The bearish scenario is most likely for the EUR/USD pair.

Hello, dear colleagues!

During the trading week of March 7-11, the EUR/USD pair was volatile. However, the bears became dominant. These trends will be shown on the EUR/USD charts. Meanwhile, let's discuss the latest significant events, outline the similar events which are due this week and touch on the monetary policy.

The European Central Bank meeting is considered the major event of the last trading week. Besides, it was highly anticipated by traders. However, tightening of the ECB rhetoric was extremely unlikely. Hawkish comments were not typical for the ECB. Moreover, the Russian military operation in Ukraine has further complicated the previously disrupted supply chain by the COVID-19 pandemic.

As for last week's ECB meeting, it can be classified as a pass-through meeting. Such meetings do not cause dramatic changes in the monetary policy and do not provide market participants with relevant data. It was previously reported that the ECB would gradually reduce its quantitative easing program. However, this measure is insufficient to reduce accelerating inflation in the EU. The only way to fight galloping inflation rate is to raise interest rates. Nevertheless, the ECB is not willing to use this effective method, expecting inflation to eventually fall to the regulator's target of 2%. Therefore, there is a significant difference in monetary policy between the ECB and the Fed.

The analytical departments of some major commercial banks expect that the Fed may raise the key interest rate 4 to 6 times this year. Therefore, let's evaluate the possible effect on Wednesday when the Fed announces the results of its two-day meeting and decides on the key rate. Moreover, Fed Chairman Jerome Powell will hold a press conference later. The Fed is expected to raise interest rates by 25 basis points at the upcoming meeting. Besides, Jerome Powell will likely outline the Fed's next moves. Thus, the Fed's decision on interest rates, followed by Jerome Powell's comments will be the most significant and anticipated event of the week. Let's analyze the technical picture of the EUR/USD pair, focusing on the close of the previous trading week.

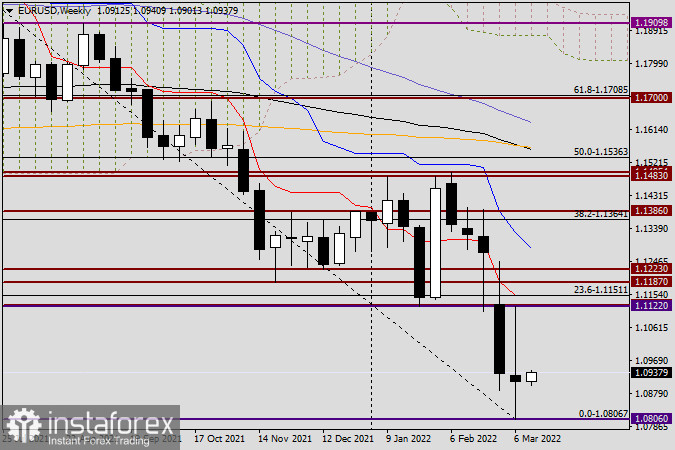

Weekly

As mentioned above, the pair traded differently as evidenced by the long upper and lower shadows of the last candlestick. Moreover, euro bulls had a significant advantage over their counterparts two days before the weekly trading ended. However, they lost their advantage and the bears took the lead. Notably, the upper shadow of the candlestick is a little bit longer than the lower one. This fact is favorable for the bears. However, it will be possible to indicate further pair's movement only after a real breakout of the resistance at 1.1122 (last week's highs) or after a support breakout of the previous lows at 1.0806 occur. I believe that the Fed meeting will be significant for the market to determine the further direction of the EUR/USD pair. Besides, taking into account the high probability of the interest rate increase and the Fed Chairman's following hawkish signals, it is evident that the bearish scenario will be most likely for the EUR/USD pair.

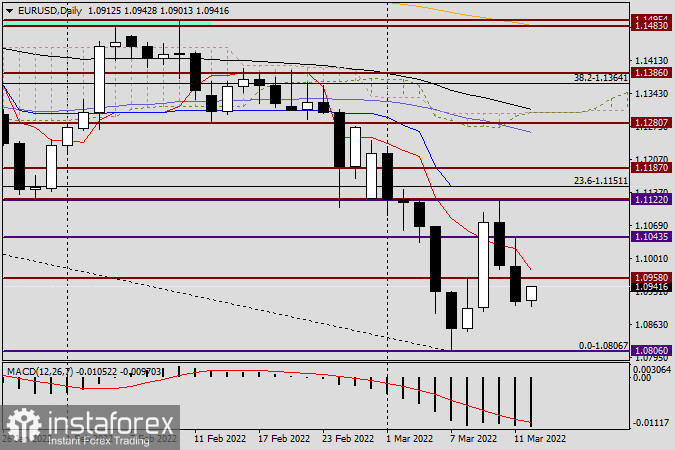

Daily

This chart clearly shows that after the pair rose dramatically during the trading on March 9, the situation stabilized in the next two days. Euro bears managed to take control of trading. Therefore, they returned the pair below the red Tenkan line of the Ichimoku indicator, as well as below the resistance level of 1.0958. Taking into account the current technical picture and most likely increase in the Fed interest rate, it is evident that the main trading recommendation for the EUR/USD pair are sales. It is recommended to sell the pair after its insignificant and short-term upward corrective pullbacks. I think it is better to start selling the EUR/USD pair after it rises to the price area of 1.0975-1.1000. It will be possible to specify the entry points to the market in tomorrow's article on EUR/USD where smaller time frames will be analyzed.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română