Despite the fact that the Bank of England is not going to swim against the tide and intends to raise the repo rate for the third time since the start of the pandemic, and the British economy is less dependent on Russian oil and gas than continental Europe, GBPUSD quotes have collapsed to the lowest level since November 2020. Investors are seriously concerned about tightening fiscal discipline, rising household electricity bills, and increased risks of recession in the UK economy. All this may force the BoE to slow down in tightening monetary policy.

Britain is much closer to the epicenter of a military conflict in Eastern Europe than the United States, which is why Financial Times experts are more willing to cut its GDP growth forecasts than its American counterpart. Yes, in January the UK economy expanded by 0.8% MoM, exceeding the forecasts. Yes, it is currently 0.8% higher than before the pandemic. Yes, Russia accounts for only 4% of gas supplies, 1.3% of merchandise trade, and 0.7% of Britain's foreign investment. But the country buys blue fuel at European prices, which are currently excessively high.

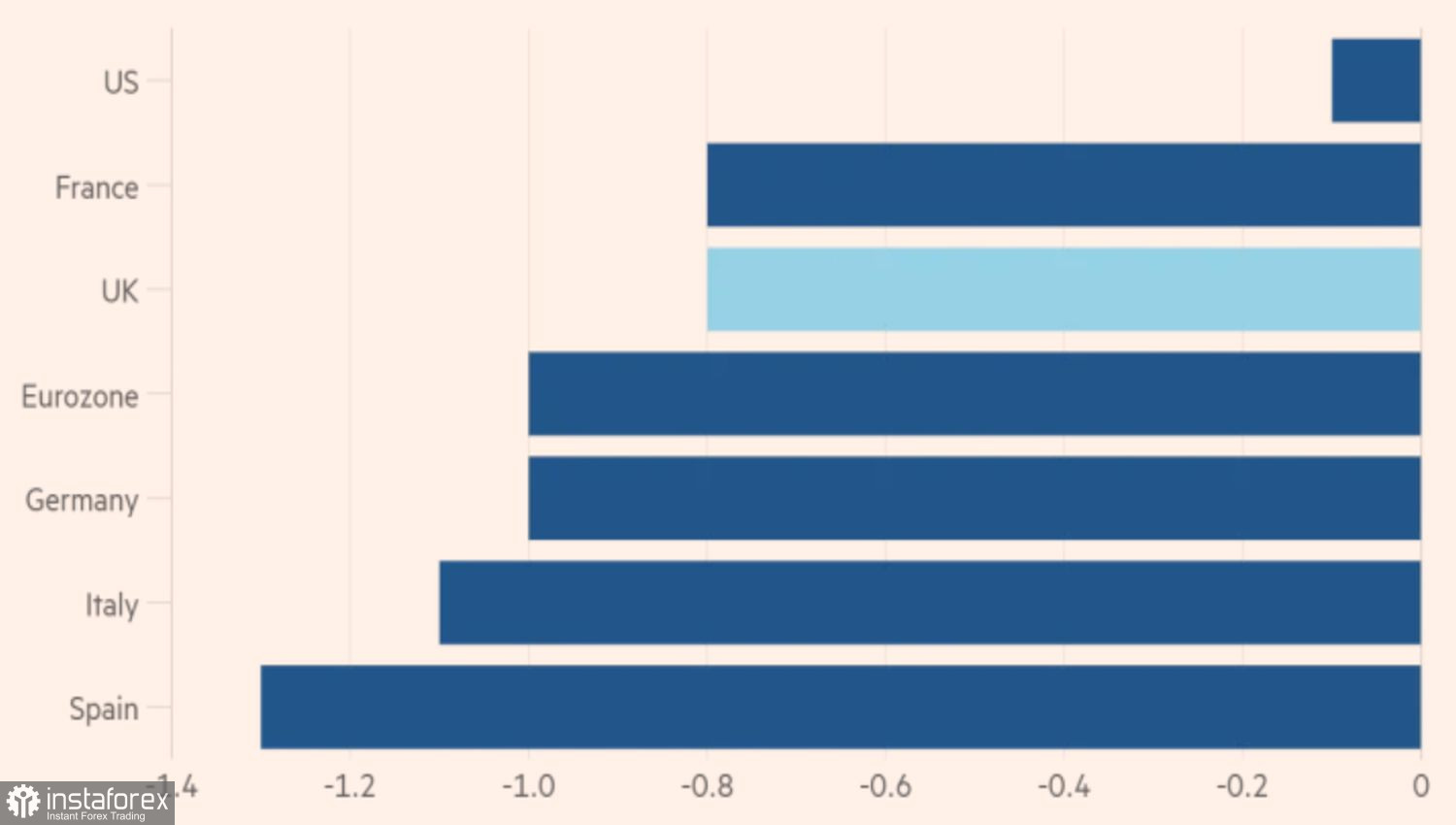

Changes in the forecasts of Financial Times experts on the economies of the United States and Europe as a result of the impact of the Ukrainian crisis

Considering that in February some members of the BoE Monetary Policy Committee voted in favor of raising the repo rate by 50 basis points at once, the question of its increase by 25 basis points in March can be considered closed. The indicator will return to the levels it was at before the pandemic. At the same time, the derivatives market expects borrowing costs to rise to 1.5% by the end of summer and up to 2% in a year. In the latter case, we are talking about a mark that was last seen during the previous global economic crisis of 2008-2009. The main thing is not to go too far. According to MPC member Silvana Tenreyro, an attempt by the Bank of England to bring inflation back to the 2% target too quickly is fraught with rising unemployment and destabilizing the economy.

In my opinion, a gradual tightening of monetary policy is what the doctor ordered. BoE Governor Andrew Bailey and his colleagues have the opportunity to sit and watch how the repo rate hike by 25 basis points at each meeting of the Committee will influence inflation and economic growth, and then make further decisions.

In this regard, the Fed may be more aggressive than the Bank of England, because the U.S. has a livelier labor market, a stronger economy due to large-scale fiscal stimulus, and faster inflation. Ultimately, they are located farther from the zone of military conflict in Ukraine. The chances that the federal funds rate will rise immediately by 50 basis points is higher in the U.S. than in the UK. This circumstance, coupled with the high demand for the U.S. dollar as a safe-haven asset, pushes the quotes of the analyzed pair down.

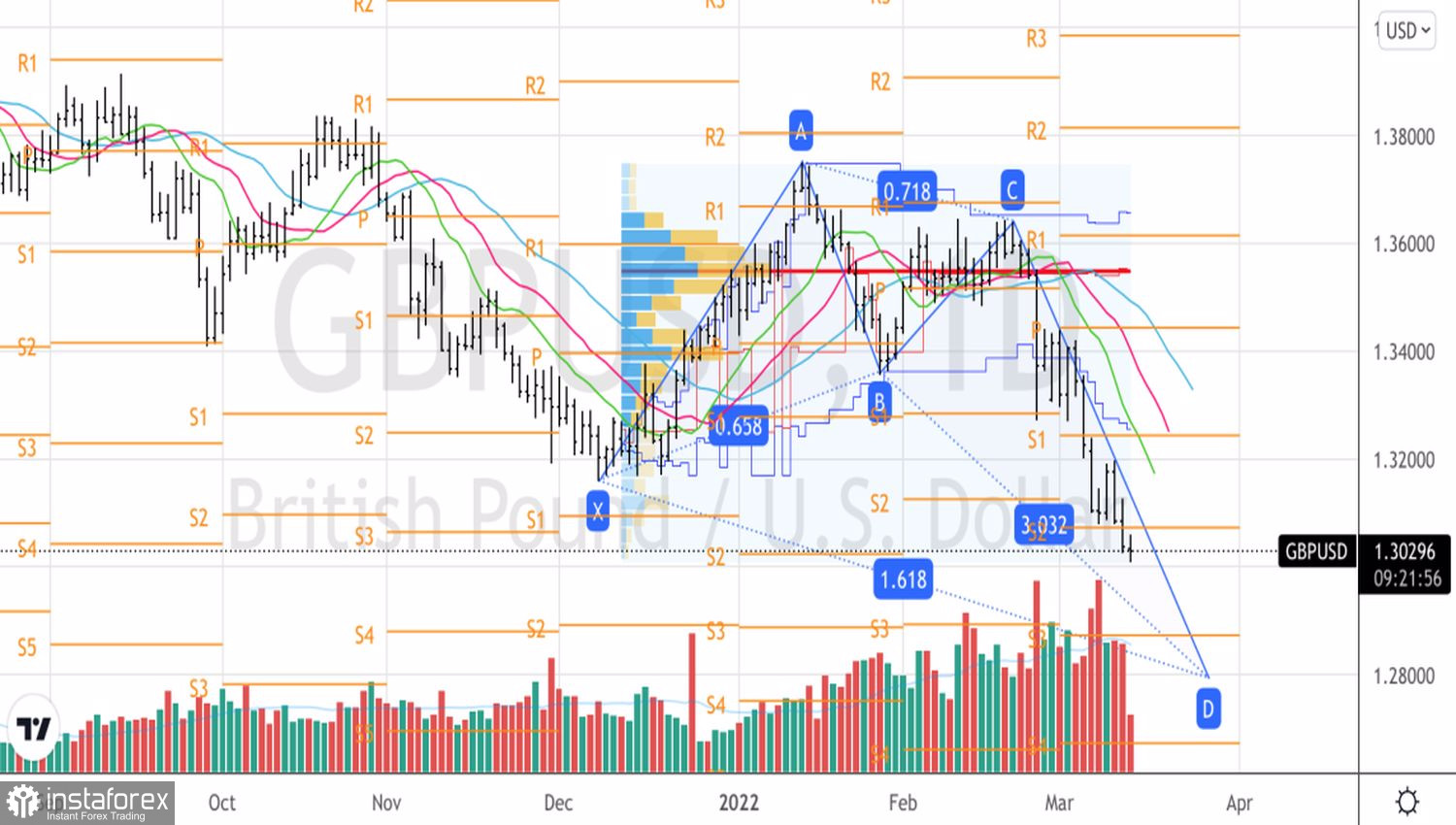

Technically, the downward movement of the GBPUSD towards the target of 161.8% according to the Crab harmonic trading pattern continues. It corresponds to the mark of 1.28. The inability of the pound to return above the pivot level at 1.3075 will be a sign of bullish weakness and a reason for the formation of short positions with targets at 1.289 and 1.280.

GBPUSD, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română