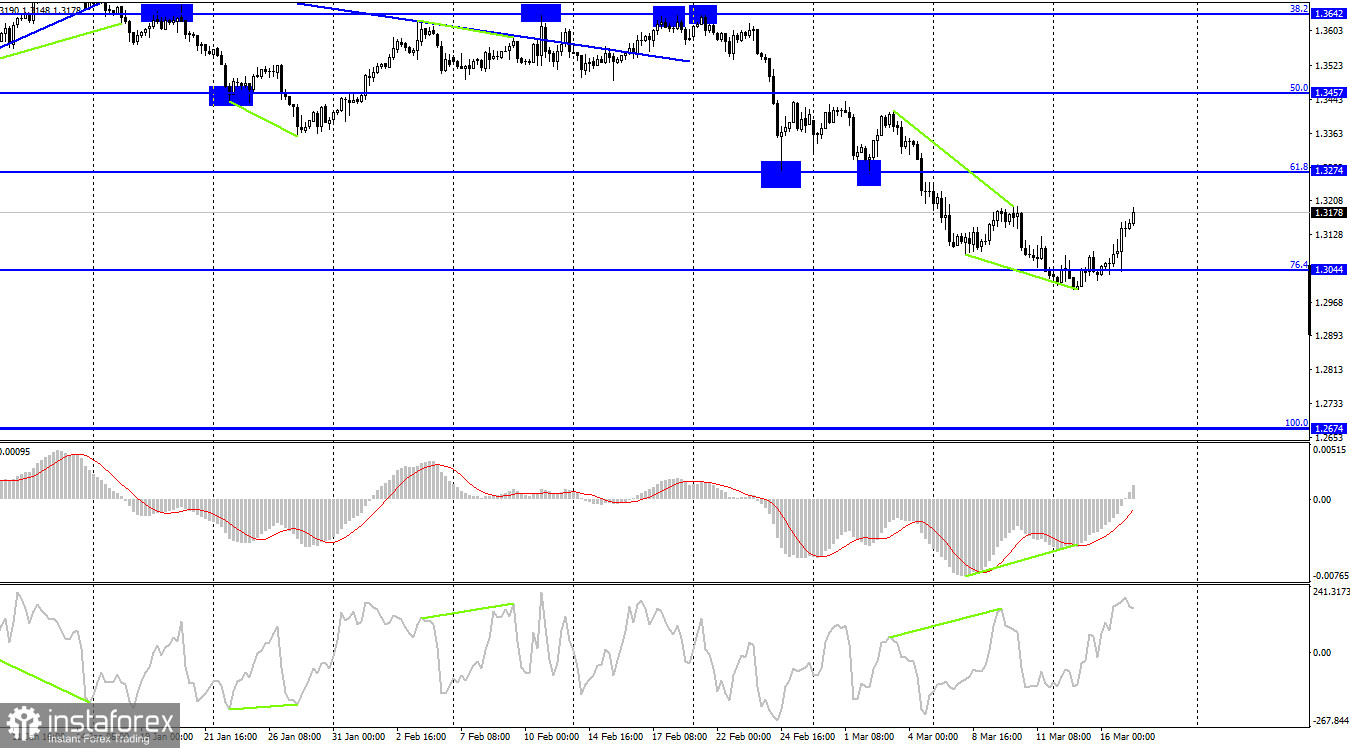

Hello, dear traders! According to the H1 chart, GBP/USD closed above the 200.0% Fibonacci level (1.3071) and the descending trend line and headed towards the 161.8% retracement level (1.3181). The quote may reverse in case of a pullback and go down to the 200.0% Fibonacci level. Consolidation above 1.3181 will increase the likelihood of an increase to the 127.2% Fibonacci level (1.3279). The pound and the euro traded alike yesterday due to the FOMC meeting and Chairman Powell's speech. After the outcome of the meeting had been announced, traders were buying the dollar within just an hour. It seemed that the decision had left them disappointed as they had hoped for a 0.5% increase, not for a 0.25% hike. Although the FOMC meeting could not have been called dovish, traders definitely expected more hawkish results.

One way or another, the dollar fell in price. Meanwhile, market participants had priced in a 0.25% rate hike long ago. The Bank of England will soon announce its monetary policy decision. At least two increases are expected from the British regulator this year although it never said it would raise interest rates to 2-3% as the Fed did. Nevertheless, the BoE is dealing with the same problems its American counterpart has. The UK is facing continuing inflation, which is based on factors that could hardly be affected by monetary policy tools. The BoE is highly likely to raise the benchmark rate by 0.25%. Traders are already prepared for it. At the same time, a different scenario may play out, so you should be ready for any price movement.

The pair reversed up after the MACD indicator had formed a bullish divergence on the H4 chart. The price is now heading towards the 61.8% Fibonacci level (1.3274). The quote may reverse and go down to 1.3044 in case of a pullback. There have been no emerging divergences so far.

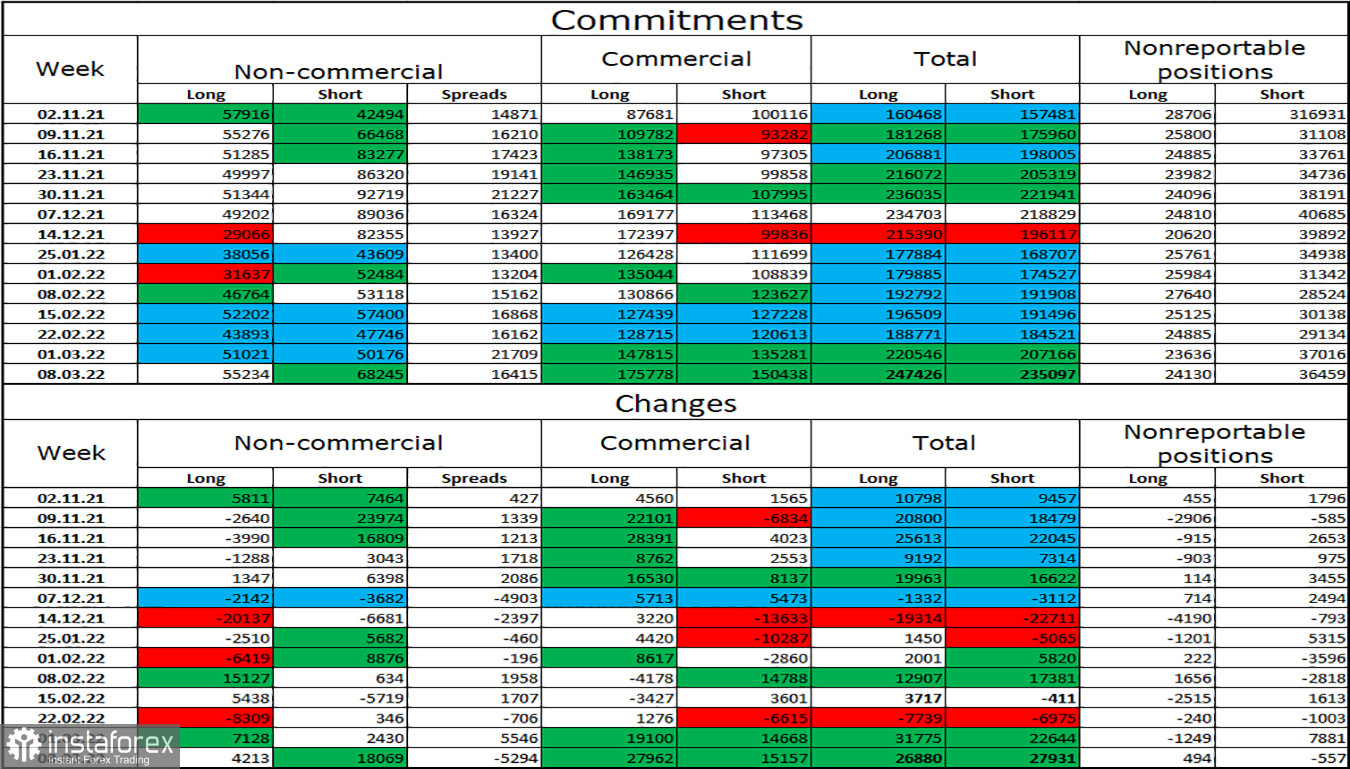

Commitments of Traders (COT):

The sentiment of non-commercial traders has dramatically changed over the reporting week. The number of long positions increased by 4,213 and that of short ones soared by 18,069. Overall, sentiment grew more bearish and the number of short positions rose sharply. The ratio of longs and shorts now reflects the actual state of things. The pound is bearish as major players prefer to sell it right now. However, their sentiment changes fast, and the British pound has been falling for quite a long time.

Macro events:

United Kingdom: - BoE Interest Rate Decision (12-00 UTC), MPC Meeting Minutes (12-00 UTC)

United States: Initial Jobless Claims (12-30 UTC), Industrial Production (13-15 UTC)

Today's macroeconomic calendar of the UK contains all the important events. The BoE interest rate decision will be of primary importance and will have a significant impact on the market.

Outlook for GBP/USD:

On the H1 chart, short positions could be opened on a pullback from 1.3181, with the target at 1.3071. Long positions could be entered after consolidation above the trend line on the H1 chart, with the target at 1.3181.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română