EUR/USD

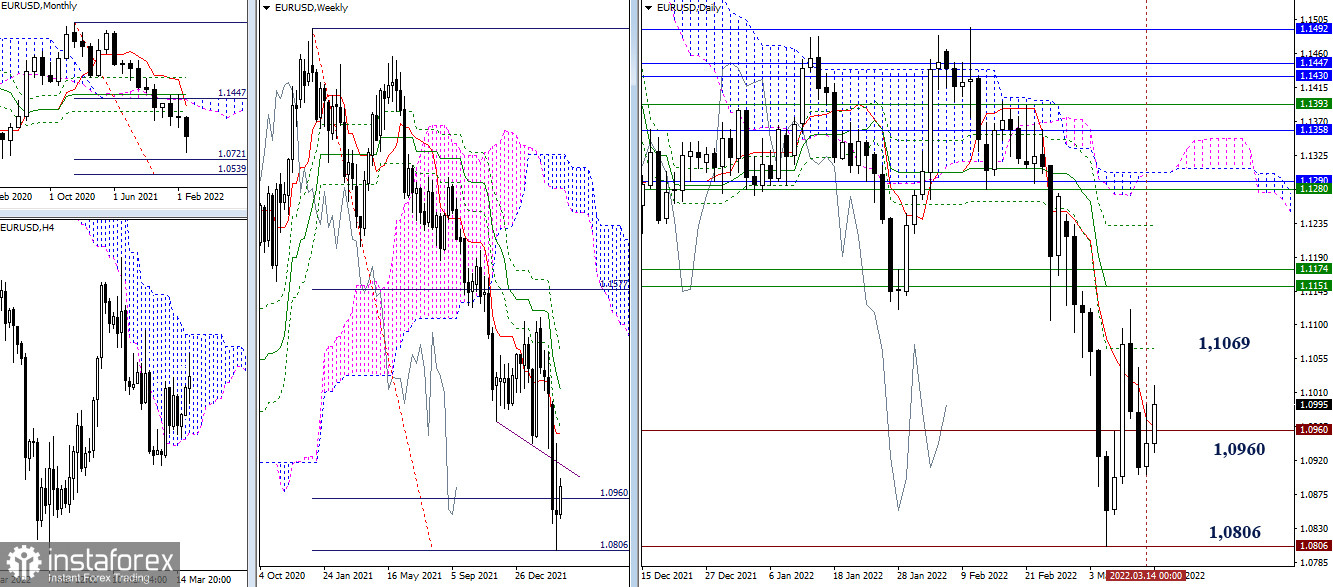

The situation has not changed significantly over the past day; the uncertainty indicated earlier remains. The pair remains in the zone of attraction and influence of the daily short-term trend (1.0964) and the first target of the weekly target for the breakdown of the Ichimoku cloud (1.0960). Based on this, we can state the preservation of the main prospects in the event of a change in the current balance of power. The nearest upward targets today are 1.1069 (daily Fibo Kijun) and 1.1151-74 (weekly levels + daily Kijun). The main downward reference is still the minimum extremum (1.0806), consolidation below which will restore the downward trend and go beyond the weekly target.

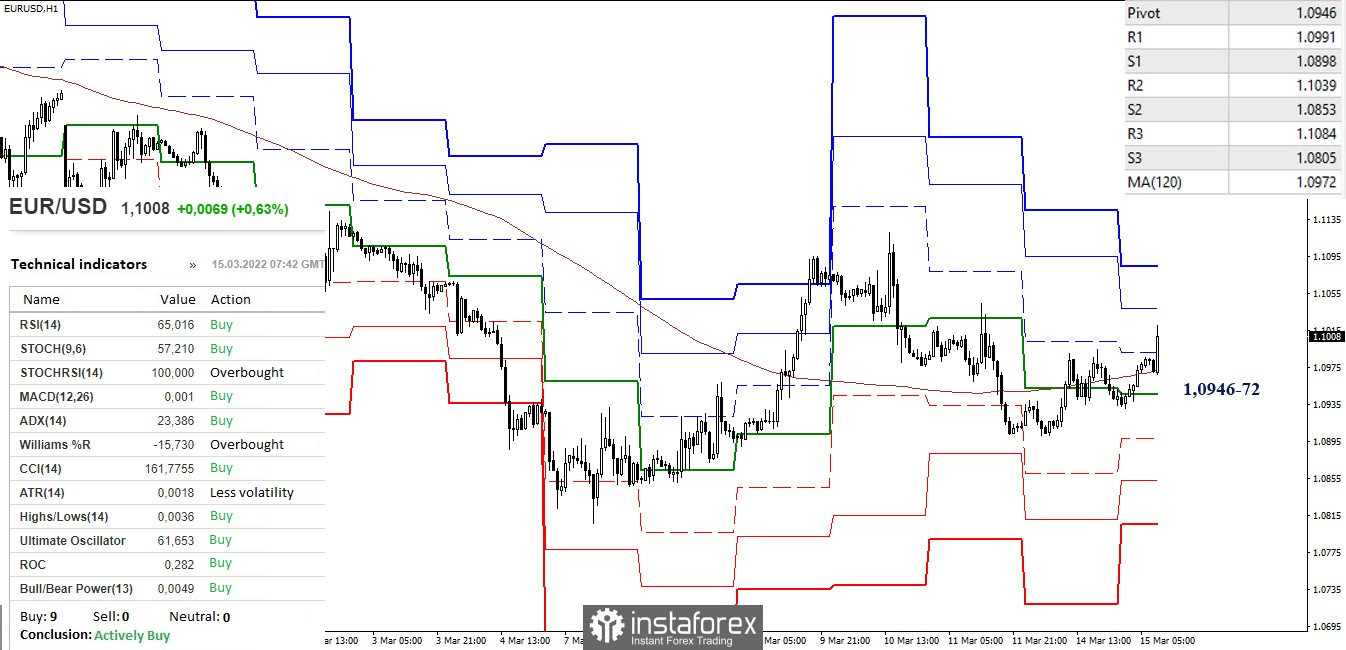

In the lower timeframes, there is a struggle for possession of key levels, which today can be noted at 1.0946 (central pivot point of the day) and 1.0972 (weekly long-term trend). Consolidation above will provide bulls with a preponderance of forces, and their next upward targets within the day are located at 1.1039 – 1.1084 (resistances of classic pivot points). A return to the key levels (1.0946-72) will return the preponderance of forces to the side of the bears, then it will be possible to consider bearish prospects, they serve as supports for intraday classic pivot points, at the moment they are at 1.0898 – 1.0853 – 1.0805.

***

GBP/USD

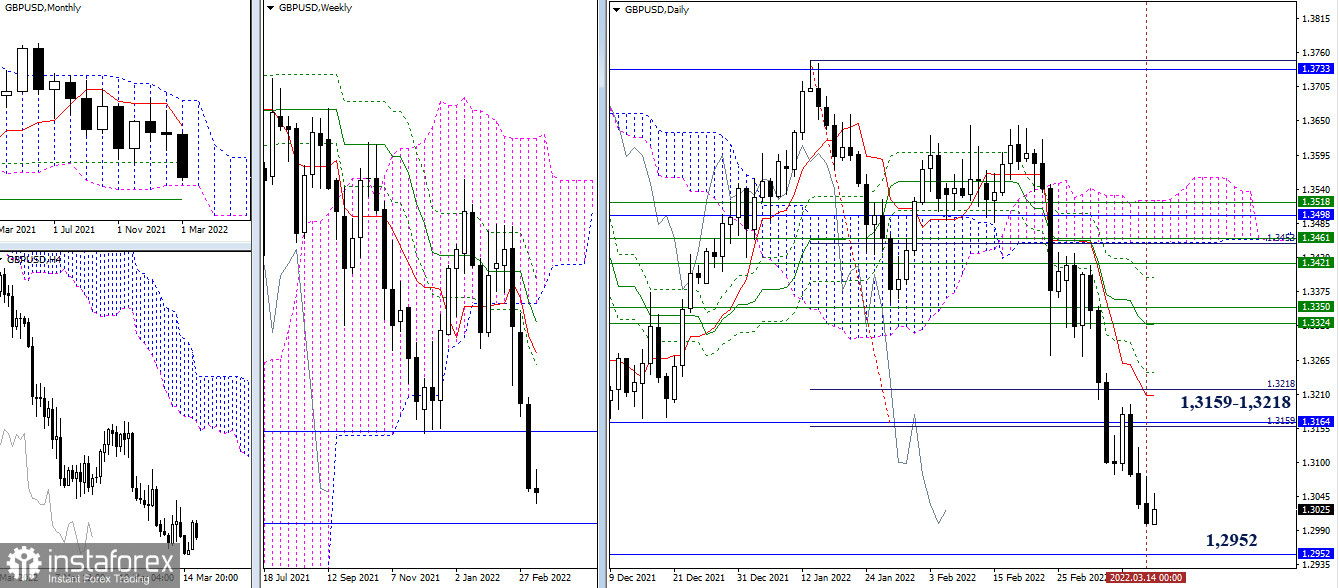

Yesterday bears updated the last week's low, but they failed to continue the active decline. The lower boundary of the monthly cloud (1.2952) is now the closest reference point for further decline. The levels passed earlier formed a resistance zone 1.3159 - 1.3218 (daily levels + daily target for the breakout of the Ichimoku cloud + monthly Fibo Kijun), which will be tested first when bullish sentiment returns to the market.

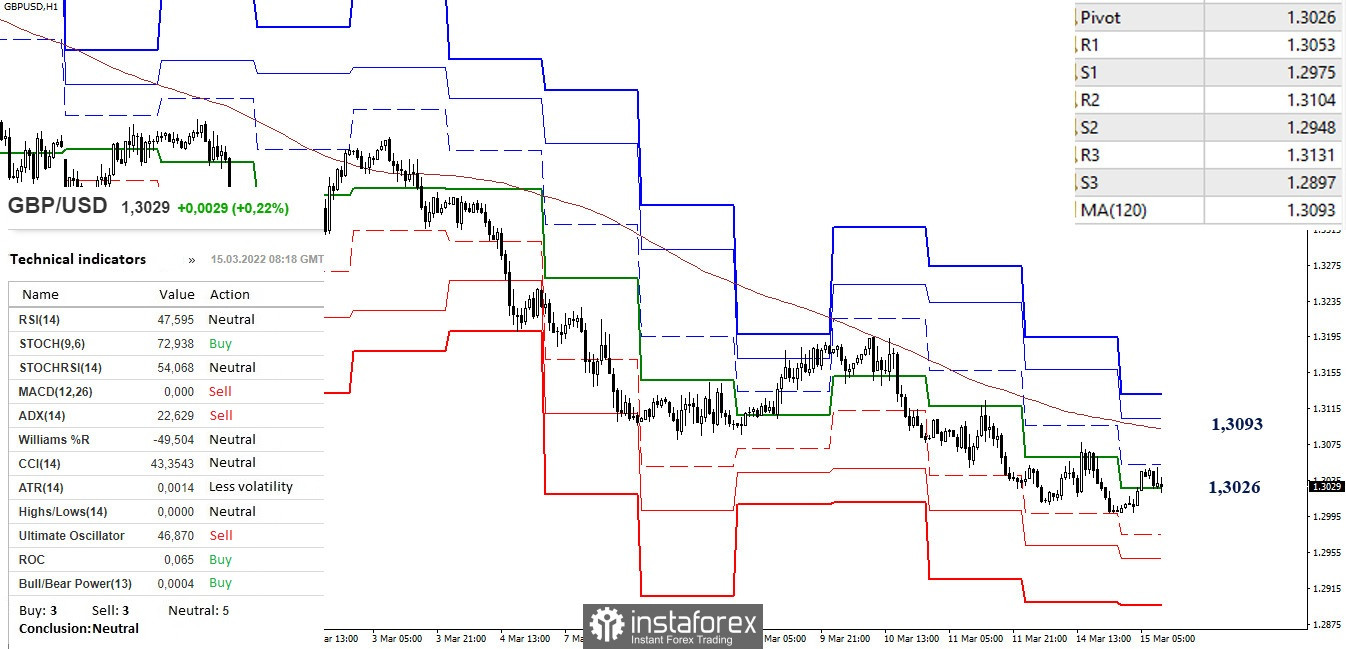

At the moment, we are witnessing the development of an upward correction on the lower timeframes. The emerging correction allowed the pair to rise above the central pivot point of the day (1.3026). If the bulls manage to gain a foothold here and continue the rise, then the next reference point for the development of the correction will be the resistance of the weekly long-term trend (1.3093). This level can affect the distribution of forces, its breakdown and reversal will give the main advantage to the bulls. The formation of a rebound from the central pivot point (1.3026) and the restoration of the downward trend (1.3000) will allow bears to continue the decline. Downward references within the day today are at 1.2975 - 1.2948 - 1.2897 (classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română