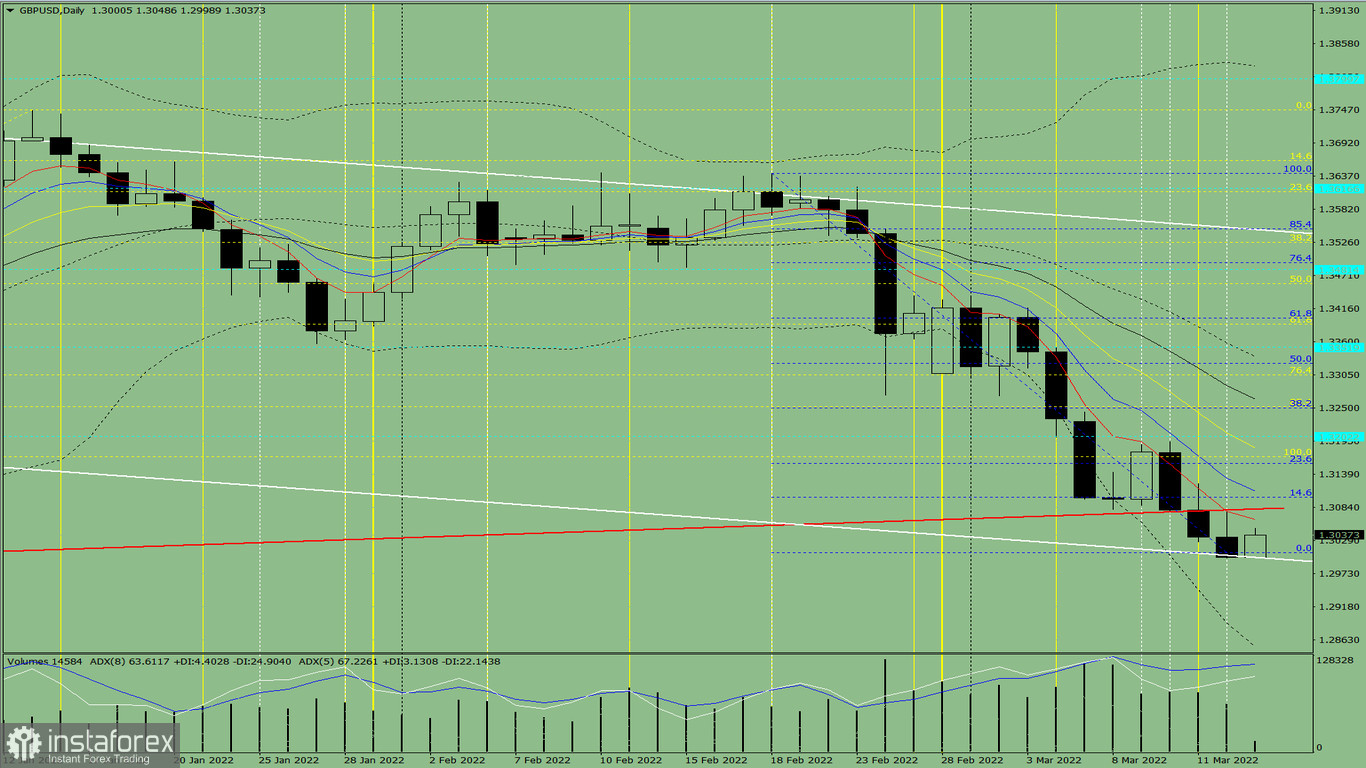

Trend analysis (Fig. 1).

The market may move up on Tuesday from the level of 1.3001 (close of yesterday's daily candle) to the target level of 1.3100, the 14.6% retracement level (blue dotted line). In case of testing this level, the price may continue to move up to the target level of 1.3158, the 23.6% retracement level (blue dotted line).

Fig. 1 (daily chart).

Comprehensive analysis:

- Indicator analysis - up;

- Fibonacci levels - up;

- Volumes - up;

- Candlestick analysis - up;

- Trend analysis - up;

- Bollinger Bands - up;

- Weekly chart up.

General conclusion:

The price may move up from the level of 1.3001 (close of yesterday's daily candle) to the target level of 1.3100, the 14.6% retracement level (blue dotted line). In case of testing this level, the price may continue to move up to the target level of 1.3158, the 23.6% retracement level (blue dotted line).

Unlikely scenario: from the level of 1.3001 (close of yesterday's daily candle), the price may move downward to the target level of 1.2852, the lower border of the Bollinger Band indicator (black dotted line). In case of testing this level, the price may move up to the target level of 1.3100, the 14.6% retracement level (blue dotted line).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română