In this article, we are going to discuss the trajectory of the pound sterling after the FOMC meeting and the main events for today.

Hi everyone!

The pound/dollar pair declined significantly even though the Fed decided to raise the interest rate by 25 basis points and take a hawkish stance on monetary policy. However, the rate increase has already been factored in by market participants. Traders locked in profits after the meeting. Therefore, the US dollar unexpectedly dropped yesterday. Experienced traders are always ready for such a turn of events. To this end, they were not surprised. They remember quite well the principle - buy on rumors, and sell on the news. In my morning article on the euro/dollar pair, I have already described yesterday's market movements following the Fed meeting and the press conference. I will not touch upon this topic in this article. The only thing I would like to mention is the firm hawkish position of Fed Chairman Jerome Powell. He expressed willingness to raise the key rate at almost every meeting if it is appropriate.

To be frank, I was expecting such rhetoric as traders had been awaiting monetary policy tightening for too long. Other investors thought likewise and factored in the probability of the rate hike. Thus, the US dollar was unable to grow. I assume that if the Fed had raised the interest rate by 50 basis points, the market reaction would have been completely different. I would like to emphasize that there is one more crucial event for the pound sterling. Today, at 15:00 MSK, the Bank of England will announce its monetary policy decision and publish the meeting minutes. They will reflect the economic prospects as well as reveal who voted in favor and against the rate increase. The UK central bank is expected to hike the benchmark rate by 25 basis points. However, speculators have already priced in such a scenario. This is why the trajectory of the pound sterling will mainly depend on the content of the meeting minutes and the BoE governor's rhetoric. If the watchdog hikes the key rate and hints at further monetary policy tightening, the pound sterling is likely to gain momentum against the US dollar. Let's look at the daily chart of GBP/USD.

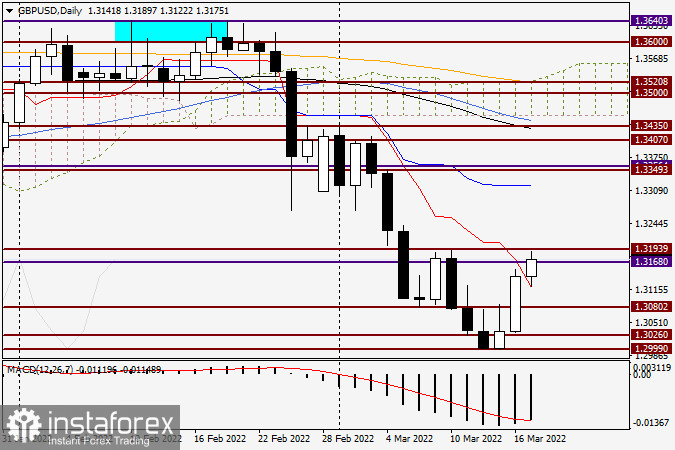

Daily

The pound/dollar pair returned to the support level of 1.3080 within yesterday's upward movement. So, now we can easily say that it was a false breakout. Oftentimes, when the breakout turns out to be false, a strong movement in the opposite direction follows. In this case, the pair may continue its upward movement. However, the results of the BoE meeting will largely influence the pound sterling. Judging by technical indicators, the pound sterling is ready to test the resistance level of 1.3193. After that, it may try to break through the level of 1.3200.

If the pair closes today above the indicated level, the likelihood of s strong upward movement will certainly grow. If this scenario comes true, the next target level will be 1.3320 where the blue Kijun line of the Ichimoku indicator passes. Alternatively, the pound sterling will face bearish pressure provided that the results of the meeting will disappoint investors. In such a situation, a bearish reversal pattern of candlestick analysis may appear on the daily chart with the closing price below the red Tenkan line or even below 1.3080. I would also avoid giving any recommendations on GBP/USD. We should wait for the decision of the Bank of England and the market reaction. Tomorrow we will return to the analysis of this pair. After the end of today's trading, we will think about the future prospects of this asset.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română