As widely expected, the central bank hiked the benchmark rate to 0.50% from 0.25%. It is the first rate increase since 2018. Following the meeting, the greenback started rising. However, its growth was rather insignificant. Shortly after, the greenback lost all its gains due to Jerome Powell's speech. In fact, comments provided by the Fed's chair should have boosted the US currency. This is why such a behavior of the US dollar seems rather atypical.

Analysts believe that it is associated with changes in forecasts. The Fed cut the economic growth outlook amid the current geopolitical situation. However, it is not the main reason for the weakness of the US currency. The fact is that the consequences of the sanctions, which have been imposed just after the launch of the special military operation in Ukraine, will hit all the countries in the world. Even in the best-case scenario, economies will slow down. Yet, it is somewhat surprising that the Fed has revised forecasts for economic projections only for the current year, while estimates for the next year have remained unchanged. Perhaps this decision confused investors.

Importantly, according to previous predictions, the key rate should have been raised to 0.75%-1.00% by the end of the year. Now, it is expected at the level of 1.75%-2.00%, and it is not the ceiling. Previously, the interest rate was forecast to be in the range of 1.50% - 1.75% by the end of 2023. However, the forecast was upwardly revised to 2.75%-3.00%. A projection for 2024 was also changed. In December, the regulator predicted the interest rate at the level of 2.00%-2.25%. The central bank altered dramatically its forecasts as well as announced the fastest pace of monetary policy tightening in several decades. In less than two years, the key rate will be raised to 3.00% from 0.50%. By the end of this year, the regulator is likely to hike the interest rate by 1.50%. Since the Fed is planning to hold another six meetings this year, it is expected to raise the key rate by 0.25% at each of them.

Taking into account these forecasts, the US dollar should have demonstrated steady growth. Instead, the pound sterling began to grow albeit rather slowly. Perhaps the US dollar is unable to regain ground amid the puzzlement of investors caused by new monetary policy projections. Once they admit the current state of affairs, the greenback will resume its rapid rise.

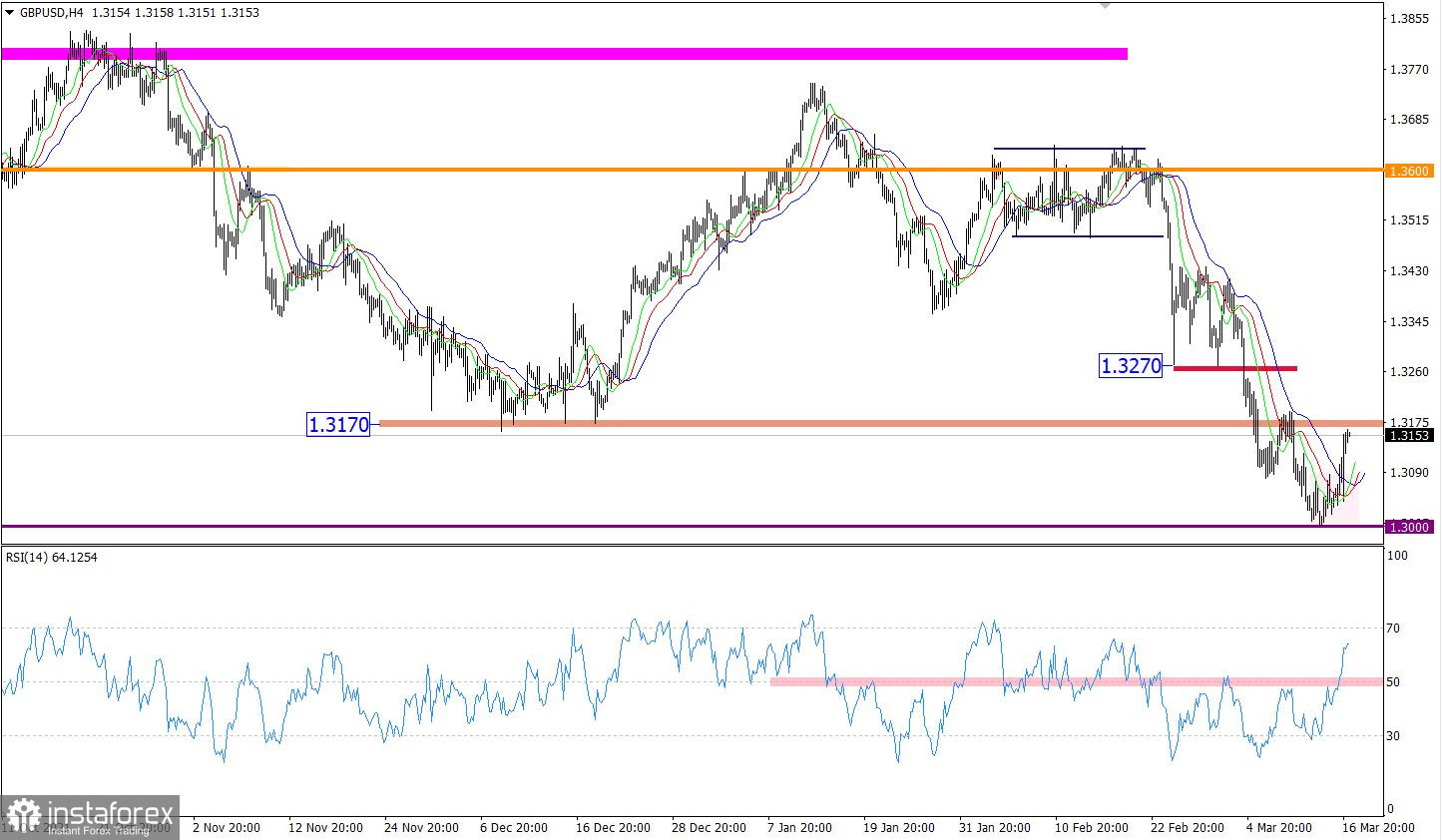

The pound/dollar pair has entered a correction phase rebound from the psychologically important level of 1.3000. As a result, the pair gained 150 pips, returning to a high of March 10.

The RSI indicator is moving above 50/70 on the 4H chart, signaling a rise in long positions.

The Alligator indicator confirms the correction stage by a change in the direction of moving averages on the 4H chart. On the daily chart, the Alligator indicator signals downtrend. There are no intersections between the moving averages.

Outlook

The pair is likely to maintain its upward correction if it consolidates above 1.3200. If this scenario is incorrect, there will be an increase in the volume of short positions and price stagnation.

Complex indicator analysis gives a buy signal on the short-term and intraday amid the recent upward movement. Technical indicators provide a sell signal on the medium-term charts due to a downtrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română