To open long positions on GBP/USD, you need:

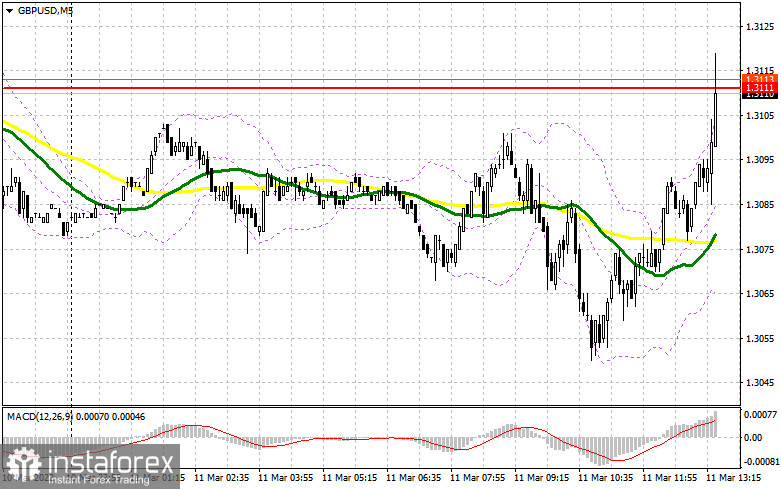

In my morning forecast, I paid attention to the levels of 1.3111 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. Against the background of unsuccessful attempts by bears to fail the annual minimum after the release of fairly good fundamental statistics on the growth rate of the UK economy, bulls tried to take control of the market, which kept trading within a narrow side channel. Considering that we did not reach the levels indicated, I did not wait for signals to enter the market. For the second half of the day, the technical picture has been completely revised. And what were the entry points for the euro this morning?

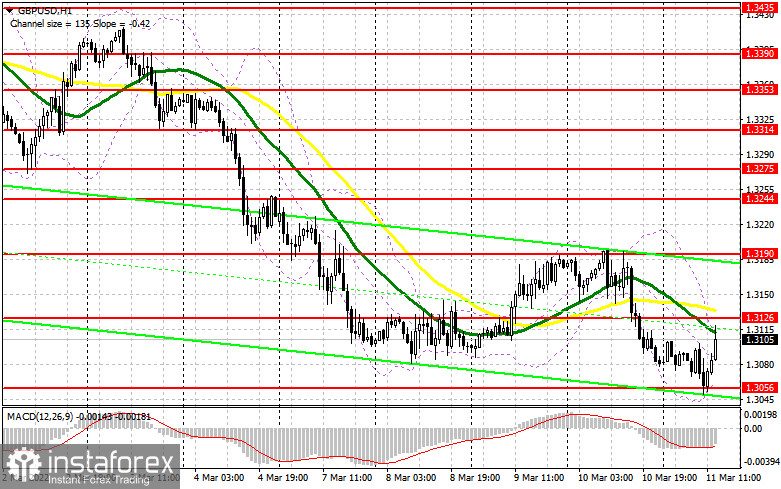

During the American session, everything will depend on today's inflation data from the University of Michigan, as well as on the mood of US consumers - that's exactly what they promise to spoil the bears all day. As I have repeatedly noted, the fall of the British pound will be limited, at least for the reason that we have clear aggressive actions of the Bank of England about interest rates ahead, since inflation in the UK is almost the most important headache of citizens and politicians governing the country. An increase in rates will lead to a return of demand for the pound. All this balances the Federal Reserve's interest rate hike next week and the geopolitical conflict that has not gone away. An important task of the bulls during the American session remains the protection of the 1.3056 support formed by the results of today. Long positions from this level can be considered only in the case of a decline in the pound and after the formation of a false breakdown since the entry will be carried out against a bear market. The pair's decline to this support may occur if the US data surprises traders. The growth of GBP/USD will be aimed at the resistance of 1.3126. Only a breakthrough and a reverse test of this area from top to bottom will lead to the demolition of several sellers' stop orders, allowing them to continue to increase long positions more actively. The target, in this case, will be the 1.3190 area, which is also the upper boundary of the wide side channel in which the pair has spent all this week. A more difficult task will be to reach the resistance of 1.3244 - this will deal a strong blow to the bearish trend observed since the end of February. I recommend fixing profits there. In the scenario of a decline in GBP/USD in the afternoon and the absence of bulls at 1.3056, it is best to postpone purchases until the next support of 1.2976. But even there, I advise you to open long positions only when a false breakdown is formed. You can buy GBP/USD immediately for a rebound from 1.2914, or even lower - from a minimum of 1.2856, counting on a correction of 20-25 points within a day.

To open short positions on GBP/USD, you need:

The bears did not achieve their goal, as strong statistics on the UK prevented this. Now, with short positions, I advise you to act very carefully so as not to fall into the trap at the most annual lows. Only after the formation of a false breakdown at 1.3126, it is possible to sell GBP/USD further along with the trend. The main goal, in this case, will be the support of 1.3056. The lack of activity on the part of buyers there, as well as the breakdown and reverse test of this level from the bottom up - all this will give an additional entry point into short positions to fall to the lows: 1.2976 and 1.2914. A more distant target will be the 1.2856 area, where I recommend fixing the profits. However, these levels will be available only next week. If the pair grows during the US session after weak US data, it is best to postpone sales. The demolition of 1.3126 may lead to a sharp increase in the pound against the background of new stop orders from sellers. In this case, I advise you to open short positions of GBP/USD after a false breakdown in the area of 1.3190, but you can sell the pound immediately for a rebound from 1.3244, counting on a correction within the day by 20-25 points.

The COT reports (Commitment of Traders) for March 1 recorded a sharp increase in long positions and a reduction in short ones. This led to a reduction of the negative delta value to almost zero. However, you need to understand that now such reports are secondary, and the market is changing almost daily, flying by 100-200 points against the background of the ongoing geopolitical conflict that has affected almost the whole world. Most likely, the report next week will show a sharp demand for short positions, so it's best not to look too closely at the current figures yet. It makes no sense to talk about what the policy of the Bank of England or the Federal Reserve System will be since, in the event of an aggravation of the military conflict, it will not matter at all. Now Russia and Ukraine have sat down at the negotiating table, and much will depend on the results of these meetings - there will be a lot of them. The only thing that is clear for sure is high inflation in the UK, which will force the Bank of England to act more actively. Given the slowdown in economic growth and retaliatory sanctions from Russia, it is unlikely that the regulator will go for a sharper increase in interest rates - and this must be done, otherwise, inflation will devour not only the available incomes of the population but also sharply reduce them. The COT report for March 1 indicated that long non-commercial positions increased from the level of 42,249 to the level of 47,679, while short non-commercial positions decreased from the level of 48,058 to the level of 48,016. This led to the preservation of the negative value of the non-commercial net position at the level of -337 versus -5,809. The weekly closing price dropped to 1.3422 against 1.3592.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates an active confrontation between buyers and sellers.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the lower limit of the indicator in the area of 1.3060 will increase the pressure on the pound. A break of the upper limit of the indicator in the area of 1.3115 will lead to the growth of the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română