Having completed the past week with an increase of 1.8%, the dollar also starts the new week on a positive note. At the time of this writing, dollar index (DXY) futures are trading near the 99.17 mark, maintaining a tendency to further growth. The dollar is growing in anticipation of the outcome of the Fed meeting and against the backdrop of the release of February data on inflation in the U.S. According to data released last week, the consumer price index rose from 7.5% to 7.9%. Core CPI rose from 6.0% to 6.4% in February. Inflation in the U.S. thus rose to new 40-year highs. These data do not yet reflect the impact of the situation in Ukraine, and March inflation may be even higher. According to U.S. Treasury Secretary Janet Yellen, the country is waiting for another year of rising prices against the backdrop of the Ukraine crisis. The current situation forces the Fed to act, on the one hand, decisively, raising interest rates, on the other hand, cautiously, given the geopolitical tensions.

It is expected that on Wednesday, when the Fed meeting ends, its leaders will raise interest rates by 0.25%. However, market participants fear indecision on the part of the Fed in order to significantly reduce inflationary pressures. If before Russia's military special operation in Ukraine, market participants were waiting for 6-7 increases in the Fed's interest rate this year, now these expectations have dropped significantly. The 0.25% interest rate hike is already priced in. However, the dollar continues to rise. Investors prefer it to other traditional defensive assets such as gold and the yen. Of greatest interest will be the Fed's press conference, which will begin half an hour after the publication of the decision on rates. Investors want to hear Fed Chairman Jerome Powell's opinion on the future plans of the Central Bank for this year.

A more hawkish stance on monetary policy is viewed as positive and strengthens the U.S. dollar, while a more cautious stance can be seen as indecision and negatively affect the USD.

In addition to the Fed, the meetings of the central banks of Japan and the UK will also take place this week. The pound received some support after the publication last Friday of positive macro statistics. In January, British GDP rose from -0.2% to +0.8% (+10% year-on-year, from 6.0% in December), which also turned out to be much better than economists' forecasts. All major sectors of the economy increased. The service sector - by 0.8%, the manufacturing sector - by 0.7%, the construction sector - by 1.1%. Nevertheless, economists believe that GDP growth may be seriously reduced in the near future, as the economy is under pressure from the consequences of the military conflict in Ukraine. In the meantime, the ongoing recovery of the UK economy speaks in favor of a further increase in the key interest rate, given the strong rise in inflation in the country.

The decision on interest rates of the Bank of England will be published on Thursday at 12:00 GMT. It is expected that at this meeting, the BoE will raise interest rates again (to 0.75%) while maintaining the volume of purchases of government bonds at the same level of 895 billion pounds. However, despite the fact that very positive macro data is coming from the UK, the interest rate may also remain at the same level of 0.50%, given the situation in Ukraine.

Also at the same time, the BoE's monetary policy report will be published, containing an assessment of economic prospects and inflation. If the tone of the report is soft, then the British stock market will receive support, and the pound will decline. Given the uncertainty over the Ukraine crisis, fewer members of the Monetary Policy Committee will vote in favor of a stronger rate hike compared to last month, when 4 out of 9 members supported such a move. This may reduce the likelihood of a rate hike at the next two meetings, which will be negative for the pound, economists say.

Conversely, the report's tough rhetoric on curbing inflation, implying a further increase in the interest rate in the UK, will lead to a strengthening of the pound.

In connection with the upcoming meeting of the Bank of England, market participants will be interested in the report of the Office for National Statistics (ONS) with data on the average salary of Britons and the unemployment rate.

Earnings growth is a positive factor for the GBP, while the low value of the indicator is negative. The March report suggests that the average salary, including bonuses, rose again in the last calculated 3 months (November-January), by +4.6% (after growth of +4.3%, +4.2%, +4.9% , +5.8%, +7.2%, +8.3%, +8.8%, +7.3%, +5.6%, +4.0% in previous periods); without premiums also increased by +3.7% (after growth by +3.7%, +3.8%, +4.3%, +4.9%, +6.0%, +6.8%, +7.4%, +6.6%, +5.6%, +4.6% in previous periods). The data points to continued growth in wages, which is a positive factor for the pound. Data worse than forecast/previous values will have a negative impact on the pound. It is also expected that for 3 months from November to January, unemployment was at the level of 4.0% (against 4.1%, 4.2%, 4.3%, 4.5%, 4.6%, 4.7% , 4.8%, 4.7%, 4.8%, 4.9%, 5.0%, 5.1%, 5, 0% in previous periods). This is also a positive factor for the pound.

If the data from the UK labor market turns out to be worse than the forecast and/or the previous value, then the pound will be under pressure. In any case, at the time of publication of data from the British labor market, an increase in volatility in its quotes and in the GBP/USD pair, respectively, is expected.

Technical analysis and trading recommendations

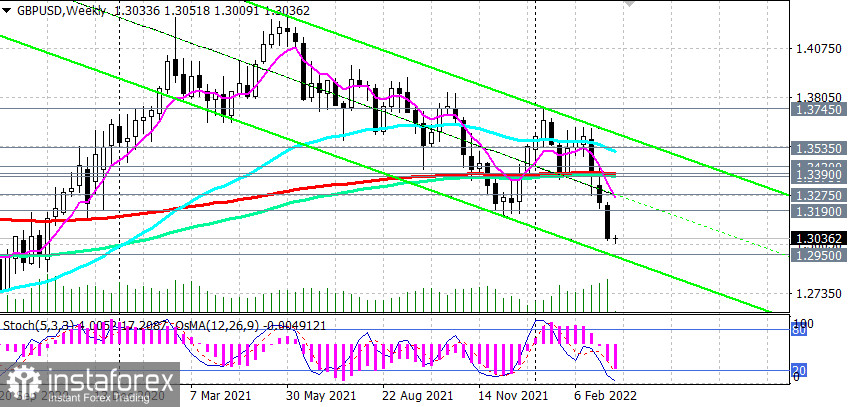

At the time of this writing, the GBP/USD pair is trading near the 1.3040 mark, remaining in the bear market zone below the key resistance levels of 1.3390 (200 EMA on the weekly chart), 1.3535 (200 EMA on the daily chart). The pair continues to develop negative dynamics, moving within the descending channel on the weekly chart. Its lower border passes through the 1.2950 mark.

A breakdown of this support level will strengthen the negative dynamics of GBP/USD, sending the pair towards local lows 1.2680, 1.2400.

In an alternative scenario, GBP/USD first needs to consolidate in the zone above the short-term resistance level of 1.3190 (200 EMA on the 1-hour chart and the local resistance level). In this case, the corrective growth may continue to the resistance levels of 1.3373 (200 EMA on the 4-hour chart), 1.3390 (50 EMA on the daily chart, and 200 EMA on the weekly chart).

However, only a breakdown of the key resistance level of 1.3535 can once again return GBP/USD to the bull market zone, sending the pair first to the local maximum of 1.3745, and then towards the highs of 2021 and the 1.4200 mark. And the very first signal for the implementation of an alternative scenario may be the breakdown of short-term resistance levels 1.3075 (200 EMA on a 15-minute chart), 1.3124 (local resistance level).

Support levels: 1.2950, 1.2680, 1.2400

Resistance levels: 1.3075, 1.3124, 1.3190, 1.3275, 1.3373, 1.3390, 1.3430, 1.3535, 1.3640, 1.3700, 1.3745, 1.3900, 1.3970, 1.4000

Trading recommendations

GBP/USD: Sell Stop 1.3010. Stop-Loss 1.3110. Take-Profit 1.2950, 1.2680, 1.2400

Buy Stop 1.3110. Stop-Loss 1.3010. Take-Profit 1.3124, 1.3190, 1.3275, 1.3373, 1.3390, 1.3430, 1.3535, 1.3640, 1.3700, 1.3745, 1.3900, 1.3970, 1.4000

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română