Asian shares dropped on Monday following a rout in Chinese technology stocks. Treasuries tumbled as higher commodity prices raised fears that the US may need to aggressively tighten monetary policy to curb inflation.

A 9% drop in the performance of Chinese technology firms reverberated across the region, leaving the Asia-Pacific equity index in the negative for the second session. The lock-up of Covid in Shenzhen, the tech hub, added to the geopolitical and regulatory risks facing the sector, partly due to tensions between the US and China.

Japanese shares rise on weaker yen and gains in the S&P 500.

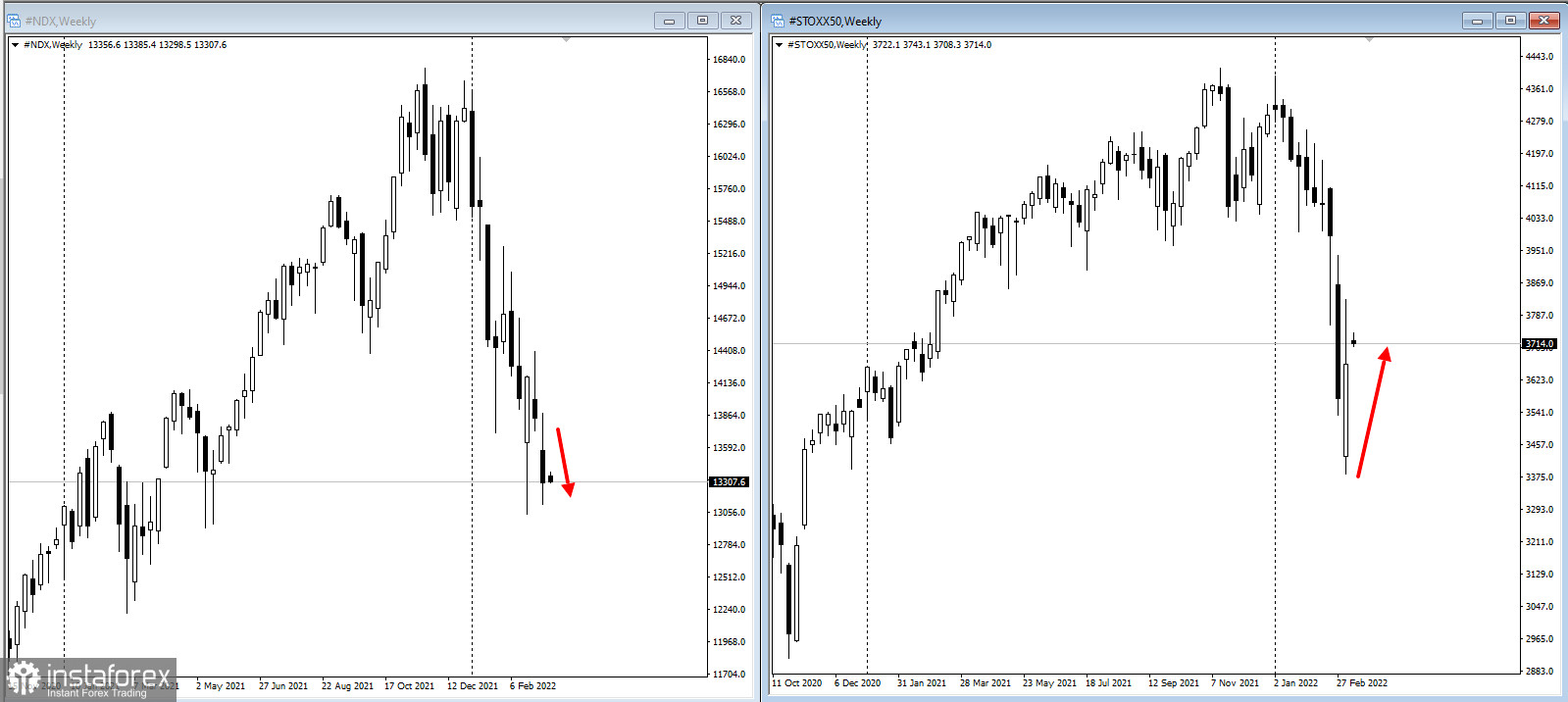

The Nasdaq 100 closed the week lower, while European indices STOXX50 climbed.

.

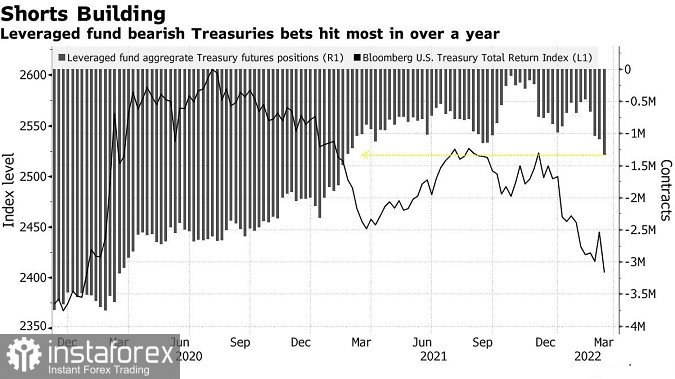

US treasuries intensified their fall, pushing the five-year US yield above 2% for the first time since May 2019. The Federal Reserve is expected to begin a cycle of rate hikes on Wednesday to curb inflation, starting at 25 basis points. Price pressures were already high before the conflict, and the isolation of resource-rich Russia has reversed commodity flows.

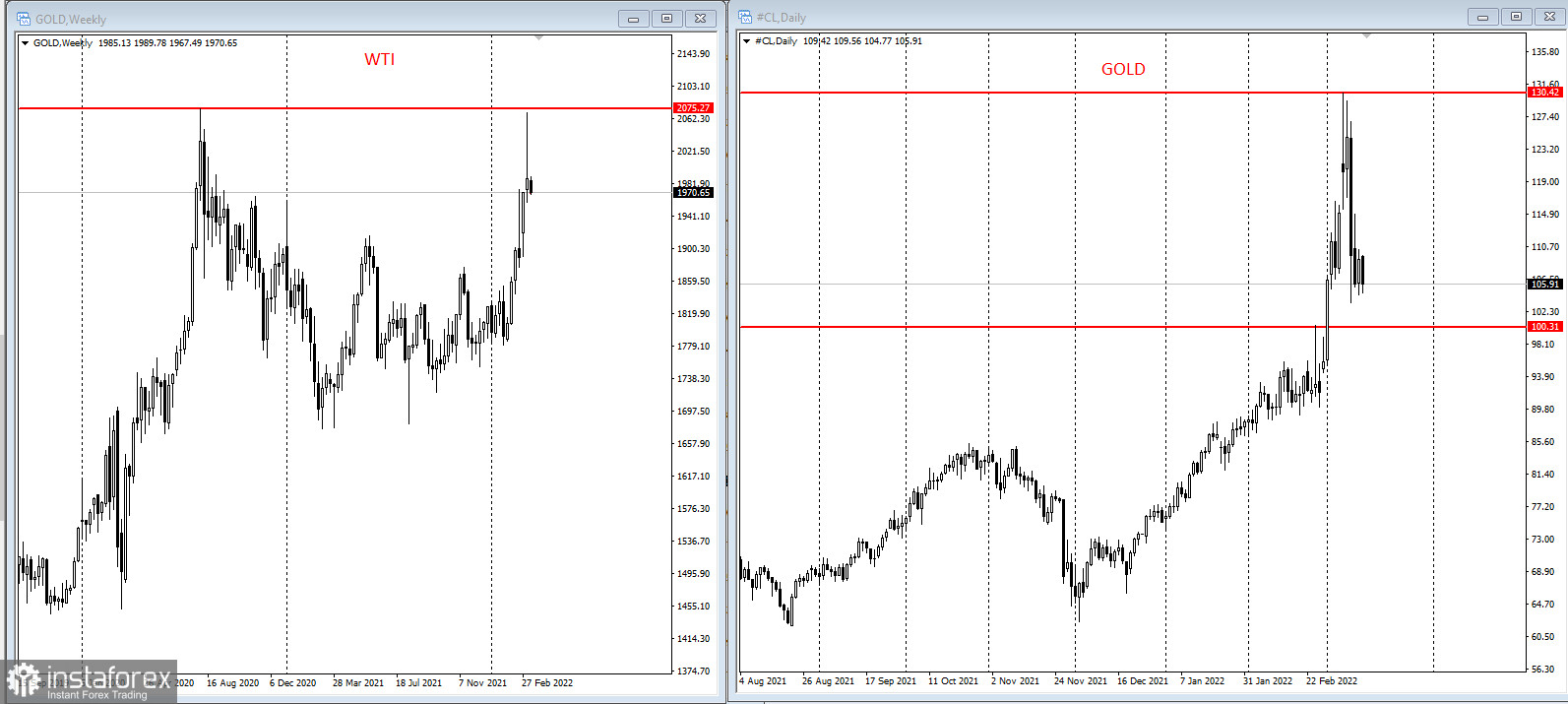

Crude oil fell, remaining above $105 per barrel. The dollar rose, commodity currencies weakened and gold retreated from the top of 2020.

The flattening of the US Treasury yield curve and a 12% fall in global equities this year signal that retreating stimulus and higher energy, grain and metals costs could stifle global economic recovery.

Investors are also waiting to see whether Russia will default on its international debt after losing access to almost half of its foreign currency reserves.

While the US and some other countries are tightening monetary policy, there is growing speculation that China will introduce more easing to alleviate the slowdown. The yuan and Chinese 10-year government bond yields have retreated.

Chinese stock indices came under pressure on Monday amid news of a new outbreak of coronavirus infection in the country. Immediate action by Chinese authorities and widespread restrictions could affect half of the country's gross domestic product.

Meanwhile, senior US and Chinese officials are set to meet on Monday to discuss Ukraine. Russian missiles hit a military training centre in western Ukraine near Poland, raising fresh fears of a conflict potentially spreading to Ukraine's borders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română