Analysis of previous deals:

30M chart of the GBP/USD pair

The EUR/USD currency pair continued the corrective movement on Tuesday that had begun a day earlier. Volatility was not weak at all again, during the day the pair went from a low to a high of about 90 points. Thus, the conclusion immediately suggests itself: the correction is a correction, but traders continue to trade the pair quite actively. Recall that a few months ago, the pair had a period when it traded every day for several months with a volatility of 40-50 points. Regardless of the fundamental and macroeconomic background. Now the opposite is true. News and reports are not available every day, but the pair walks an impressive distance every day. For example, today. There was no geopolitical news during the day, and macroeconomic statistics were reduced only to a report on industrial production in the EU and the ZEW business sentiment index. Both reports turned out to be much weaker than forecasts, but at the same time, the euro only grew in the first half of the day. And in the second half, when there were no reports, it fell. Thus, we conclude that the macroeconomic background today did not affect the course of trading in any way.

5M chart of the GBP/USD pair

There were few trading signals on the 5-minute timeframe on Tuesday, only two. Moreover, the language does not turn to call them accurate and clear. The first signal was formed near the level of 1.0990, and the price of literally one candle passed 42 points. That is, at the time of the formation of the buy signal, the upward movement has already ended. Such a sharp spike in volatility should have alerted traders, and they should have abandoned the deal. Then the price returned to the level of 1.0990 during the US trading session and tried to overcome it for several hours. After this happened, the pair continued its downward movement and by the evening almost reached the level of 1.0932. But still did not work it out. The sell signal itself turned out to be extremely inaccurate, so novice players could safely ignore it. If they did open a short position, they could earn a couple of dozen points, which is not bad at all. In general, today's movement was similar to the completion of the correction and preparation for the resumption of the downward trend.

How to trade on Wednesday:

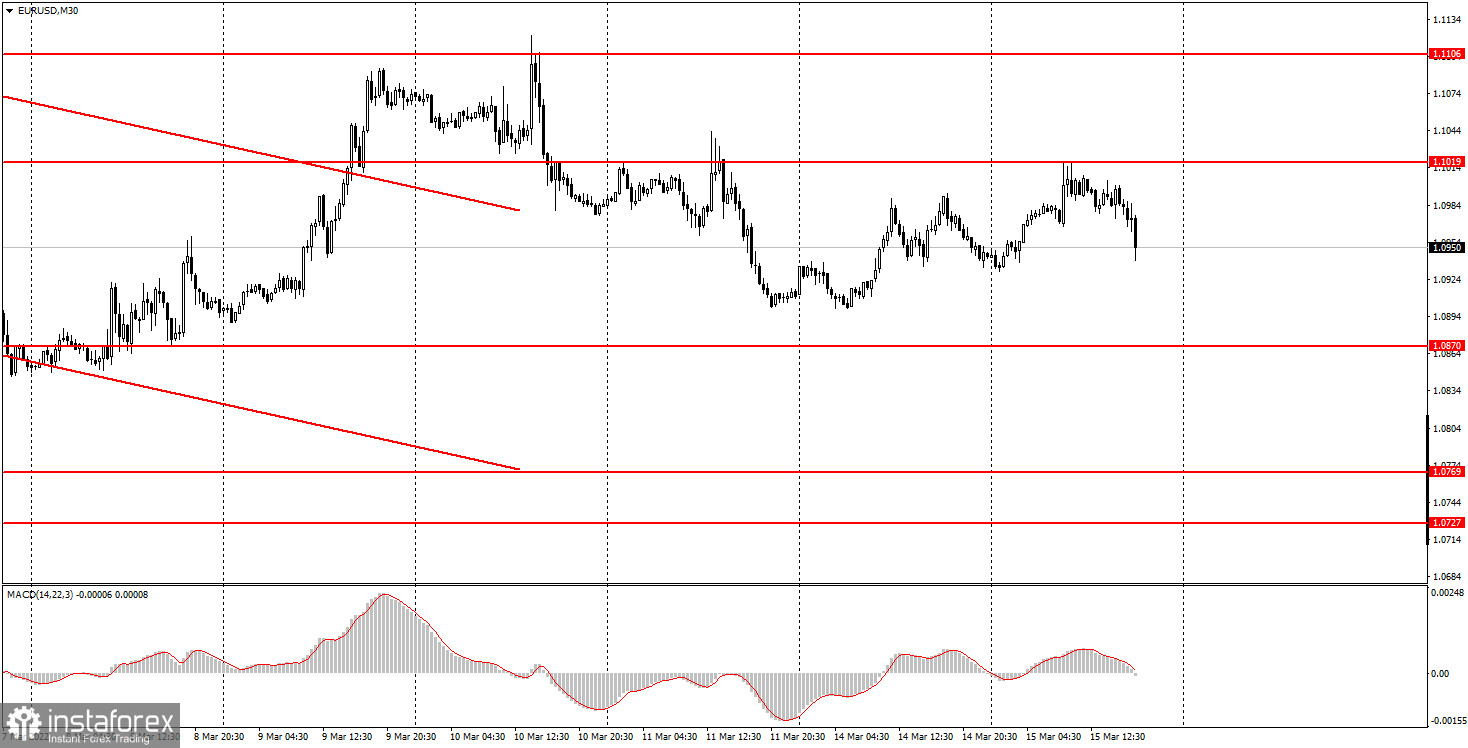

The downward trend has been canceled on the 30-minute timeframe, but now a new downward trend has been formed. There is no trend line or channel yet, but in the coming days it will be possible to form either the first or the second. The 1.0990 level has been transformed into the 1.1019 level and now it depends on it whether the downtrend will be resumed. On the 5-minute TF tomorrow, it is recommended to trade by levels 1.0870, 1.0902, 1.0932, 1.1019, 1.1106. When passing 15 points in the right direction, you should set the Stop Loss to breakeven. There are no events or publications scheduled for Wednesday in the European Union. But a report on retail sales for February will be published tomorrow in the US, and in the evening the results of the US central bank meeting and a press conference with Federal Reserve Chairman Jerome Powell will be announced. We believe that this event can cause a strong reaction of traders, as it is expected that the interest rate, a key instrument for managing monetary policy, will be increased by 0.25% or 0.5%.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the American one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română