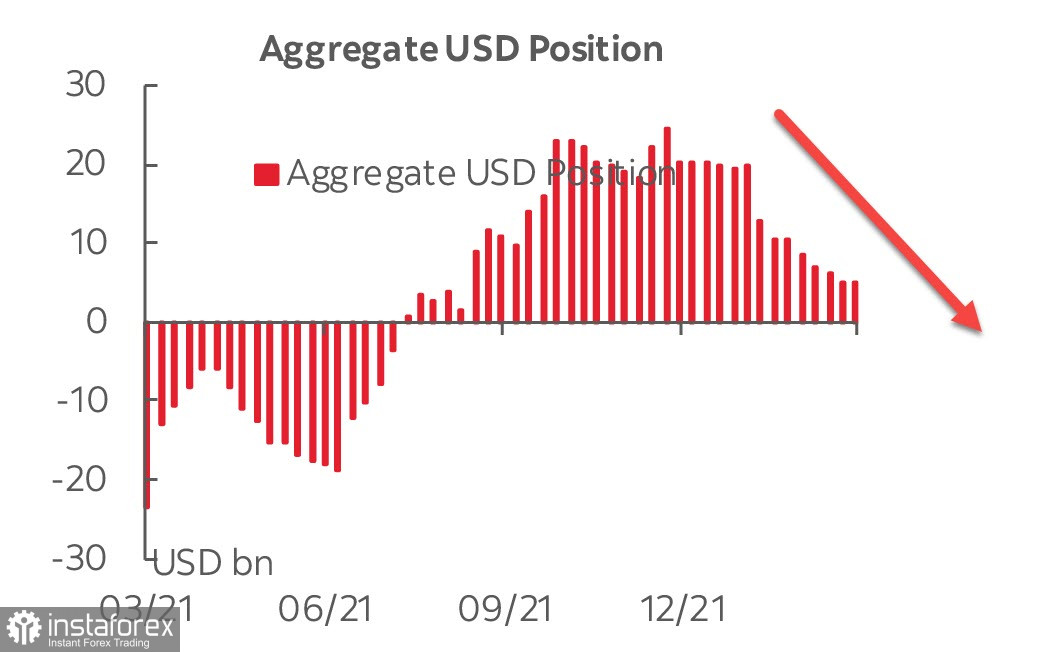

As follows from the CFTC report, the two-month decline in the dollar may be coming to an end – the weekly change of -7 million can be considered insignificant. The trend is still downward, so the dollar does not look to be gaining strength yet, especially given the rapidly growing long position in gold, which added +6.156 billion in a week and reached 56.270 billion, this is the maximum bullish rate since the beginning of 2021, the advantage is more than significant.

Simultaneously with the growth in demand for gold, it should be noted that there is an increased demand for protective currencies (CHF +768 million, JPY +1.440 billion), which generally reflects a steady withdrawal from risks.

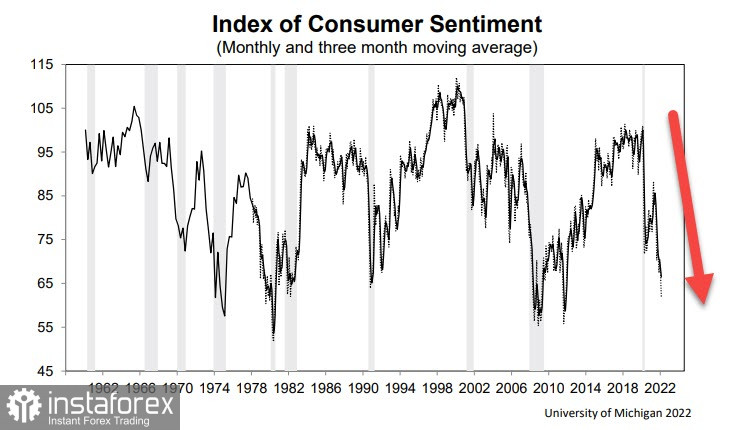

The rise in gold, among other things, may indicate growing inflationary pressure, which reduces the purchasing power of households and negatively affects consumer sentiment. The Michigan index fell to 59.7, this is the lowest since 2011, the dynamics of the decline in sentiment corresponds to the 2008 crisis.

Negative trends in the U.S. economy are unlikely to prevent the Fed from raising rates at its meeting on Wednesday, Chairman Jerome Powell confirmed last week that he would insist on a 0.25% increase. At the December meeting, the average scatter chart showed only four rate hikes in 2022, but since January, the hawkish bias of FOMC members has become much more noticeable, forecasts have even gone up to 7 hikes, but uncertainty has only increased in recent weeks. The reason for this is both faster inflation and weaker economic indicators, which require the FOMC to act in exactly the opposite direction.

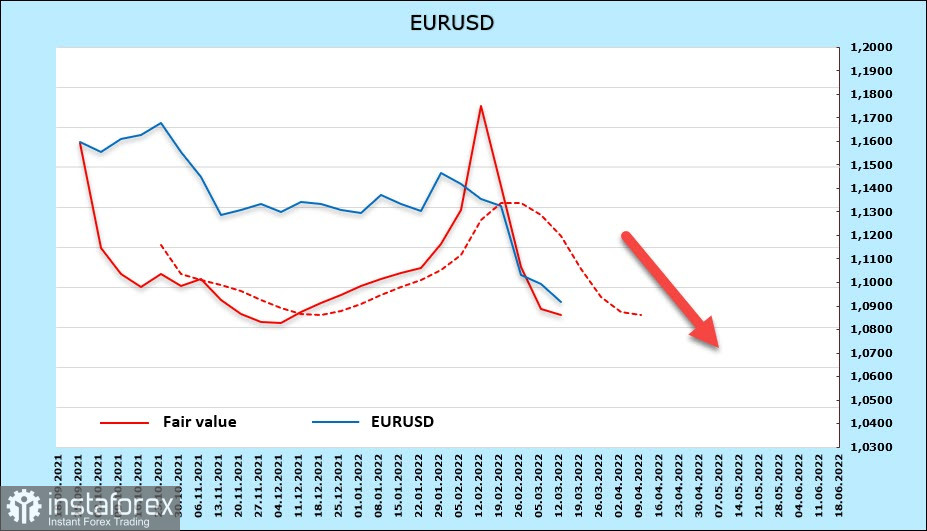

EURUSD

The ECB meeting was held in accordance with expectations, rates remained at the same levels, any tightening is expected only by the end of the year, more clarity has appeared on the stimulus program. The ECB announced net asset purchases of 40 billion euros in April, 30 billion euros in May, and 20 billion euros in June, PEPP has now been officially canceled, APP in the 3rd quarter. In general, the results of the meeting look balanced, but it is hardly worth trusting the ECB forecasts, since the continent is now experiencing a much stronger factor of instability than the ECB took into account in its forecasts.

The net long position in the euro fell by 1.014 billion over the week to +8.017 billion, the trend is still bullish, but, apparently, fears about the economic consequences of the military operation in Ukraine are gaining momentum. European economies are at risk of being the hardest hit by the conflict as rushed sanctions threaten Europe's food and energy security.

As a result, capital begins to flow out of Europe, which is reflected in the dynamics of the settlement price.

The euro continues to trade in a bearish channel, the 22-month low has been updated, the dynamics is negative, further decline should be expected. The target is 1.0636, a long-term minimum since 2017, and the lower border of the channel also runs approximately near this support.

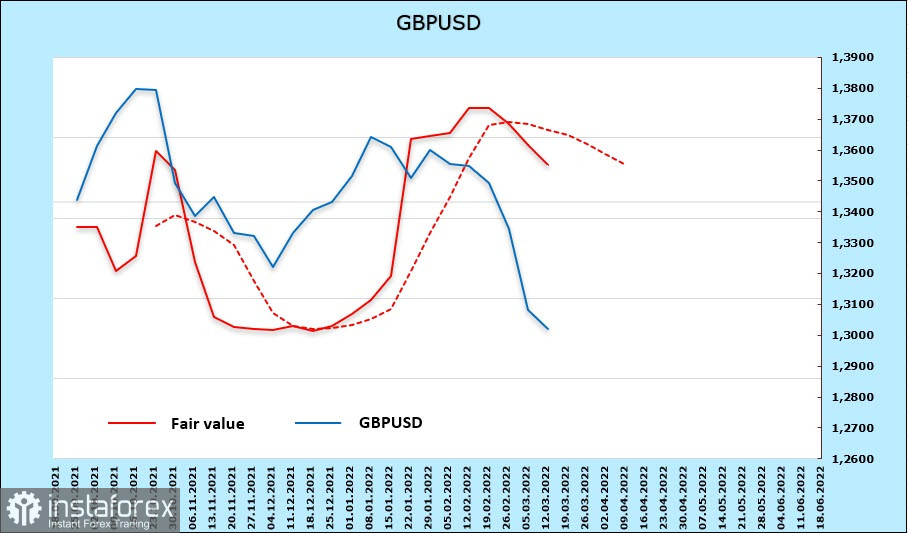

GBPUSD

The National Institute for Economic and Social Research (NIESR) has published an estimate of GDP growth rates, let's highlight the key points. First, omicron has had a weak impact on economic activity and is expected to grow by 1.3% in Q1. At the same time, inflation is growing rapidly, an average of 7% is expected for the year, this will reduce the purchasing power of households, GDP growth may slow down to 4%.

Overall, the NIESR outlook for the pound is negative, as inflation is higher and GDP growth is lower than in the previous forecast. The situation in Ukraine will obviously continue to put pressure on key indicators.

The pound lost 998 million in a week, as follows from the CFTC report, it looks worse than the euro, the positioning is bearish (-1.026 billion), but not yet pronounced. The estimated price goes down, we assume that the further fall of the pound is the most likely scenario.

The pound has updated the 13-month low, the momentum is strong, the next support is in the 1.2810/50 zone. A too rapid decline increases the probability of a corrective pullback, in this case, the recent low of 1.3167 will act as resistance, but if this happens, then it is logical to use the pullback for aggressive sales.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română