The European Union, as Josep Borrel said, seems to have really exhausted all possibilities for sanctions against Russia. The new sanctions package can be called purely symbolic, as it affects only a number of individuals and legal entities. In addition, Brussels intends to apply to the World Trade Organization for the suspension of the most favored nation regime in relation to Russia. But this point will have practically no effect, since Russia has not exported any goods to Europe anyway, except for raw materials, of course. So the introduction of protective duties, especially against the background of full-scale sanctions, will not affect the Russian economy in any way. It turns out that at least the European Union does not intend to further strengthen the sanctions confrontation, and it is quite possible that Russia will reciprocate. Which of course somewhat calms the market participants.

But another point is much more important. If you believe the statement of the official representatives of Ukraine, the negotiation process seems to have moved from a dead point, and some kind of peace agreement will be reached in the near future. At least, the adviser to the head of the office of the President of Ukraine, Oleksiy Arestovych, said that it could be achieved within a week. This means that the fighting may soon stop, and with it the flow of refugees to Western Europe will stop. And after all, it is the fighting that is the main reason for the rather large-scale weakening of the pound. The very prospect of their termination in the near future already contributes to its growth, which we have been observing since yesterday. If the situation does not change, and will move in this direction, then this growth will continue.

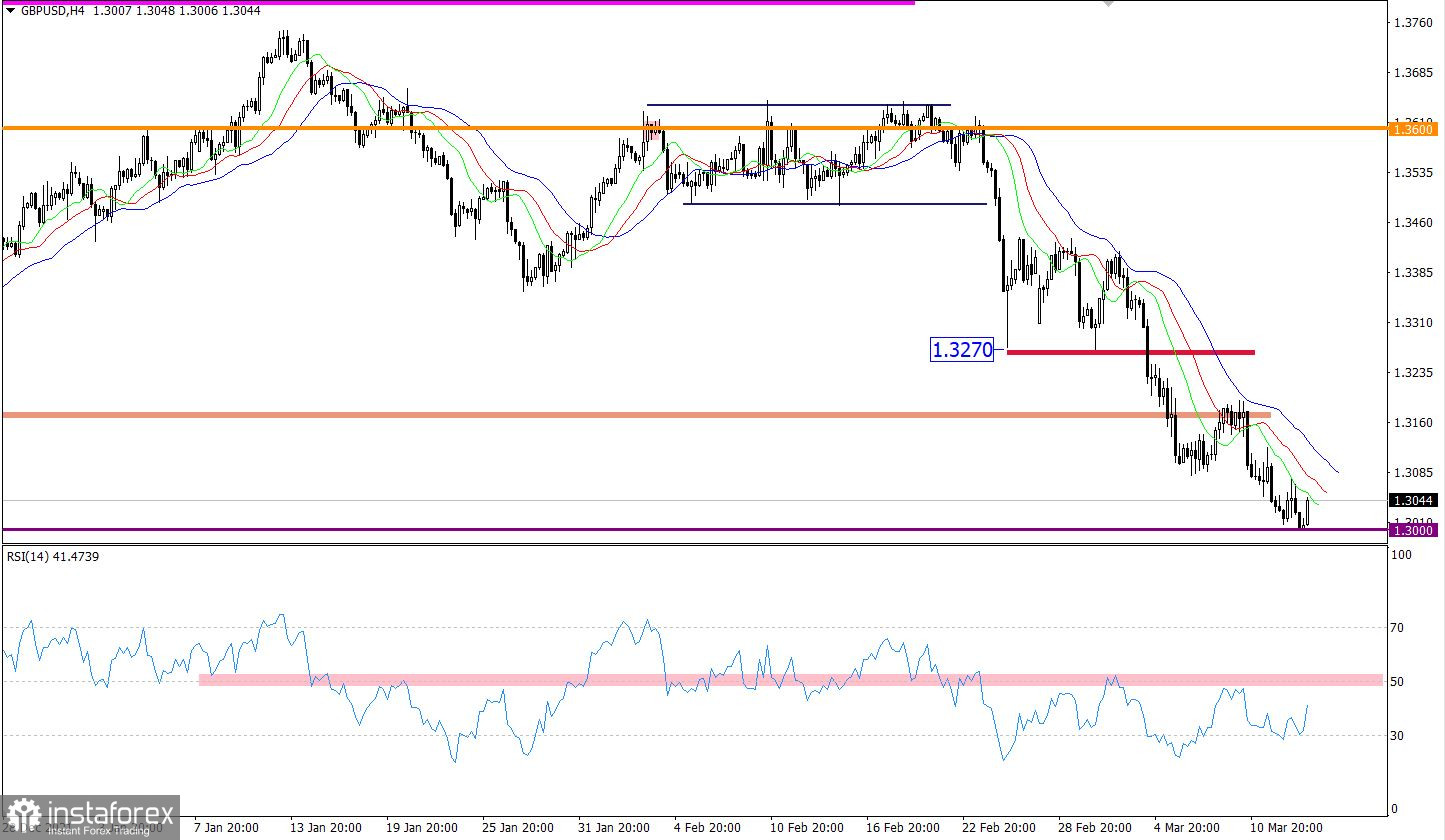

The GBPUSD currency pair approached the level of 1.3000 with surgical precision, where the downward movement slowed down. The psychological level puts pressure on bears, but in this situation it is considered by traders only as a variable foothold on the path of a downward trend.

The RSI technical instrument moves in the lower area of the 30/50 indicator in a four-hour period, which indicates a high interest of traders in short positions. RSI D1 is in the oversold zone, which is due to the intense downward movement and the important price level of 1.3000.

Alligator H4 and D1 indicate a downward trend. There are no intersections between MA moving lines.

Expectations and prospects:

Despite the high desire of traders to continue to form a downtrend, the level of 1.3000 has a negative impact on the volume of short positions. This may lead to a slowdown in the downward cycle and, as a result, a price pullback.

A complex indicator analysis gives a signal to buy in the short term due to a price rollback. Indicators in the intraday and medium-term periods signal a sale, due to a downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română