The Fed's two-day monetary policy meeting begins today, and it will take place against the background of continued inflation in the US and geopolitical tension in Ukraine.

Many expect the central bank to raise the interest rate by 0.25% tomorrow, shifting the range from 0.0% -0.25% to 0.25% -0.50%. If that happens, demand for stocks will increase, while demand for dollar will decrease. But if a signal is given that the bank will act on the basis of the current situation, the situation on the markets may change dramatically.

Will the continued rise of US inflation be a strong signal for a rate hike? Yes, it can be, but in this case, the US will fall into a full-fledged recession, burdened by geopolitical conflict.

It seems that the Fed will try to mitigate the negative consequences expected by the markets by raising the rate by only 0.25% to 0.50%. Their forecasts for rates, inflation and employment will also play an important role because if those turn out to be more negative, reflecting the possibility of recession, a new wave of sell-off will occur in the markets. The tone of Powell's statement will also be decisive as a dovish one will prompt a bull market.

Summing up, a milder outcome of the meeting could lead to local demand for risky assets and to a weakening of dollar. That is why traders should wait for the results before entering the market.

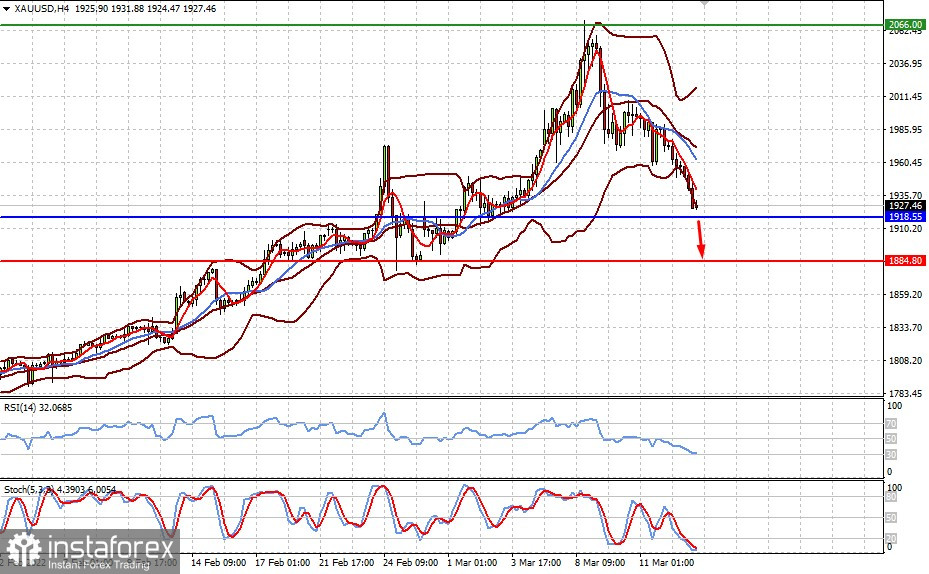

Forecast for today:

EUR/USD pair is consolidating under 1.1000. The result of the Fed meeting tomorrow may provoke a rise to 1.1100.

Spot gold is still above 1918.55. But a rally in risky assets will lead to a dip to 1884.80.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română