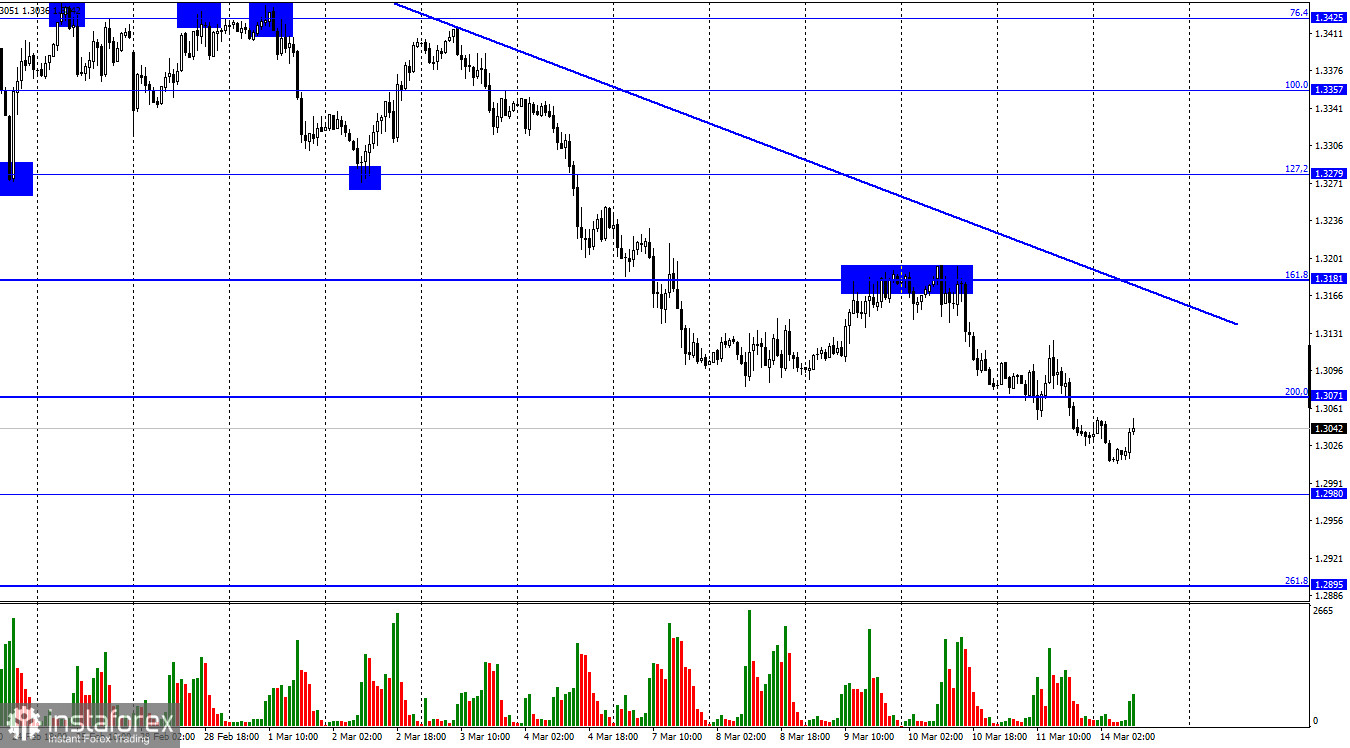

Hi, dear traders! On Friday, the pound/dollar pair kept dropping on the 1H chart. It closed below the correction level of 200.0% - 1.3071. The next downward target is located at 1.2980. The ongoing downward movement signals the bearish bias. Before closing above the trend line, it will be very difficult for the pound sterling to rebound. The Fed is highly likely to raise the key rate this week, which is bullish for the US dollar. However, there will also be several opportunities for the pound sterling to finally assert strength. It has already been declining for several weeks in a row. Its downward movement is mainly associated with geopolitical tensions.

Despite a strong bearish trend, the pound sterling is likely to perform a reversal in the near future. The Bank of England will also hold a meeting this week. Some analysts expect a rate increase of 0.25%. If so, it will be the third rate increase in a row. Currently, the Bank of England is ahead of the Fed in terms of rate hikes. It may be the main reason for a trend reversal this week. The geopolitical conflict in Ukraine seems to be lasting for some time. The armies are now acting cautiously. The negotiations between Kyiv and Moscow will be of the utmost importance. Market participants hope that the parties will be able to reach at least some positive results. If so, the euro and the pound sterling will climb. At the moment, the British currency is weaker than the US dollar. Notably, last week, traders ignored upbeat US economic reports. This is why they are likely to take notice only of the most crucial economic data this week. Traders are anticipating the Fed and BoE meetings as well as speeches of Jerome Powell and Andrew Bailey.

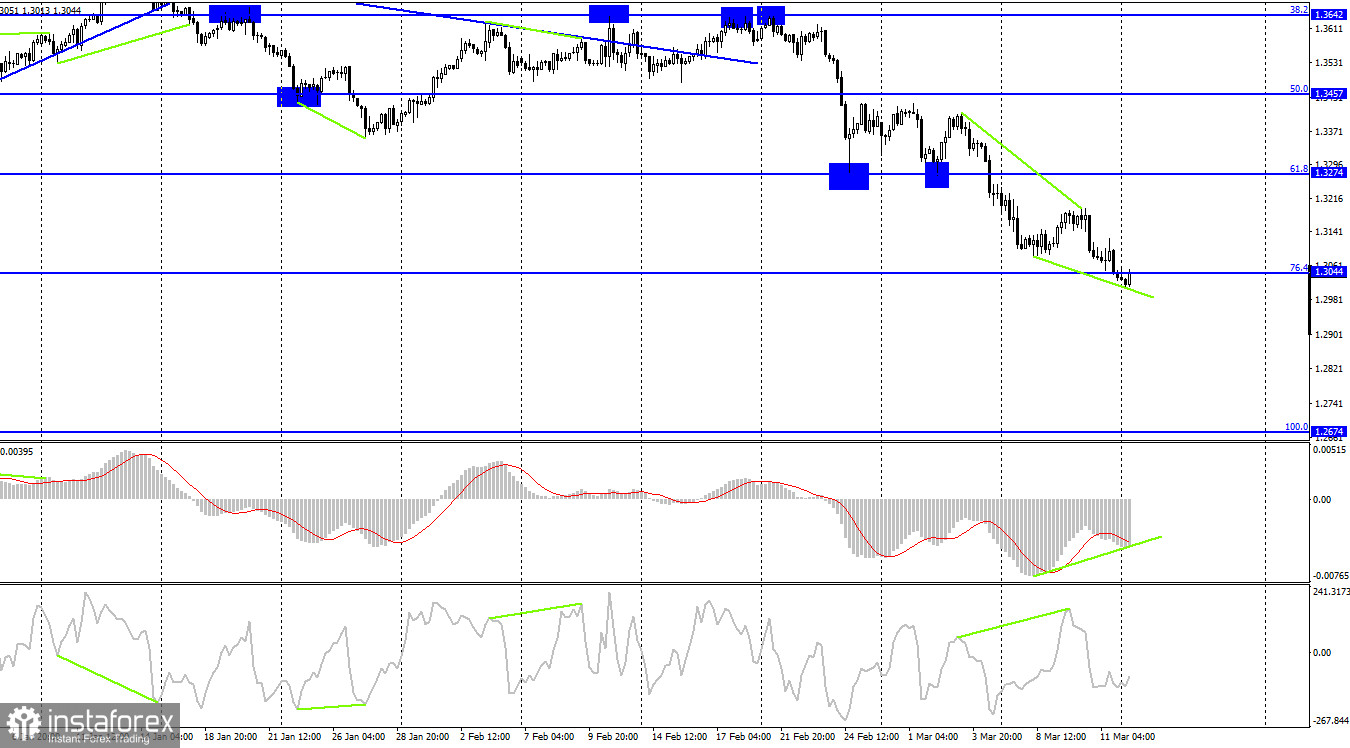

On the 4H chart, the pound/dollar pair declined after the formation of a bearish divergence of the CCI indicator. It dropped to the correction level of 76.4% - 1.3044. There was no rebound from this level but the growing bullish divergence may trigger a reversal. After that, the pound sterling is likely to resume an upward movement. If this scenario does not come true, the pair could decrease to the next Fibo level of 100.0% - 1.2674.

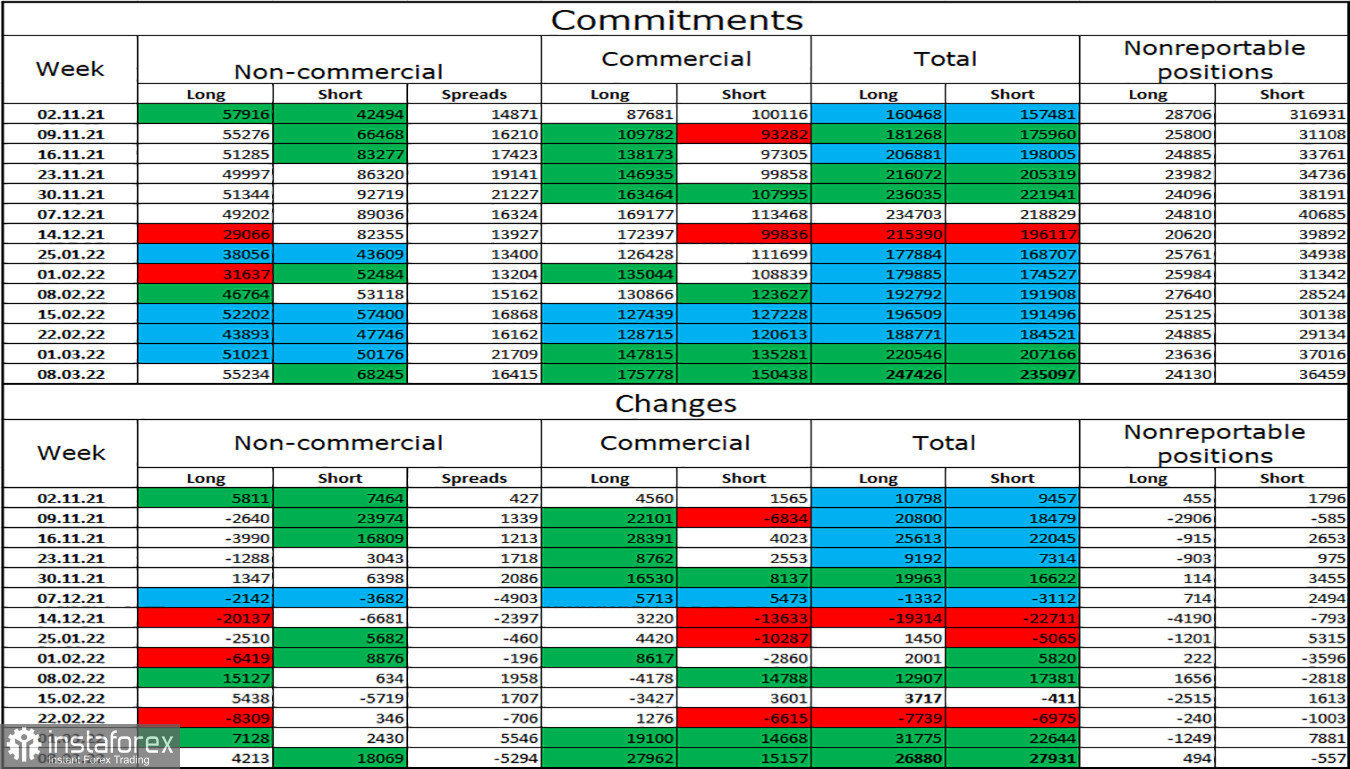

Commitments of Traders (COT):

The mood of the "Non-commercial" traders has changed dramatically over the last reporting week. The number of Long contracts jumped by 4,213, while the number of Short contracts rose by 18,069. Thus, the general mood of the major market players has become more bearish as the number of Short contracts has increased significantly. The ratio between Long and Short contracts for speculators now corresponds to the actual market situation. The pound sterling is falling. Therefore, large investors prefer short positions rather than long ones. Nevertheless, please keep in mind that the mood of major market players changes too often and the pound sterling has been falling for quite a long time.

Macroeconomic calendar for the US and the UK:

On Monday, the economic calendar for the UK and the US is completely empty. Thus, today there will be no volatility in the market. Currently, the pound sterling is growing but everything may change in the afternoon.

Outlook for GBP/USD and trading recommendations:

It is better to open short positions on the pound sterling if the pair closes below 1.3044 with the target levels of 1.2980 and 1.2895. It is also recommended to wait for the cancellation of the bullish divergence of the MACD indicator. I would not advise you to open long positions on the pound sterling today as the US dollar's outlook is more positive.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română