Long-term perspective.

During the current week, the EUR/USD currency pair tried to start an upward correction against the downward trend, which has been forming for the 15th month in a row. In the middle of the week, the pair grew by 200 points during one day, and there were no specific reasons and grounds for such strong growth. Nevertheless, this movement can be attributed to a technical correction, since from time to time the price still needs to be adjusted. And in general, almost all factors now continue to remain on the side of the US currency. We have already said earlier that the geopolitical factor fully supports the US dollar since this currency remains a "reserve" for the whole world. That is, in the event of another crisis, many investors abandon risky assets, investments, and currencies, transferring their capital to the dollar. Naturally, the demand for the dollar in this case increases, which leads to the growth of the US currency against most currencies. That is, strictly speaking, it is the dollar that is growing now, and not the euro or the pound are falling. The macroeconomic factor also remains on the side of the US currency. The European economy was not in the best condition even before the Ukrainian-Russian crisis, and now, when more than 2 million refugees from Ukraine migrated to the EU countries, an additional burden has been created on it. Consequently, the ECB simply cannot tighten monetary policy, since any rate hike will mean cooling the already not-so-hot economy. At the same time, the Fed begins a cycle of raising the key rate, which will most likely last throughout 2022. Consequently, the dollar will be in additional demand, thanks to the Fed. The Ichimoku indicator perfectly visualizes what is happening on the market right now. All recent corrections ended near the important Senkou Span B or Kijun-sen lines.

COT analysis.

The new COT report, which was released on Friday, showed a weakening of the "bullish" mood among professional traders. The first weakening in the last few months. We have already drawn the attention of traders to the fact that major players were actively building up long positions, but at the same time, the European currency was falling and continues to do so. This time, the "Non-commercial" group has opened about 15 thousand contracts for purchase and 20.5 thousand contracts for sale. Thus, the net position decreased by 5.5 thousand. Despite this decrease, the overall mood remains bullish, and the trend is downward. The problem is that the demand among major players for the euro currency may be growing, but at the same time, the demand for the American currency is also growing and at a much higher rate. Therefore, we are now dealing not with a classic market situation, when the demand for one currency is growing and the second is declining, but with a situation where the demand is growing for both currencies, but one of them is much faster and stronger. From our point of view, this explains the growth of the dollar in recent weeks on all fronts. Thus, now the data from the COT reports simply do not coincide with what is happening with the euro/dollar pair. Therefore, it is impossible to make a forecast for the pair based on COT reports.

Analysis of fundamental events.

There have been quite important fundamental and macroeconomic events during the current week. Of course, the ECB meeting should be noted, which once again emphasized the unwillingness of the regulator to tighten monetary policy. In principle, the market has been ready for this for a long time, since Christine Lagarde has repeatedly stated over the past months that she will not follow the Fed. Thus, there was practically no chance of the ECB supporting the euro. The second important event of the week was the US inflation report. The markets learned that the consumer price index has already risen to 7.9% y/y, but did this come as a surprise to anyone? Oil and gas are rising in price, so prices for many other goods and services are also rising, pulling up inflation. Moreover, inflation is likely to continue to rise in the coming months, but if the Fed fights it by raising rates, the ECB will not.

Trading plan for the week of March 14 - 18:

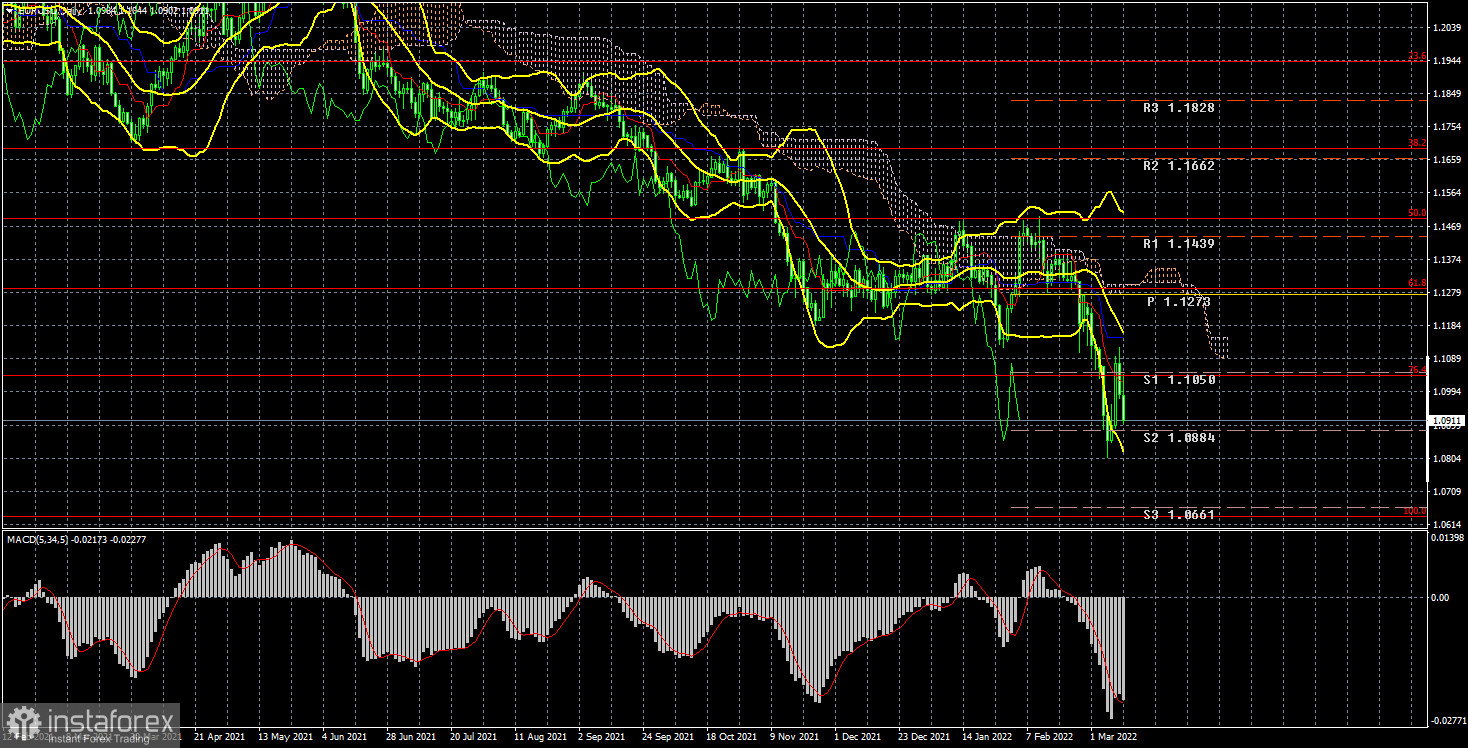

1) On the 24-hour timeframe, the pair resumed its downward movement after a short pause. In principle, only geopolitics matters now, but macroeconomics does not support the pair's growth either. At the moment, the price has overcome the Fibonacci level of 76.4%, thus, the course has been taken to the next Fibonacci level of 100.0% - 1.0637. And we believe that this goal is quite real for the next couple of weeks. Especially if we take into account the current geopolitical situation.

2) As for purchases of the euro/dollar pair, they are not relevant now. First, there is not a single technical signal or sign that at least an upward correction can begin. Second, the "macroeconomics" that could theoretically support the euro is simply ignored. Third, geopolitics may continue to put pressure on traders and investors who still believe that in any incomprehensible situation it is necessary to buy the dollar.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the net position size of each category of traders.

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română