The EUR/USD currency pair has been trading more calmly than a day earlier or over the past few weeks. It becomes clear that traders are slowly returning to the usual trading mode, but still, a new "bomb" can explode on the foreign exchange market at any moment. So far, the European currency is near its 14-month low and it is impossible to say that things have started to get better for it. It is better to say that there is a temporary pause during which the euro currency can at least adjust a little. But even in this case, so far everything looks not too favorable for the euro since at the moment it has managed to move away from its lows by "as much as" 180 points. Thus, from a technical point of view, the situation has not changed in any way yet. The pair may gain a foothold above the moving average line once again, but this again is unlikely to mean a change in the mood of traders to "bullish". After all, in this case, technical analysis does not reflect the mood of the market. Why?

Because any trading system or indicator in the absence of a constant trend movement will begin to show signs of its completion, which in fact may just be a temporary pause. Even now, the price will consolidate above the moving average, but this is unlikely to mean that the market has stopped paying attention to the geopolitical factor in Ukraine. This is unlikely to mean that traders have abandoned new purchases of the "reserve currency" at once. This is unlikely to mean that the economy has come into balance after the introduction of large-scale sanctions against the Russian Federation, as well as after the redistribution and redirection of global capital. Thus, we expect that the euro may rise this week to the level of 1.1108. Or even to the level of 1.1230, but it is unlikely to be higher. This week, actually today, the Fed will hold a meeting at which a decision may be made to raise the rate by 0.5%. And although at this time the probability of such a decision by the FOMC is small, it still exists. And a rate increase of 0.5% may provoke a new collapse of the euro/dollar pair.

The geopolitical situation is not improving, it is weakening.

The title of this paragraph does not look quite clear. We will try to explain what we mean and how it affects the foreign exchange market. In the first two weeks of the military operation, Russian troops carried out an offensive on all fronts available to them. Since at least 150,000 Russian troops were concentrated on the border with Ukraine, which is not enough to capture an entire country, but a lot, if we talk about military operations, at first they actively moved forward, which created the appearance of an escalation of the conflict every day. However, as soon as the Russian troops reached all the significant Ukrainian cities, the escalation of the conflict immediately stopped, since the Russian troops failed to take any city except Kherson. And this is exactly the situation that persists now, three weeks after the start of the conflict. What happens? It turns out that the military actions have moved into the stage of "tactics".

Both sides have taken positions and cannot move forward. Exactly what we have observed in the last 8 years in the Donbas. Consequently, the geopolitical situation has stopped heating up and deteriorating, but it is not improving either, since negotiations between Kyiv and Moscow are not progressing, there is no progress. Accordingly, we can describe what is happening now as a "weakening". There are no improvements, there is no deterioration, but the intensity of hostilities and their scale are becoming smaller and weaker. Thus, the foreign exchange market may be already starting to trade based on the fact that the situation is not getting worse, which means there is no reason to panic now. However, we believe that the situation in Ukraine can flare up at any moment with renewed vigor. Already, many military experts and political scientists note that the Russian army may be resupplying and regrouping to launch a "second wave" of attacks on Ukraine. Consequently, military operations have not been put on pause, and the conflict itself has not yet turned into a sluggish and long-lasting one. This means that there may be new shocks, new sanctions, new collapses, and so on.

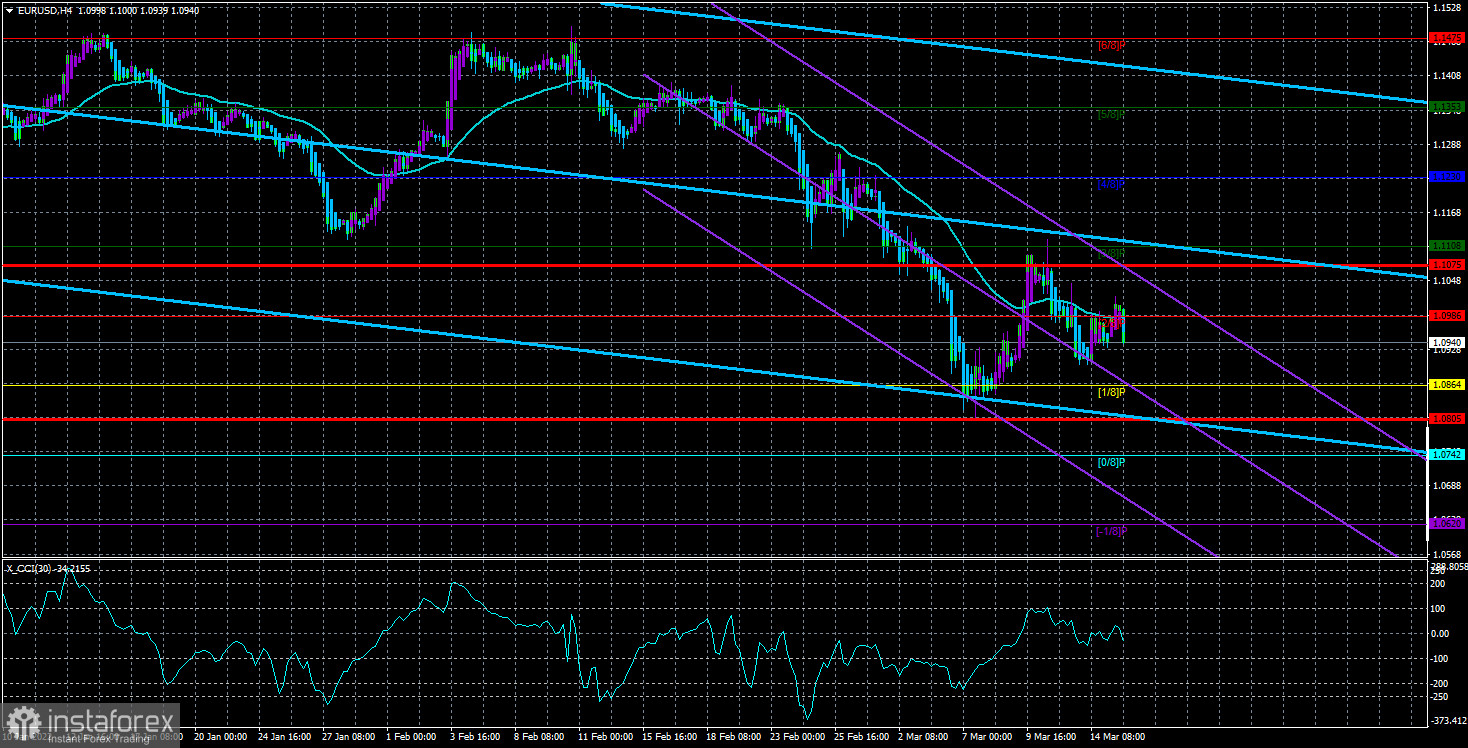

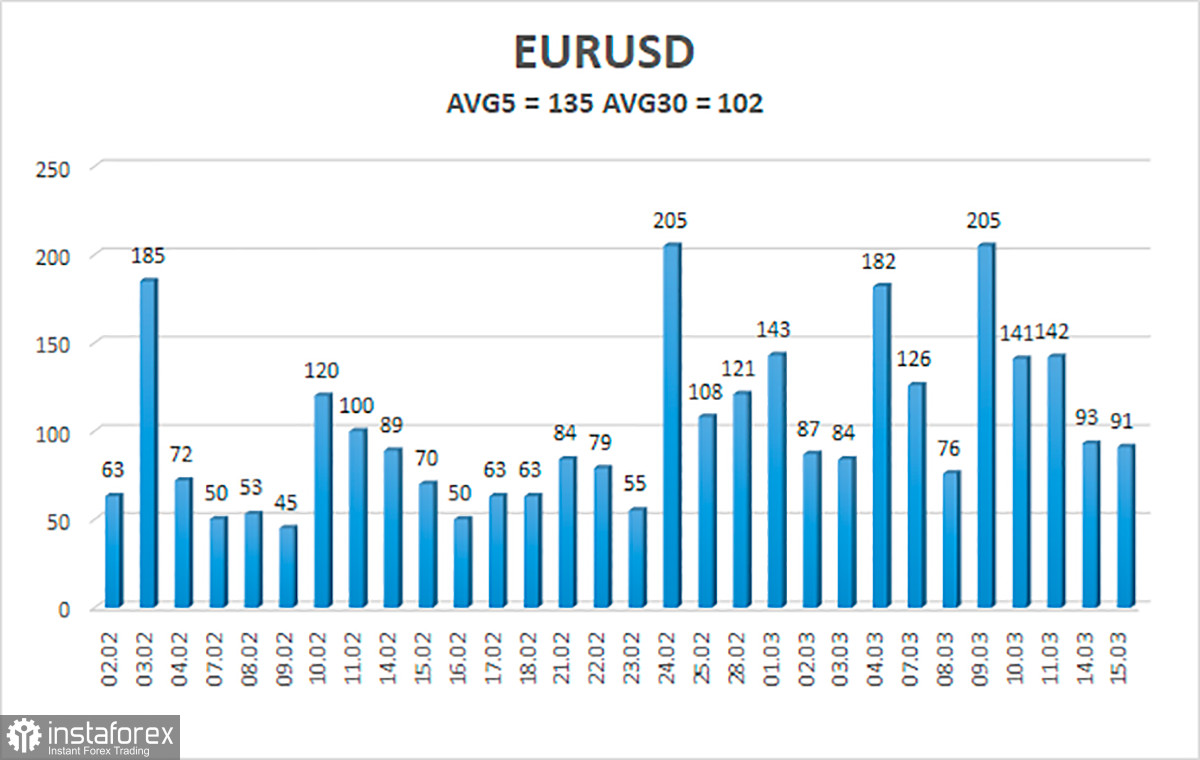

The volatility of the euro/dollar currency pair as of March 16 is 135 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0805 and 1.1075. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading recommendations:

The EUR/USD pair completed a round of correction and consolidated back below the moving average. Thus, new short positions with targets of 1.0864 and 1.0838 should now be considered if the price bounces off the moving average. Long positions should be opened no earlier than the price is fixed above the moving average line with targets of 1.1075 and 1.1108.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română