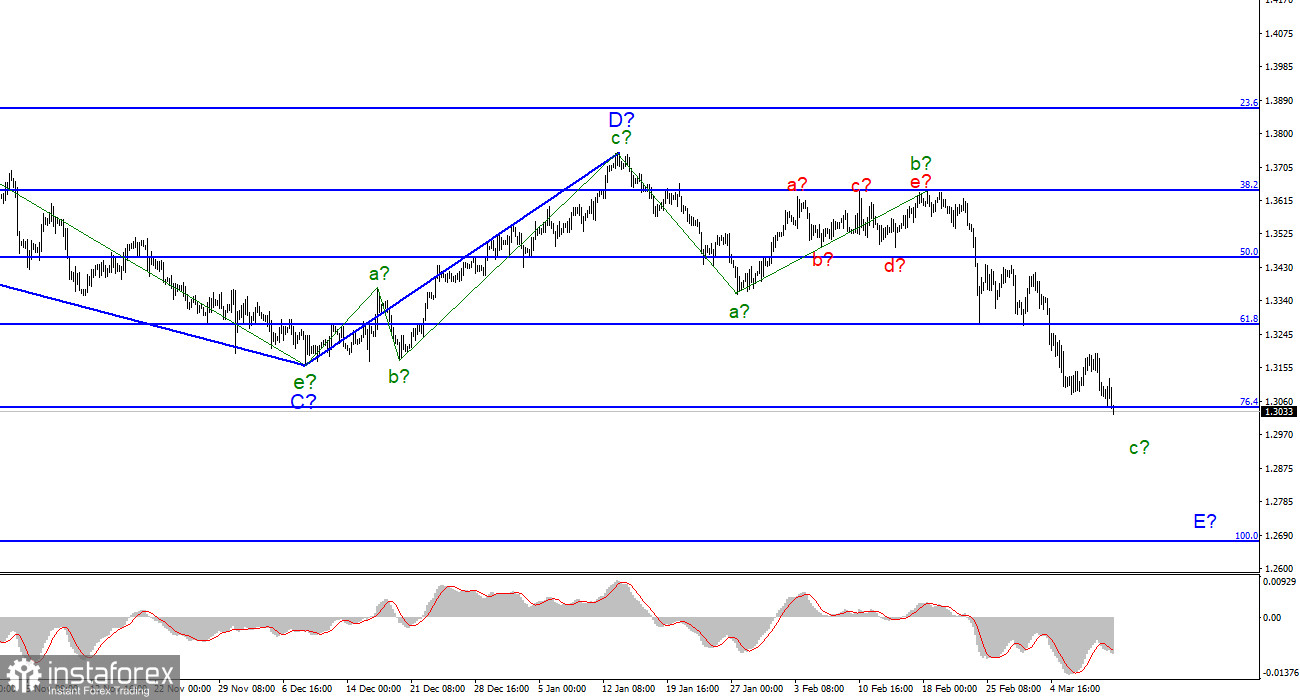

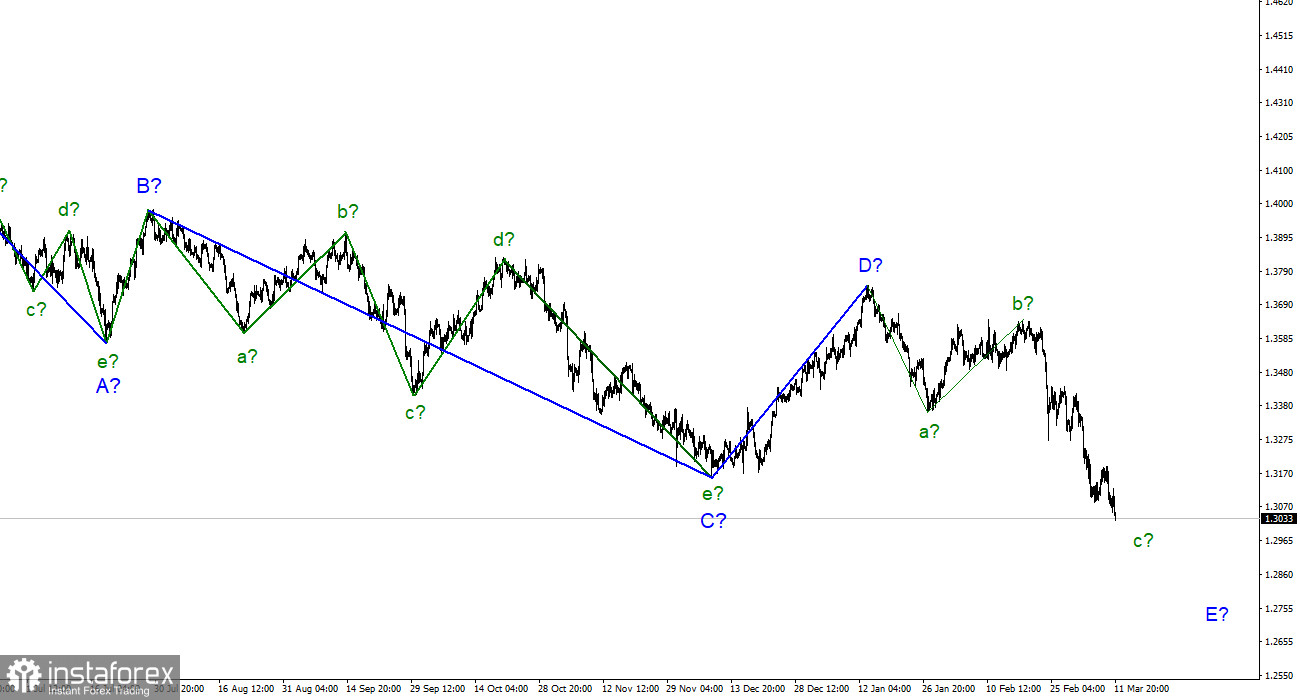

For the pound/dollar instrument, the wave markup continues to look very convincing, although it is quite difficult. The decline in quotes at the current time indicates the construction of a wave c in E, which is already getting very long. In total, there should be five waves inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for at least another month. At the time of writing, the quotes of the British are only slightly below the low of wave C. This indirectly suggests that the decline is just beginning, and the last descending wave E may turn out to be very long. In the coming weeks, the geopolitical background will be of great importance. A successful attempt to break through the 1.3041 mark, which equates to 76.4% by Fibonacci, may lead to an even greater increase in demand for the US currency. I don't see any alternative options for wave marking yet. Everything is quite unambiguous. Geopolitical information also has a devastating effect on the British, which fully corresponds to the current wave markup.

GDP and industrial production pleased only observers.

The exchange rate of the pound/dollar instrument decreased by another 50 basis points during March 11. The instrument has been declining for three weeks in a row. That is, a new decline began just at the same time as the military conflict in Ukraine. That is, the Briton had chances to change the current wave pattern and attempt to build a new upward trend section. But geopolitics has led to a sharp drop in demand for the instrument, so now a new wave of E is being built. On Friday, all the most important reports of this week were released in the UK. Industrial production in January increased by 0.7% every month, although markets expected less growth. GDP grew by 1.1% m/m, although here the market was waiting for the worst value. But, as we can see, what the market was waiting for and what the market received did not affect its mood in any way. There was only one attempt during Friday to increase the demand for the British, but it did not last long. Thus, the market simply did not pay attention to the statistics.

And in the USA, nothing was interesting during the day at all. There wasn't even much geopolitical news on Friday. The market has already realized that any negotiations between Kyiv and Moscow are doomed to failure. If the parties agree, it will be a very long time. And all this time there will be a military operation. People will die, cities will be destroyed. And new sanctions will be imposed against the Russian Federation, its economy, which has already received a powerful blow, will only shrink, and the director of the Central Bank of the Russian Federation Elvira Nabiullina can only do "a good face with a bad game." In Moscow, there are now huge queues at those cash desks where you can still buy a dollar in cash. And, from my point of view, this perfectly reflects the state of the Russian banking system at this time. Muscovites are not even afraid of the absolute wild rate of the American dollar. And he does not frighten them, because they believe that he will be even worse. In general, there are clearly few reasons for optimism now.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of wave E. The instrument made two unsuccessful attempts to break the 1.3645 mark, but the third was successful. Therefore, I continue to advise the sale of the instrument, now with targets located around the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since wave c in E does not look completed yet. A successful breakout attempt of 1.3043 will also be a signal to sell.

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the British quotes around the 27th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română