The conflict between Russia and Ukraine is damaging the global economy. Due to the record number of sanctions, the usual supply chains are disrupted, and it may take some time for new ones to form. In addition to the humanitarian and resource crisis, this triggers the stagnation of major industries and impacts the US dollar and the euro.

Robert Kiyosaki, a famous entrepreneur from the US, recently stated that the stock markets are inflating a bubble due to hyperinflation. The entrepreneur singled out a special role for the Fed in his vision of the future. Indeed, given the growing dependence of the economies of many countries on the US dollar and the euro, the influence of the Fed on global processes is likely to grow.

History shows that during geopolitical turmoil it is the Fed that becomes the main steering wheel of the world economy. During the Gulf War, the benchmark rate reached 6% and triggered an economic crisis in Mexico and Asian countries within a few years. From 2001 to 2008, the Fed was also conducting key rate operations causing the global financial crisis.

This year has already promised the beginning of the global financial crisis, which contributes to a new economic restructuring of the world. Central banks of developed countries are expected to raise their key rates soon. Sanctions against Russia are a deterrent measure affecting the economies of Europe and the US. According to Goldman Sachs, the Fed is going to raise the rate six times in 2022.

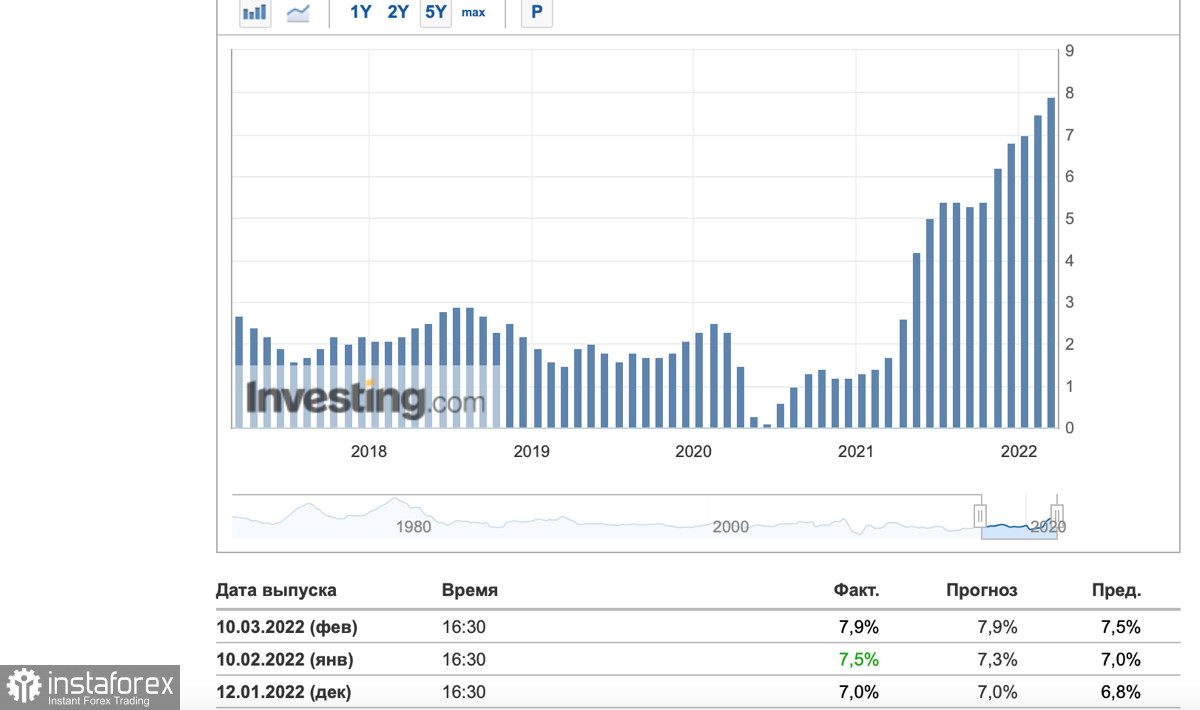

The first meeting will be held on March 16, and there is every reason to believe that Powell's office may take the sanctions pressure into account and raise the key rate by more than 0.25%. The February inflation rate of 7.9% may become an additional argument for the institution. The main negative factor in raising the key rate is a tightening of liquidity conditions. This directly affects investment flows in the stock and cryptocurrency markets.

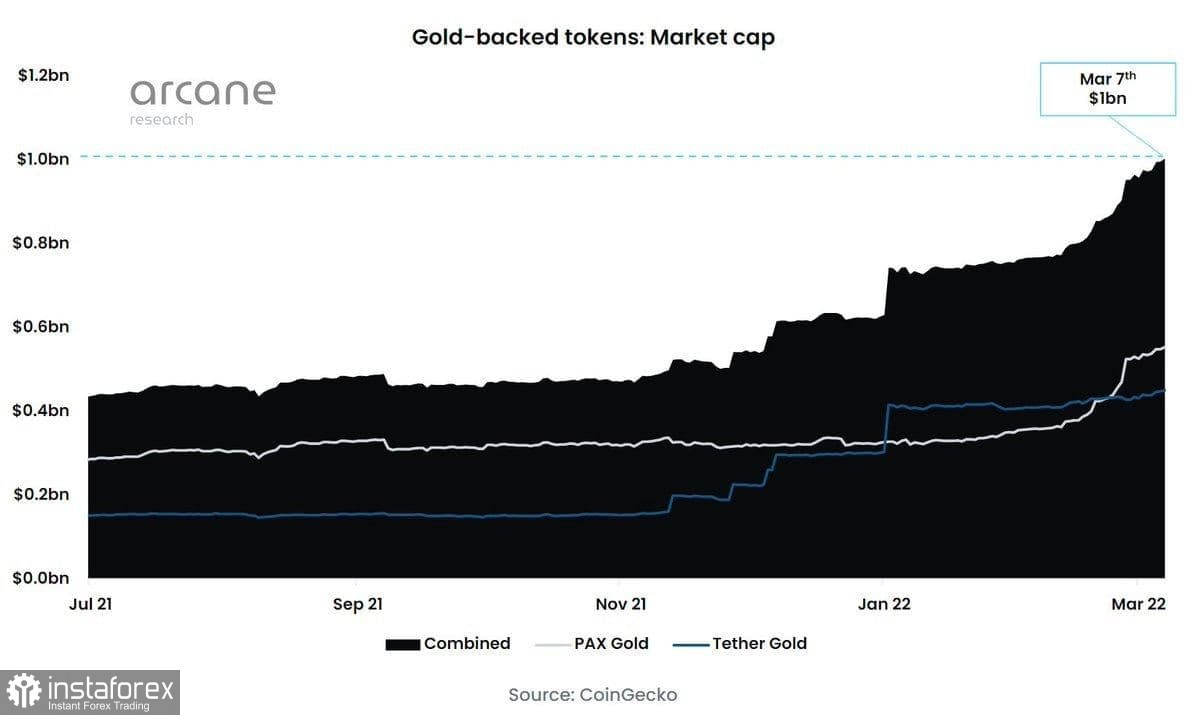

Despite the Fed was holding the key rate at the end of the February meeting unchanged, Bitcoin's bullish momentum has stalled. Global markets are assessing a tightening of monetary policy. Investors evaluated the prospects of fiat money while understanding the impending rate hikes by central banks around the world. At this time, BTC began to decline, and major players once again turned to gold, which has outperformed the flagship cryptocurrency in terms of its ability to preserve value in a fiat crisis.

However, in the pessimistic outlook for key rate hikes, liquidity-deficient assets will be a lifesaver. With this in mind, there is no doubt that Bitcoin, Etherium, and other cryptocurrencies, deflationary assets may receive liquidity and become in demand. Notably, all processes are slowing down considerably, which can be seen even now. Bitcoin has been trading in a prolonged consolidation ever since there were rumors about the key rate hikes.

Since November 2021, Bitcoin has been accumulating volumes within two trading ranges: $32,000-$45,000 and $45,000-$60,000. Such prolonged sideways trading was due to tighter liquidity and a more cautious policy towards risky assets. Russia's military operation exacerbated the situation, forcing BTC to compete with gold, which gained liquidity due to historically proven advantages.

If the military and the inflationary situation deteriorate soon, the problems of digital asset volatility may fade. Investors are likely to buy deficit financial assets. With the situation far from being resolved, financial markets await tough times.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română