Stocks in the U.S. and Europe rose as traders digested the Fed's announcement that a robust U.S. economy can weather the campaign against high inflation now underway.

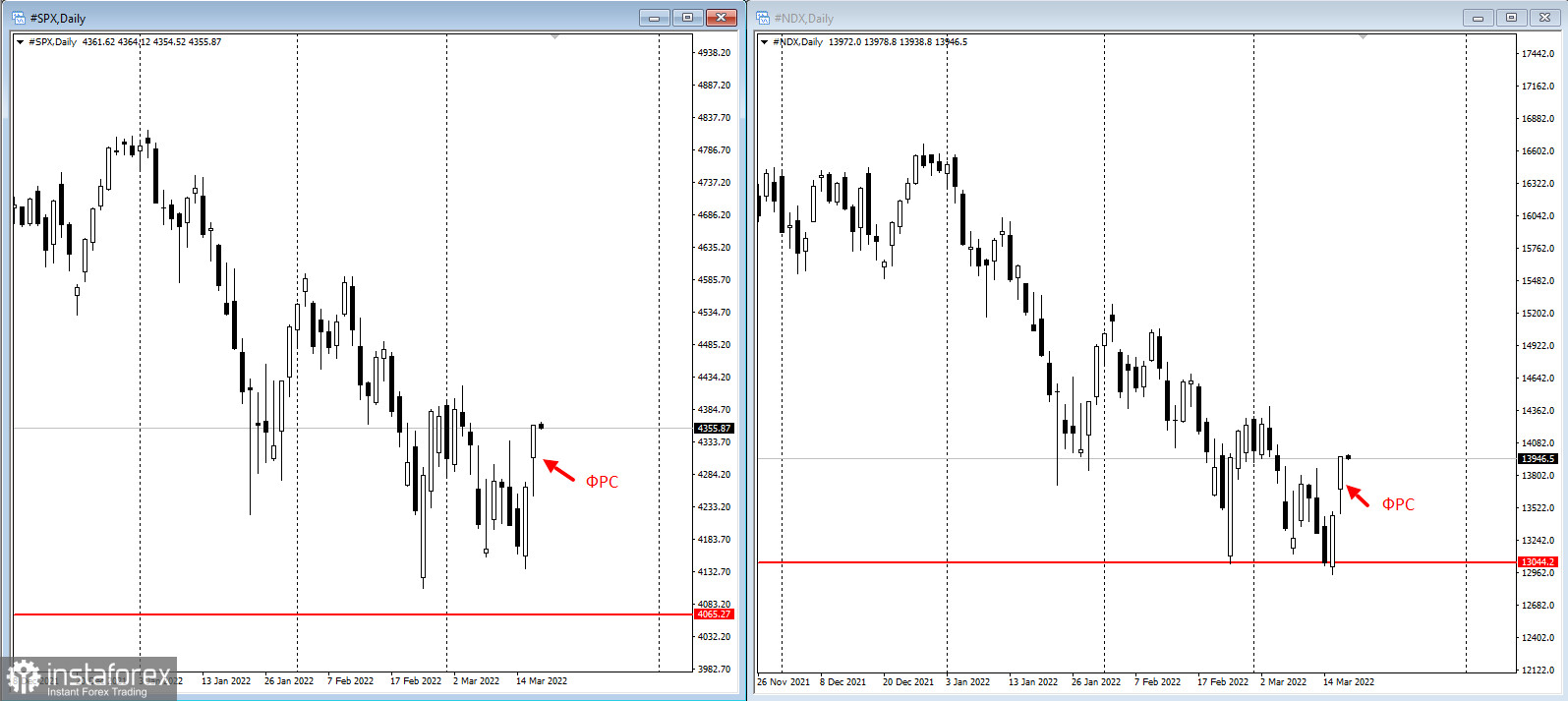

Futures for the S&P 500 and Nasdaq 100 closed the day with a good rise. The Asia-Pacific stock index rose about 3%, helped by Chinese efforts to stabilize their markets. Possible progress in ceasefire talks between Russia and Ukraine also helps bullish sentiment.

The Fed has raised rates by a quarter of a percentage point and has signaled higher rates at all six remaining meetings in 2022. Chairman Jerome Powell said the U.S. economy is "very strong" and can handle monetary tightening.

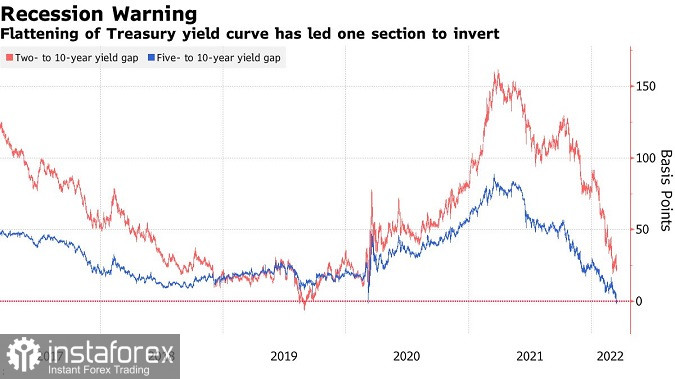

Treasuries rose, while part of the bond curve - the gap between five-year and 10-year yields - flipped for the first time since March 2020. For some, the latter highlights the growing risk that the Fed's efforts to rein in inflation could trigger an economic downturn.

The Fed has said it will start cutting its $8.9 trillion balance sheet.

"Our view is that the Fed put is just a lot lower," said Mary Nicola, a global multi-asset portfolio manager at PineBridge Investments, citing U.S. policymakers may be slower to step in to help financial markets if they hit turbulence.

"If we put aside the current geopolitical situation and just focus on the US economy, the US consumer, their household balance sheets are in a much better position than they were post the global financial crisis," she said.

After the latest round of peace talks, a Russian spokesman said a neutral Ukraine with its own army was a possible compromise, while Kyiv said it needed security guarantees. And that's good news for the stock market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română