The EUR/USD pair performed a new reversal in favor of the EU currency on Monday and another one on Tuesday morning. Thus, the growth process continues in the direction of the 1.1050 level, and bear traders have finally retreated. Although I would not make hasty statements about this. The fact that the European currency is showing growth now cannot be a reason that it will show growth in the future. Last week, the ECB made its position clear. It lies in the fact that the interest rate will not be raised this year, which means that inflation is going to float freely. No one will have any influence on it and the ECB has very few ways to influence it. The European economy is going through hard times in its history. It managed to "move away" from the coronavirus pandemic with great difficulty, but even now the quantitative stimulus program continues to work in the European Union. That is, at this time, the ECB is still printing money to stimulate its economy. And if so, then raising the rate does not make any sense, and the economy needs to be stimulated, not tightened.

But the Fed may announce an interest rate hike tomorrow. I believe that the only thing that can save the euro from a new fall is that there has been talk of a repeated increase in the Fed rate for six months, that is, traders could already take this increase into account in the current dollar rate. If so, the euro will be saved for a while. However, it will still not be possible to eliminate the geopolitical factor from the equation. A military operation conducted by the Kremlin continues in Ukraine. Although many international experts do not believe that this operation will be able to be implemented for a long time (Russia simply does not have the necessary resources for this), there are always various options. And Moscow itself understands perfectly well that it cannot take a step back. There are already reports that China may join this conflict as an ally of the Russian Federation. However, it does not want to do it publicly, so as not to fall under sanctions from the West and the European Union. Since in this case, the whole world will be split into two large blocks, and the probability of a Third World War will increase.

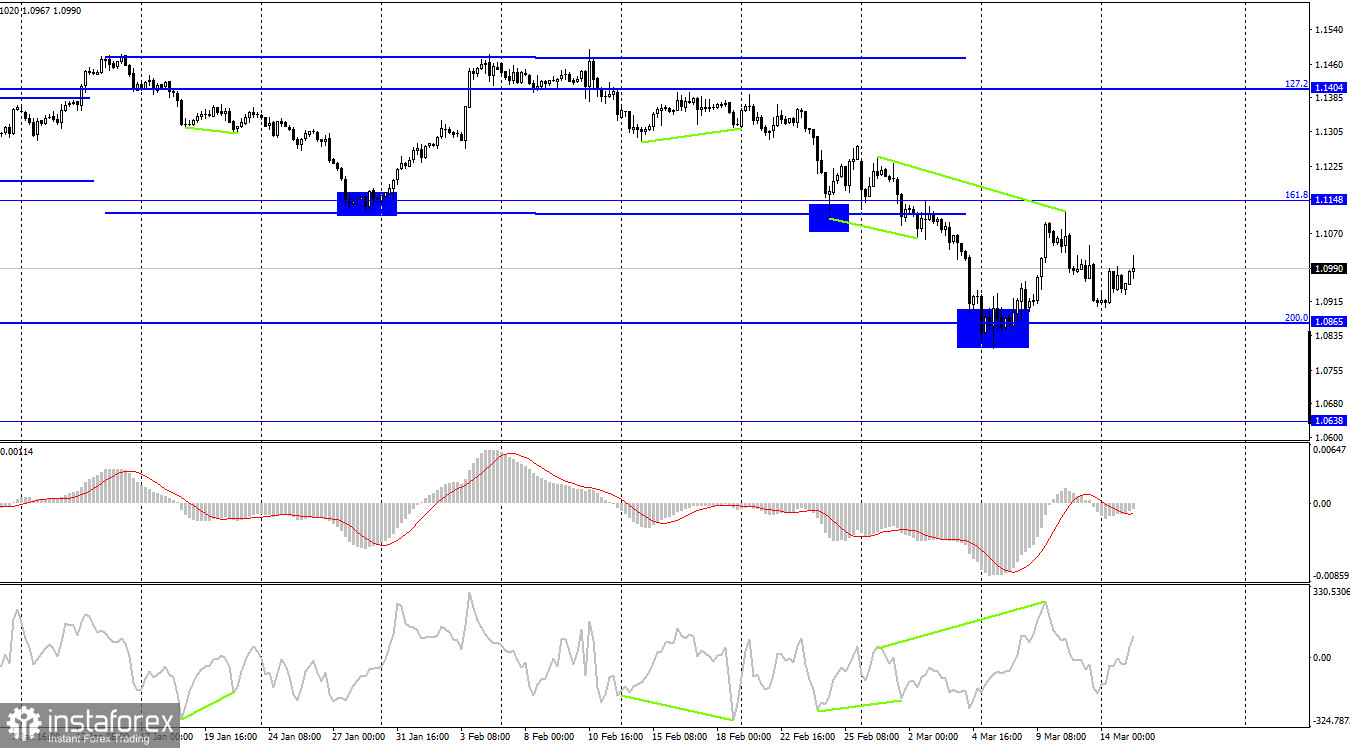

On the 4-hour chart, the pair performed a reversal in favor of the US dollar after the formation of a bearish divergence at the CCI indicator. Thus, the fall in quotes can be continued in the direction of the corrective level of 200.0% (1.0865). A rebound from this level will work in favor of the EU currency, but it is more likely to close below this level and a further drop in quotes in the direction of the 1.0638 level.

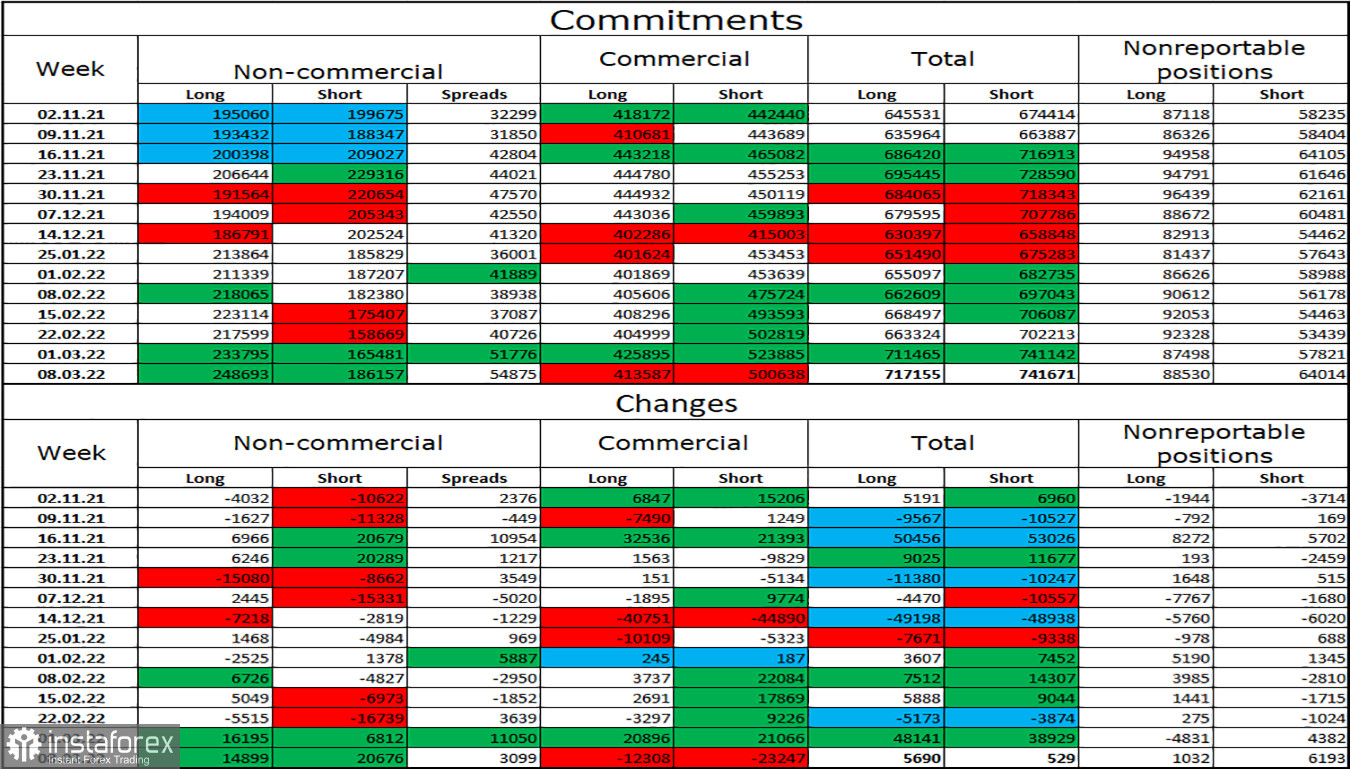

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 14,899 long contracts and 20,676 short contracts. This means that the bullish mood of the major players has become weaker. The total number of long contracts concentrated on their hands now amounts to 248 thousand, and short contracts - 186 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is still characterized as "bullish" and is strong. This would give an excellent opportunity for the European currency to count on growth, if not for the information background, which now supports only the American currency. We are now witnessing a paradoxical situation: the bullish mood of major players is increasing (if you look at it for several months), while the currency itself is falling. And it falls quite heavily. Thus, geopolitics is now a priority.

News calendar for the USA and the European Union:

EU - change in industrial production (10:00 UTC).

US - producer price index (12:30 UTC).

EU - ECB President Christine Lagarde will deliver a speech (15:15 UTC).

On March 15, the calendar of economic events of the European Union and the United States does not contain really interesting entries. Traders can only be interested in Christine Lagarde's speech. I believe that today the information background will have a weak impact on the mood of traders.

EUR/USD forecast and recommendations to traders:

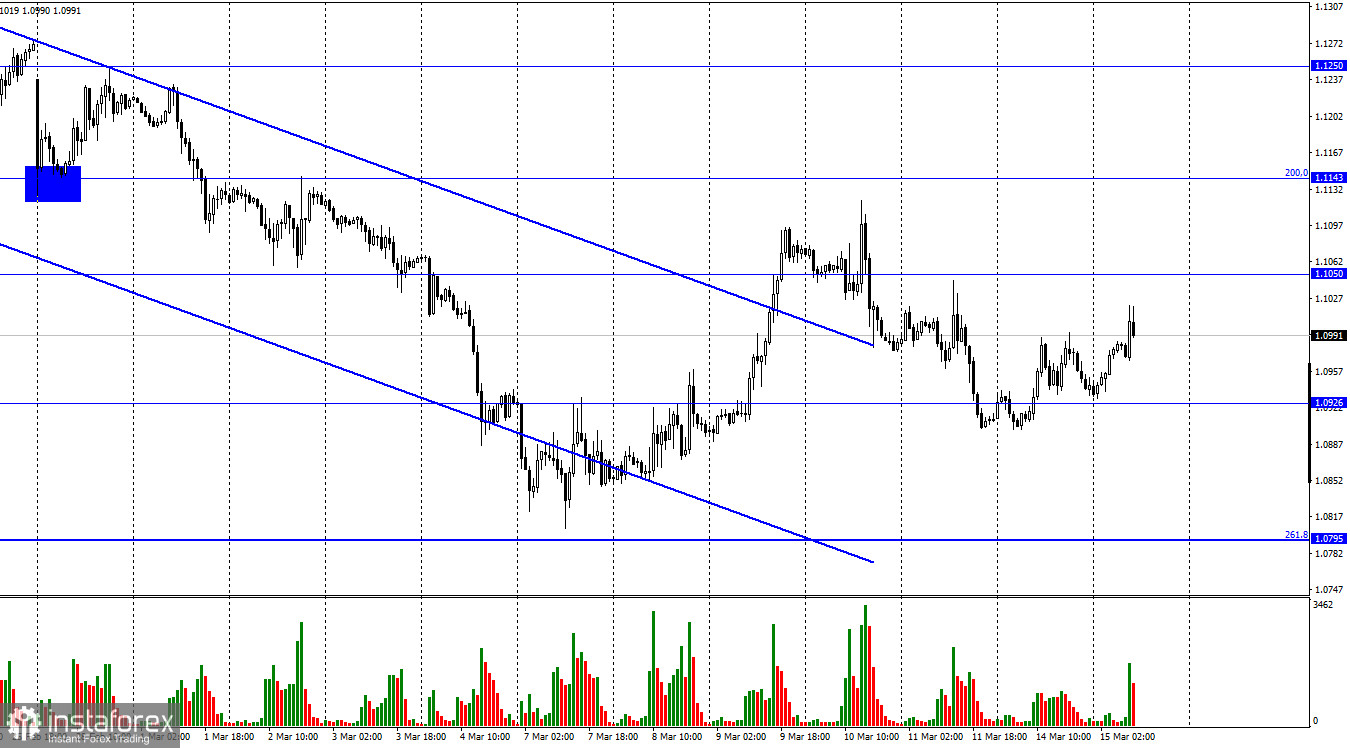

I recommend new sales of the pair if the pair performs a rebound from the 1.1050 level on the hourly chart, with targets of 1.0926 and 1.0865. I do not recommend buying a pair, since the probability of a new fall in the euro currency is too high.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română