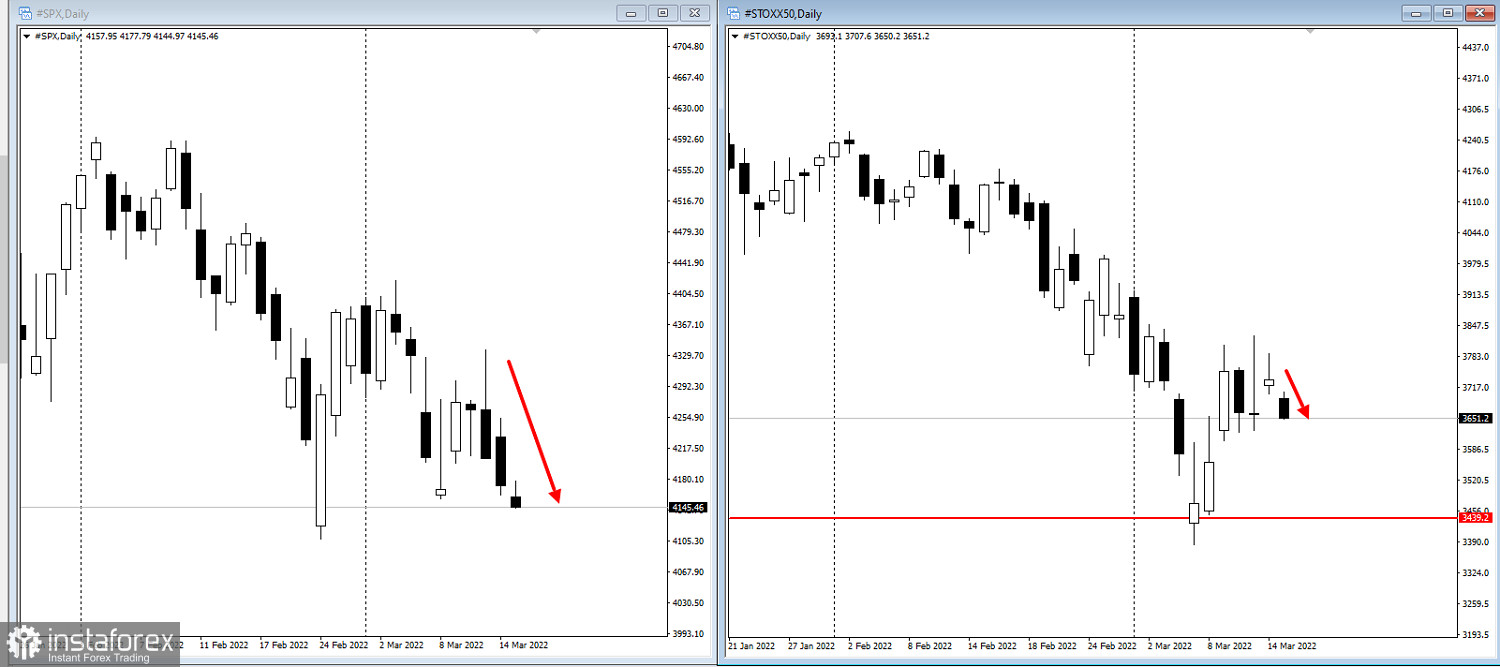

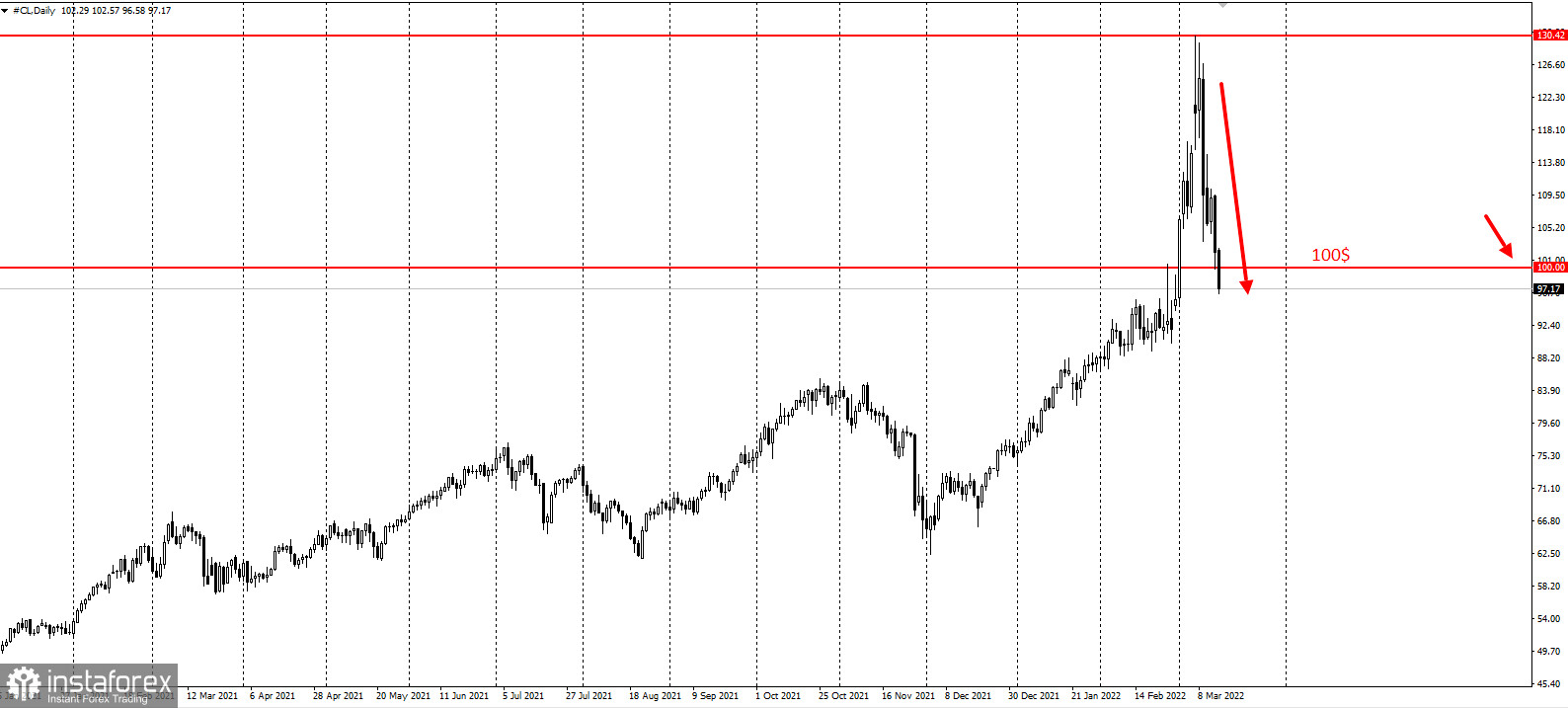

European stocks fell and US index futures nosedived after a sell-off of Chinese equities, growing fears over the war in Ukraine, and the imminent Fed monetary tightening weighed down on the market. Furthermore, crude oil prices continue to slide down below $100 per barrel.

The Stoxx Europe 50 lost more than 1%, and S&P 500 and Nasdaq 100 futures dived once again during volatile trading. On Monday, the Nasdaq closed during a bear market yesterday. A gauge of Asian shares went down towards the 19-month high, as positive Chinese economic data failed to interest investors. New lockdown measures have been enacted in several Chinese cities, as the country faces a new COVID-19 outbreak.

US Treasury bonds made gains. However, the 10-year yield remains near the highest level since 2019.

The commodity rally is weakening. WTI crude oil has fallen below $100 per barrel, as lockdowns in China threaten market demand for energy.

Traders are now pricing in about seven quarter-point interest rate increases by the Fed in 2022, starting with 25 basis points on Wednesday. Continuously high inflation, which predates the war, and a commodity shock triggered by sanctions against Russia makes monetary tightening even more important for the Fed, despite economic growth slowing down.

Meanwhile, Russia has started the payment process of two bond coupons due this week. Investors are waiting to see if the nation defaults after the U.S. and its allies froze Russia's foreign currency reserves. The ruble made gains in Moscow trading.

More volatility is expected due to geopolitical risks and mistakes by central banks tackling high inflation.

"It's going to take a while to tame inflation," Kathy Entwistle, managing director at Morgan Stanley Private Wealth Management, told Bloomberg Television. "The regular consumer is the one that is going to feel it the most this year."

Here are this week's key economic events:

- Tuesday: China one-year medium-term lending facility rate, economic activity data

- Wednesday: EIA crude oil inventory report

- Wednesday: FOMC rate decision and Fed Chair Jerome Powell news conference

- Thursday: Bank of England rate decision

- Thursday: ECB President Christine Lagarde, Executive Board member Isabel Schnabel, Governing Council member Ignazio Visco and Chief Economist Philip Lane speak at a conference

- Friday: Bank of Japan rate decision

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română