To open long positions on EUR/USD, you need:

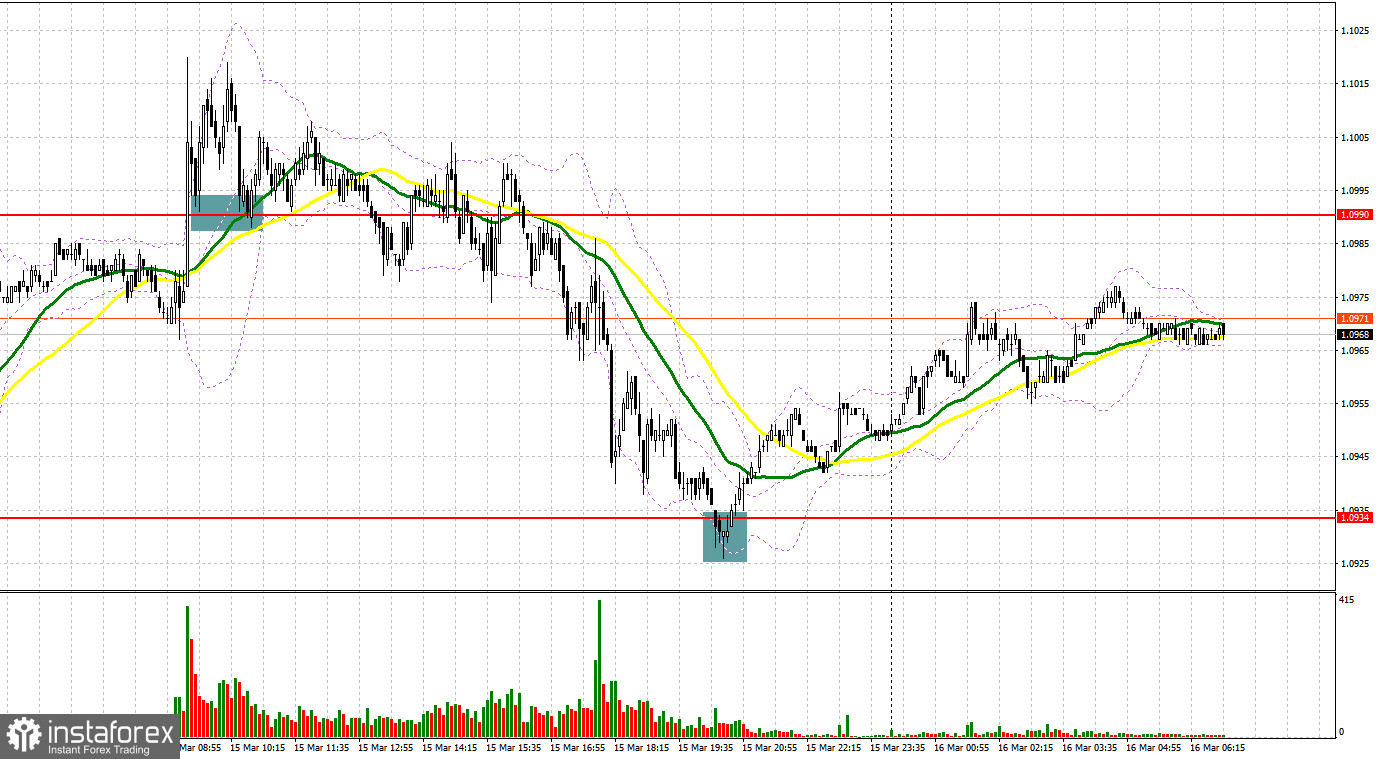

Yesterday there were several signals to enter the market. Let's look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the 1.0990 level and advised you to make decisions on entering the market. In the first half of the day, euro bulls tightened the pair above the 1.0990 level, and a reverse test of this range from top to bottom resulted in forming a buy signal. Unfortunately, the pair did not sharply rise. A maximum of 30 points could be seen. There was an active struggle for the 1.0990 level in the afternoon and it was not possible to get signals from it to enter the market. Only after a fall and a false breakout at 1.0934, a good entry point into long positions was formed, which led to an upward correction of the pair by 40 points.

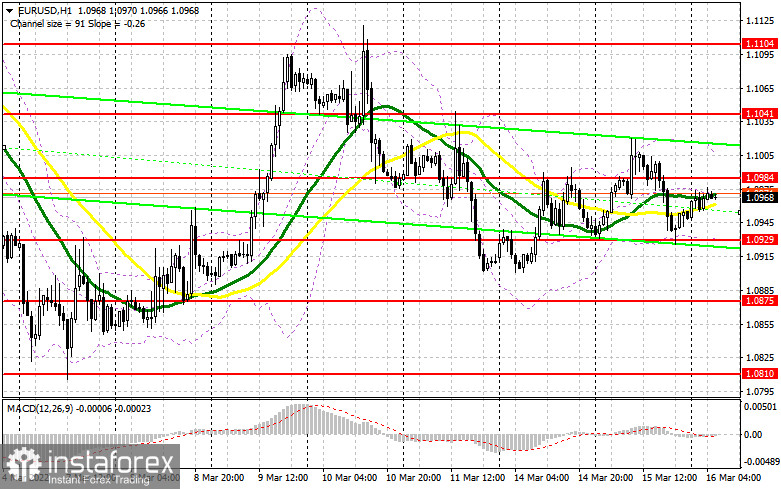

Today is an important day for us, as everyone is waiting for how the Federal Reserve will act. Will it adopt a more aggressive policy on interest rates to protect the country from inflation, or will it take a wait-and-see attitude further - acting according to the plan. The plan includes a March increase in the interest rate by 0.25 points and no more. We do not have important fundamental statistics on the eurozone in the first half of the day, so euro bulls will have a chance to build an upward correction and test the average border of the 1.0984 horizontal channel formed by yesterday's results. An equally important task is to protect the support of 1.0929. Only a false breakout at this level creates the first entry point into long positions against the bear market. To see a larger upward movement in EUR/USD, traders should be more active and surpass resistance at 1.0984. A top-down test of this level will provide a buy signal and open up the possibility of restoring the pair to the area of 1.1041. A long-range target will be the high of 1.1104 – last week's large resistance level. A breakthrough of this range will also cancel out the bearish trend and hit the bears' stop orders even more, opening a direct road to the highs: 1.1165 and 1.1227, where I recommend taking profits. However, such a scenario can be counted on with the very dovish rhetoric of the Fed chairman, as well as with good news and a decrease in geopolitical tensions in the world. In case the pair falls and the bulls are not active at 1.0929, it is best to hold back from long positions. The optimal scenario for buying would be a false breakout of the low in the area of 1.0875, but it is possible to open long positions on the euro immediately for a rebound only from 1.0710, counting on an upward correction of 30-35 points within the day.

To open short positions on EUR/USD, you need:

Bears announced themselves yesterday afternoon, but no one clearly intends to take risks before the Fed meeting. The first half of the day may again be on the euro bulls' side, so I advise you to sell as high as possible, from large resistance levels. Euro bears need to think about how to protect the average border of the 1.0984 horizontal channel. Moving averages pass just below this level, so the formation of a false breakout will lead to a sell signal and the opening of new short positions in order to re-decline to the support of 1.0929, which resisted the bears' pressure yesterday. Most likely, a breakdown of this area will occur only after the Fed meeting. The reverse test from the bottom up can take place very quickly, which will provide another signal to open short positions with the prospect of falling to the levels: 1.0875 and 1.0810. A further goal will be a new low for this year – 1.0772. If the euro rises and there are no bears at 1.0984, the bulls will start to feel much better – still, the expected rate hike from the European Central Bank in October is good news. In this case, it is best to take your time with short positions. The optimal scenario will be short positions when forming a false breakout in the area of 1.1041. You can sell EUR/USD immediately on a rebound from 1.1104, or even higher - around 1.1165, counting on a downward correction of 15-20 points.

I recommend for review:

The Commitment of Traders (COT) report for March 8 showed that both long and short positions have increased. It is not surprising that against the background of Russia's military special operation on the territory of Ukraine, there were more bears, which led to a reduction in the positive delta. However, it is surprising that in the conditions of a major fall in the euro, bulls have not capitulated, but continue to actively increase long positions, taking advantage of attractive prices. An ECB meeting was held last week, where the central bank's policy became clearer. It also adds confidence to buyers of risky assets in the current difficult geopolitical conditions. Let me remind you that ECB President Christine Lagarde announced plans to more aggressively curtail measures to support the economy and raise interest rates – a strong bullish medium-term signal for euro bulls. But do not forget that this week we will have a Federal Reserve meeting and how the US regulator will behave in the conditions of the highest inflation in the last 40 years is a big question. We also remember that although Russia and Ukraine have sat down at the negotiating table, so far these meetings do not give any special results. Against this background, I recommend continuing to buy the dollar, since the bearish trend for the EUR/USD pair has not gone away. The COT report indicates that long non-commercial positions increased from the level of 228,385 to the level of 242,683, while short non-commercial positions increased from the level of 163,446 to 183,839. At the end of the week, the total non-commercial net position decreased to 58,844 against 64,939. The weekly closing price fell from 1.1214 to 1.0866.

Indicator signals:

Trading is below the 30 and 50 daily moving averages, which indicates an attempt by the bears to take control of the market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper indicator in the area of 1.1005 will act as resistance. In case the euro falls, support will be provided by the lower border in the area of 1.0929.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română