Bulls believe it is too early to give up

Hi, dear colleagues!

The first trading day this week was bullish for the most popular currency pair that even tried to test the psychologically important landmark level of 1.1000. We will discuss later in technical analysis what has actually happened, but first let's speak about the information background of today.

Apart from the policy meeting of the Federal Reserve and the press conference of its leader Jerome Powell, the economic calendar reminds of some macroeconomic reports that should not be neglected. Today, market participants will get to know the EU industrial production data and ZEW business sentiment index for the EU and Germany. Both reports are on tap at 10:00 GMT. Later in the evening, the US will release a producer price index, including a core PPI. The Empire State Manufacturing Index is also worthy of attention. The reports from the US will be released at 12:30 GMT.

When it comes to the fundamental background, Russia's invasion of Ukraine triggered a slew of harsh sanctions on Russia. Recent European buyers of Russian oil and gas are now determined to scale back Russian supplies. Both Russian energy companies and European consumers are discouraged by such dismal prospects. Indeed, both sides were pleased about steady supplies of cheap Russian gas. All of a sudden, the fierce political standoff between Russia and Ukraine aggravated the energy crisis in Europe. The EU authorities slapped economic sanctions, including a ban on gas imports from Russia. EU countries decided to revise its energy policy and abandon Russian suppliers, searching for other exporters. As a result, European consumers are dealing with soaring oil and gas prices. The EU has come to a common denominator: to solve the question of energy dependence on Russia's dodgy regime. The whole world has to adjust to new reality.

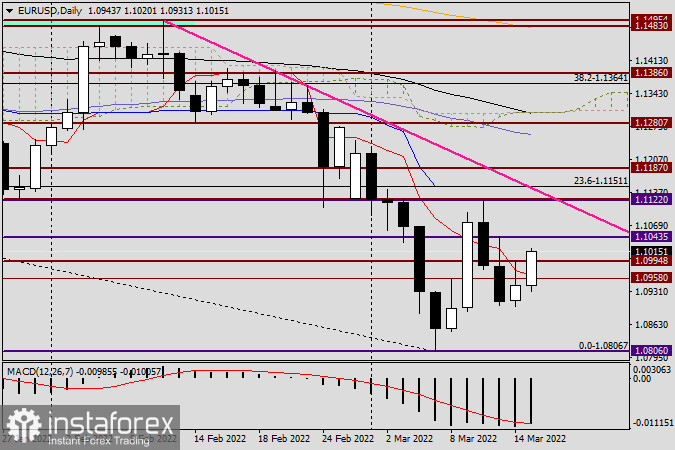

Daily

Yesterday, the euro bulls perked up, heading for the landmark level of 1.1000. However, approaching this important level, at 1.0994 in particular, the currency pair had to deal with strong resistance of sellers. So, EUR/USD had to retreat. The currency pair closed trading on March 14 below the red Tenkan line of the Ishimoku indicator and below the level of 1.0958 that used to serve as resistance and that matches the high of March 8. We could have supposed that the EUR bulls exhausted their strength, bearing in mind a large upper shadow of yesterday's candlestick. It seemed that the EUR bears were regaining control over the market.

In practice, things are not so evident. At the time of writing this article, EUR/USD was climbing to yesterday's highs, trying to rise higher. Perhaps the main currency pair will make another attempt to test 1.1000 and settle above it. This price action is quite possible as an upward correction before the Fed's policy announcements. Traders are willing to push the price up so that they will be able to sell it at higher prices. The odds are against that EUR/USD will extend growth after the Fed's decision to raise the refinancing rate, even though this rate hike has been already priced in by market participants.

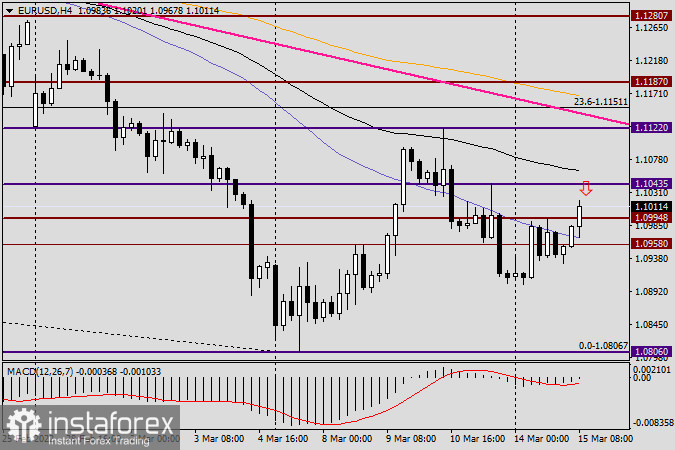

H4

On the 4-hour chart, we see that the price has already climbed above a 50-period moving average, trying to push higher. If these efforts are successful, the price is expected to move towards resistance at 1.1043 and the black exponential moving average that coincides with 1.1062. If this scenario comes true, I recommend planning short positions provided that some reversal bearish candlestick patterns appear in the area of 1.1040 – 1.1060 on the 4-hour or 1-hour charts. If the ongoing candle takes the shape of a bearish pattern and closes below yesterday's highs at 1.0994, it would be a signal to open short positions.

In conclusion, from my viewpoint, the main trading idea is still selling EUR/USD. It would be better to open short positions when you spot above-mentioned signals. To finish this article, the currency pair has just touched 1.1020 and faced strong resistance. Hence, the price, retraced to yesterday's highs. It proves that the bulls are not ready to give up yet. So, the struggle is going on!

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română