GBP/USD fully influenced by policy decisions of both central banks

Hi, dear traders!

The first major event of the week for GBP/USD will happen today. The Federal Open Markets Commission will decide on the interest rate and release its statements, followed by a press conference of Jerome Powell, chairman of the Federal Reserve. Market players expect the Fed to increase the Fed funds rate by 25 basis points – from 0.25% to 0.50%. However, it is not the only event that would influence the pound sterling this week.

Tomorrow, the Bank of England would announce its own rate decision. The British regulator is expected to increase the rate by 25 basis points as well. As a result, GBP/USD would be influenced by decisions made by both central banks, as well as the position of its respective boards. The Fed is more hawkish than its UK counterpart, and the state of the US economy is superior to the British economy as well.

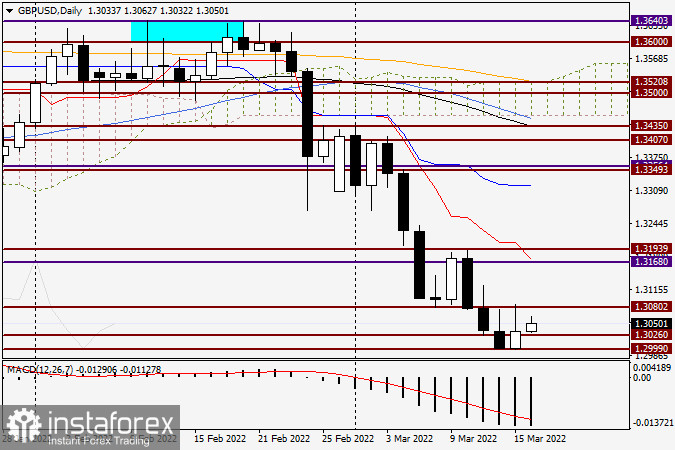

Daily

Yesterday, the pair retraced back to the broken support level of 1.3080, allowing traders to open short positions. As expected, GBP bulls encountered very strong resistance at this level – a very common situation when a support level serves as the new resistance level after a true breakout. The low upper shadow of yesterday's candlestick, which is longer than the body itself, indicates bulls would face serious difficulties.

Even if both central banks match market expectations, much will depend on the reaction of investors. At this point, the pound sterling is under bearish pressure due to a lack of demand from traders. However, the daily chart suggests upward corrections are also possible. They could be used for opening short positions in GBP/USD – the main trading strategy at the moment. However, entering the market at an appropriate time would be difficult today due to very high volatility. Short positions could be opened if the pair rises briefly into the 1.3077-1.3113 area or reaches 1.3062. However, ongoing events should be taken into account before opening new positions.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română