Long positions on EUR/USD:

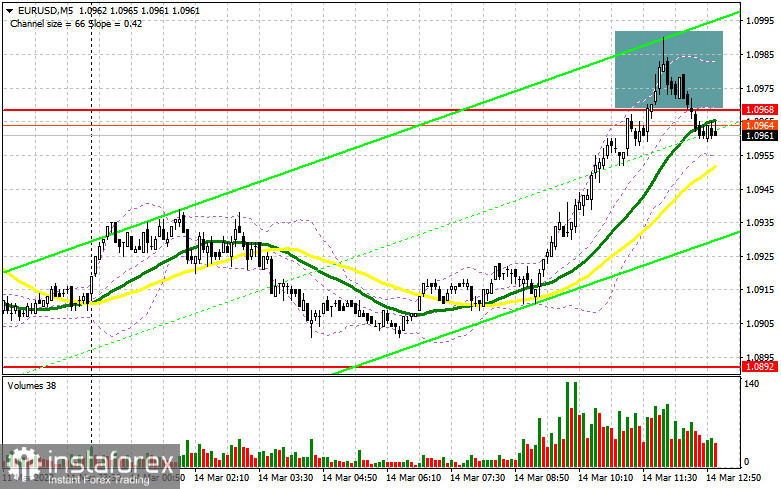

In my forecast this morning, I drew your attention to the level of 1.0968 and recommended entering the market from this level. Let's have a look at the 5-minute chart and analyze what happened. Bulls pushed the EUR/USD pair to 1.0970, and that is it for today. A false breakout at 1.0968 has created a sell signal for the euro, but bears have not shown their activity yet. As long as the pair is trading below this level, the decline is possible. Notably, there are no other entry points.

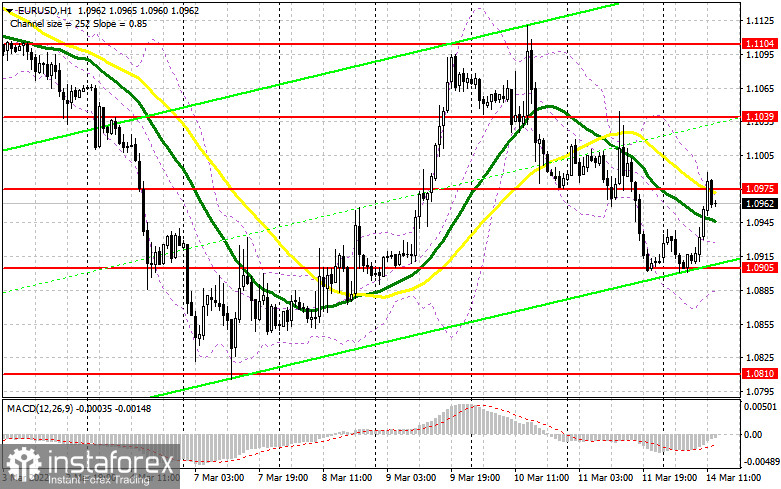

Major market players are waiting for the Fed's decisions, which may change the monetary policy of the US in the middle of this week. Everyone is also waiting for the results of the fourth meeting between Russia and Ukraine. The positive results of the negotiations may bring back demand for risky assets, including the euro. Notably, Christine Lagarde announced a more aggressive ECB policy last week. It is good news for bulls, who are just waiting for the geopolitical situation to ease. There is no data to be released this afternoon, and only the Eurogroup Meetings will take place. During the US session, bulls need to hold the price above support at 1.0905, which was revised from the morning's level of 1.0893. However, it would be good to break through 1.0975, where the moving averages are located, which are playing on the bears' side. If the pair declines, only a false breakout at 1.0905 may form the first entry point into the longs, counting on the pair to return to the area of 1.0975. If the pair reaches above this level, it may continue to rise. A reverse test top/bottom may form a buy signal for the euro and recover the pair to the area of 1.1039 and 1.1104. A breakthrough of this range is likely to cancel the bearish trend and trigger sellers' stop-loss orders, pushing the pair to the highs at 1.1176 and 1.1229, where traders may lock in profits. With another negotiation failure and a worsening of the conflict, demand for the US dollar could quickly return. Taking into account that the recent meeting between the representatives of the two countries did not bear any results, we should not expect serious progress in these negotiations either. If bulls show a lack of activity at 1.0905, a false breakout of the low around 1.0810 would be the best scenario for longs, and it is possible to open long positions on the euro only at 1.0772, allowing an upward intraday correction of 30-35 pips.

Short positions on EUR/USD:

Bears managed to hold the price below resistance this morning, but it did not trigger a large sell-off. As I noted, as long as the pair is trading below 1.0975, the euro is expected to fall. If the pair goes above this level, demand for the euro may return. The formation of a false breakout after another unsuccessful attempt to break above 1.0975 may create a sell signal and allow to open short positions with the target at the support of 1.0905. A breakthrough of this level and a reverse test bottom/top might take place very quickly, which will give an additional signal for short positions with the prospect of falling to the lows of 1.0810 and 1.0772. The decline may be fast, as there are a lot of buyers' stop-orders placed near these levels. The next target is located in the area of 1.0728, where traders may take a profit. However, only the Fed news or worsening geopolitical tension and failed negotiations are likely to trigger a large sell-off. If the euro grows and there is a lack of bears' activity at 1.0975, it would be better to postpone selling the euro. It is possible that bulls might be more aggressive. A breakthrough of this level may activate sellers' stop-loss orders. Therefore, the best scenario for short positions would be if a false breakout occurs around 1.1039. Selling the EUR/USD on the rebound is possible from 1.1104 or higher near 1.1176, allowing a downward correction of 25-30 pips.

Indicator signals:

Moving averages

Trading is carried out near the 30-day and 50-day moving averages, indicating intense competition between buyers and sellers.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

A breakthrough of the indicator's lower boundary at 1.0905 is likely to increase the pressure on the euro. A breakthrough of the upper boundary of the indicator at 1.0975 may lead to a rise in the pair.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

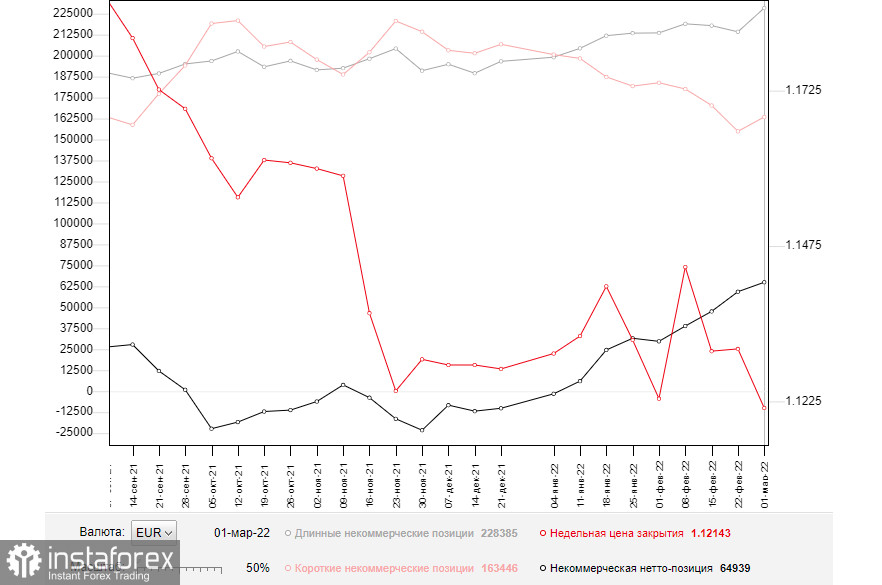

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română