American stock indices are falling, oil prices are falling, and with them the quotes of commodity currencies. Oil prices, in turn, are falling on reports that the U.S. may ease sanctions on Venezuelan oil supplies and on investors' hopes for a truce between Russia and Ukraine, which could help lift some of the West's sanctions against Russia. Oil quotes also came under pressure on reports from China, where authorities in Shenzhen province imposed a lockdown amid an increase in the number of new cases of coronavirus. This, in turn, raises investors' doubts about the sustainability of oil demand in this country with the largest economy in the world.

Meanwhile, the expected beginning of the normalization of the Fed's monetary policy is causing the dollar to strengthen. According to data released last week, inflation in the United States reached a new high in 40 years: the consumer price index in February rose from 0.6% to 0.8%, and in annual terms - from 7.5% to 7.9%. Economists' forecasts suggest that at the meeting, which begins today, Fed officials will raise interest rates by 0.25%, which will begin a cycle of tightening monetary policy of the U.S. Central Bank. In recent comments, Fed Chairman Jerome Powell noted the possibility of multiple rate hikes this year, given rising inflation.

At the same time, if back in February the markets were expecting 6 or 7 interest rate hikes in the U.S., now these expectations have dropped significantly. Many market participants and economists believe that the Fed is unlikely to signal its intention to raise rates by 50 basis points further, although it will not consider the possibility of not tightening the policy. They expect Fed officials to signal five rate hikes this year, while not fast enough real wage growth and falling incomes will force the central bank to pause after July.

However, this is not yet reflected in the dollar, which continues to strengthen, especially, as we noted above, in relation to major commodity currencies such as the Australian, New Zealand, Canadian dollars. Regarding the latter, it is worth noting that tomorrow (at 12:30 GMT) fresh consumer price indices in Canada will be published. Core Consumer Price Index (Core CPI) from the Bank of Canada reflects the dynamics of retail prices of the corresponding basket of goods and services (excluding fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products). The inflation target for the Bank of Canada is in the range of 1%-3%. The rising CPI is a harbinger of a rate hike and positive for the CAD. The core consumer price index rose in January 2022 by 0.8% (+4.3% in annual terms). Another increase in Core CPI is expected in February (by +0.6% and +4.8% in annual terms).

Noticeable support for the Canadian dollar at the end of the last trading week was provided by the published report on the Canadian labor market for February. The number of employees rose sharply, by 336,600 after falling by 200,100 last month, although economists expected an increase of only 160,000. The unemployment rate fell by 1%, to 5.5%, while market forecasts suggested a decline to only 6.2%. The average hourly wage increased by 3.3% from the previous growth of 2.4%.

The Bank of Canada may follow more aggressive rate hike tactics, based on the February inflation report, which will be released on Wednesday, after a strong report on the labor market. This is a strengthening factor for CAD.

If the expected data on inflation in Canada turns out to be better than the forecast, then this is likely to provide additional support to the Canadian dollar and will contribute to the decline in USD/CAD. Although this decline will be short-lived, given the subsequent publication of the Fed's decision on rates at 18:00 GMT. The Fed's 0.25% rate hike is already largely priced in USD quotes. Of greatest interest will be the Fed's press conference, which will begin at 18:30 GMT. Market participants want to hear from Fed Chairman Powell his opinion on the future plans of the Central Bank. The Fed's report with forecasts for inflation and economic growth for the next two years and, equally important, the individual opinions of FOMC members on interest rates will also be of interest.

A more hawkish stance on monetary policy is viewed as positive and strengthens the U.S. dollar, while a more cautious stance can be seen as indecision and will negatively affect the USD.

Technical analysis and trading recommendations

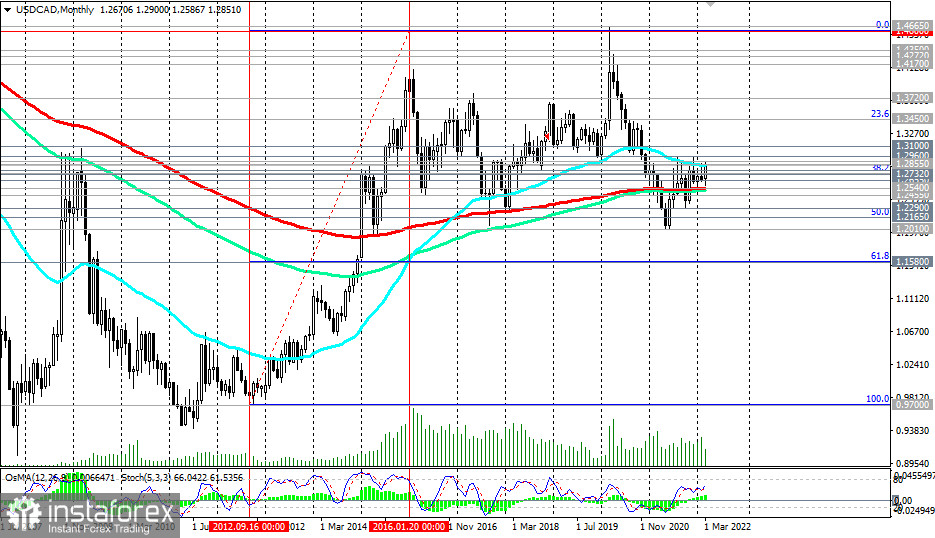

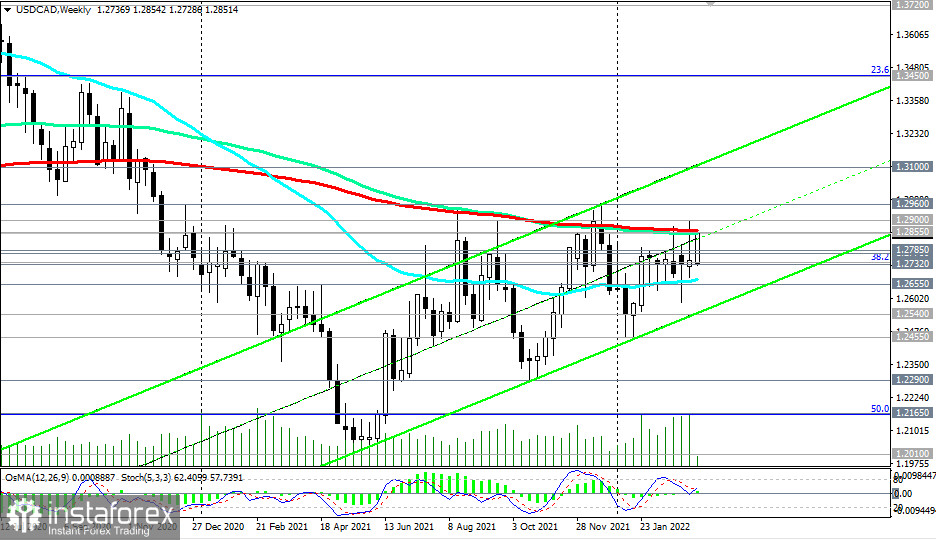

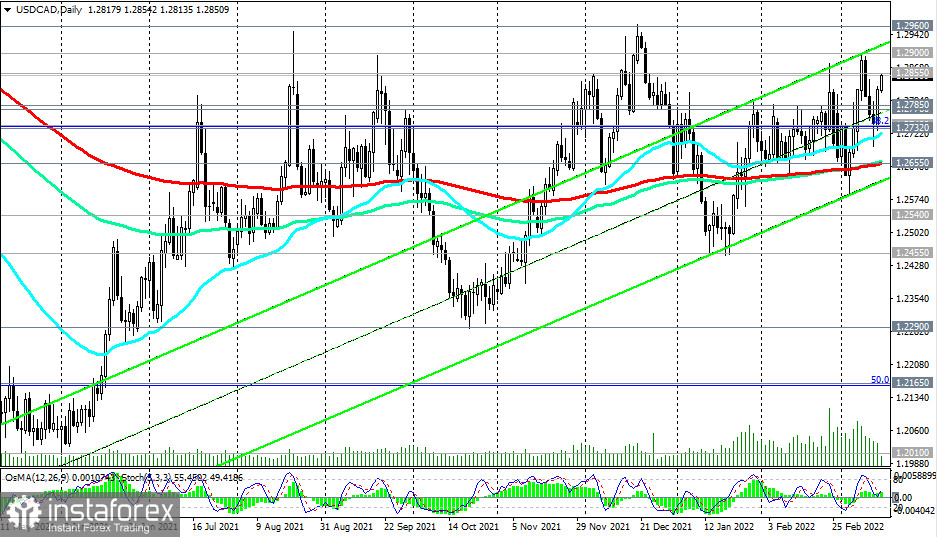

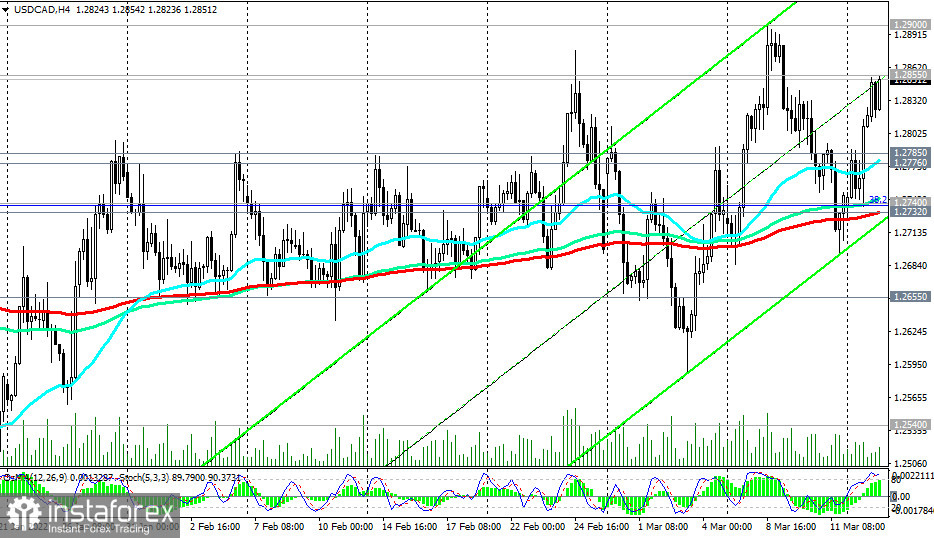

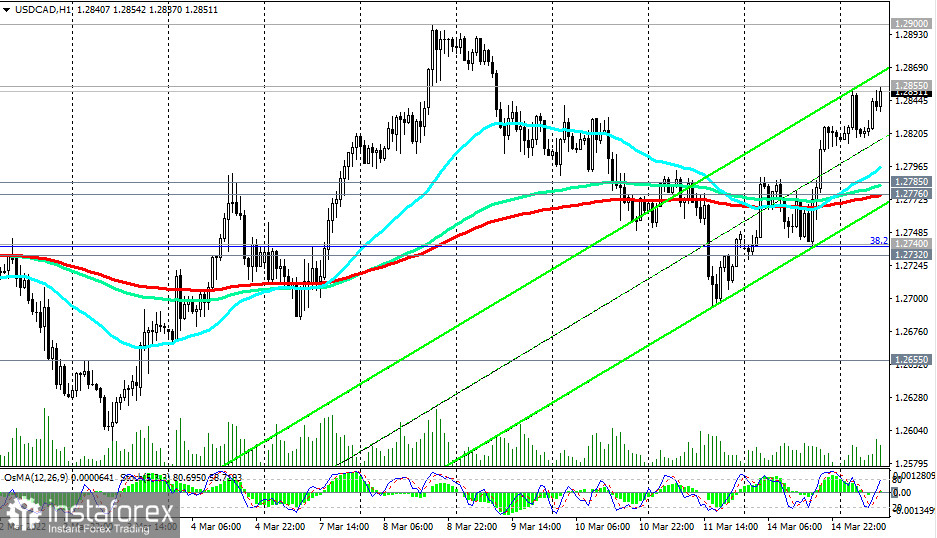

As for the USD/CAD pair, it is growing today for the second day in a row after a 3-day decline the day before. The fall of USD/CAD stopped last Friday in the zone of support levels 1.2732 (200 EMA on the 4-hour chart), 1.2740 (the 38.2% Fibonacci level retracement in the wave of USD/CAD growth from the level of 0.9700 to the level of 1.4600).

If we consider the current USD/CAD growth as corrective, then the pair has reached the maximum of corrective growth, having encountered strong resistance near the key level of 1.2855 (200 EMA on the weekly chart and 50 EMA on the monthly chart). Therefore, a reversal and resumption of decline is possible in the zone of this resistance level.

If you look at the daily and weekly charts of USD/CAD, you can see that the pair is developing upward dynamics, moving within the ascending channels. The upper limit of the channel on the weekly USD/CAD chart passes near the 1.3100 mark, which will become the nearest target for USD/CAD growth after the breakdown of the zone of strong resistance levels 1.2855, 1.2900, 1.2960.

We stick to the USD/ CAD growth scenario towards a more distant target and the resistance level of 1.3450 (23.6% Fibonacci level).

In an alternative scenario, the first signal for the resumption of short positions will be a breakdown of the local support level 1.2810, and the confirming one will be a breakdown of support levels 1.2785 (local support level), 1.2776 (200 EMA on the 1-hour chart).

The breakdown of the long-term support level 1.2655 significantly increases the risks of USD/CAD returning to the long-term bearish trend.

Support levels: 1.2785, 1.2776, 1.2740, 1.2732, 1.2655, 1.2625, 1.2540, 1.2455, 1.2290, 1.2165

Resistance levels: 1.2855, 1.2900, 1.2960, 1.3100, 1.3450

Trading recommendations

USD/CAD: Sell Stop 1.2805. Stop-Loss 1.2865. Take-Profit 1.2785, 1.2776, 1.2740, 1.2732, 1.2655, 1.2625, 1.2540, 1.2455, 1.2290, 1.2165

Buy Stop 1.2865. Stop-Loss 1.2805. Take-Profit 1.2900, 1.2960, 1.3100, 1.3450

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română