Hi, dear traders!

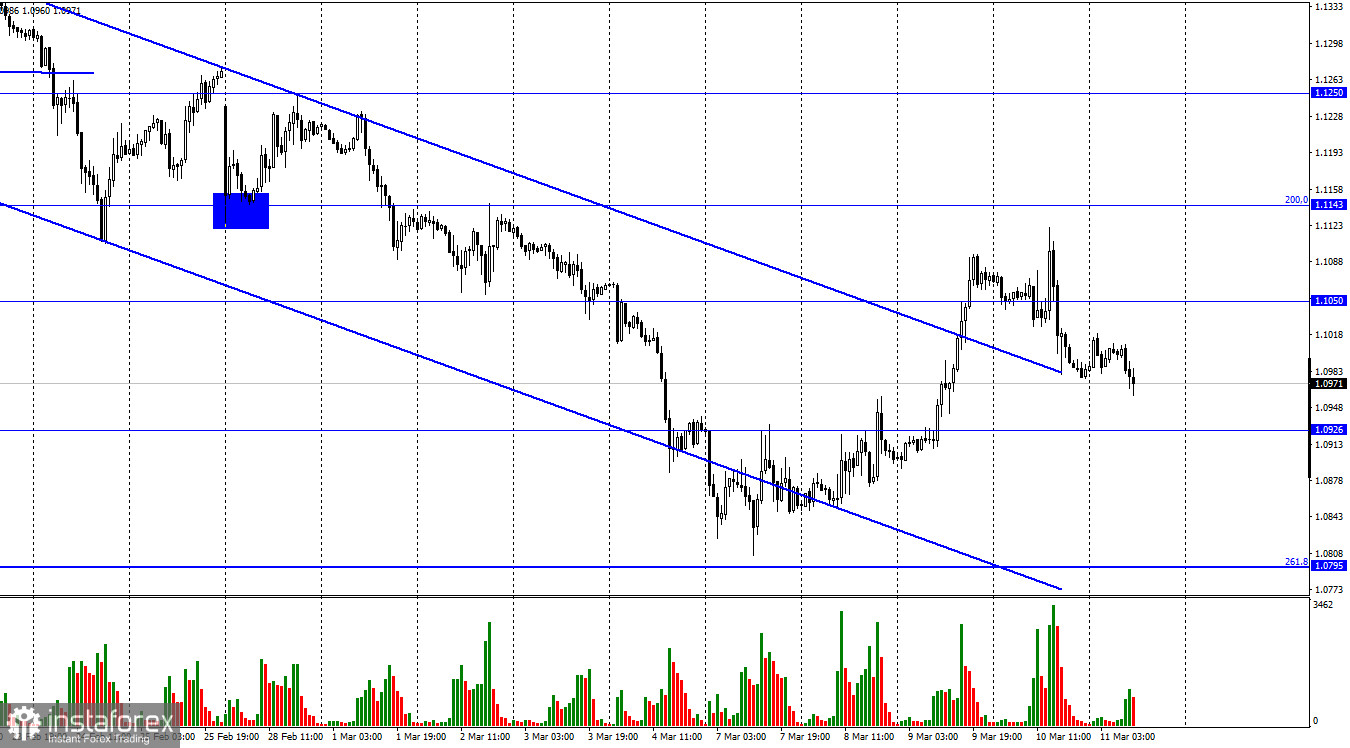

On Thursday, EUR/USD tried to extend its upward movement. However, the pair reversed downwards afterwards. It is currently falling towards 1.0926. Earlier, EUR/USD managed to settle above the descending trend channel, but it does not mean that it could rebound strongly. The geopolitical situation in Ukraine remains dire. Other reports are also negatively impacting EUR. Yesterday, the European Central Bank did not raise interest rates at its meeting, as expected. ECB's president Christine Lagarde noted increased economic risks due to the war in Ukraine, even though the negative effects of the pandemic were easing. Rising energy and commodity prices would impact the European economy, consumers, investment volume, and demand. Furthermore, the ECB has raised its inflation outlook and lowered its economic growth forecast. It is unclear how would the European regulator tackle rising inflation amid the deteriorating economic situation. Besides rising oil and natural gas prices, the EU economy could also be affected by soaring commodity prices, as well as European sanctions against Russia. European companies that ceased operations in Russia would lose revenues, forcing them to reduce production, as well as jeopardizing investments. The phase-out of Russian oil and gas imports would push up energy prices even higher. Only increased oil supply from the Middle East could relieve pressure on the European economy.

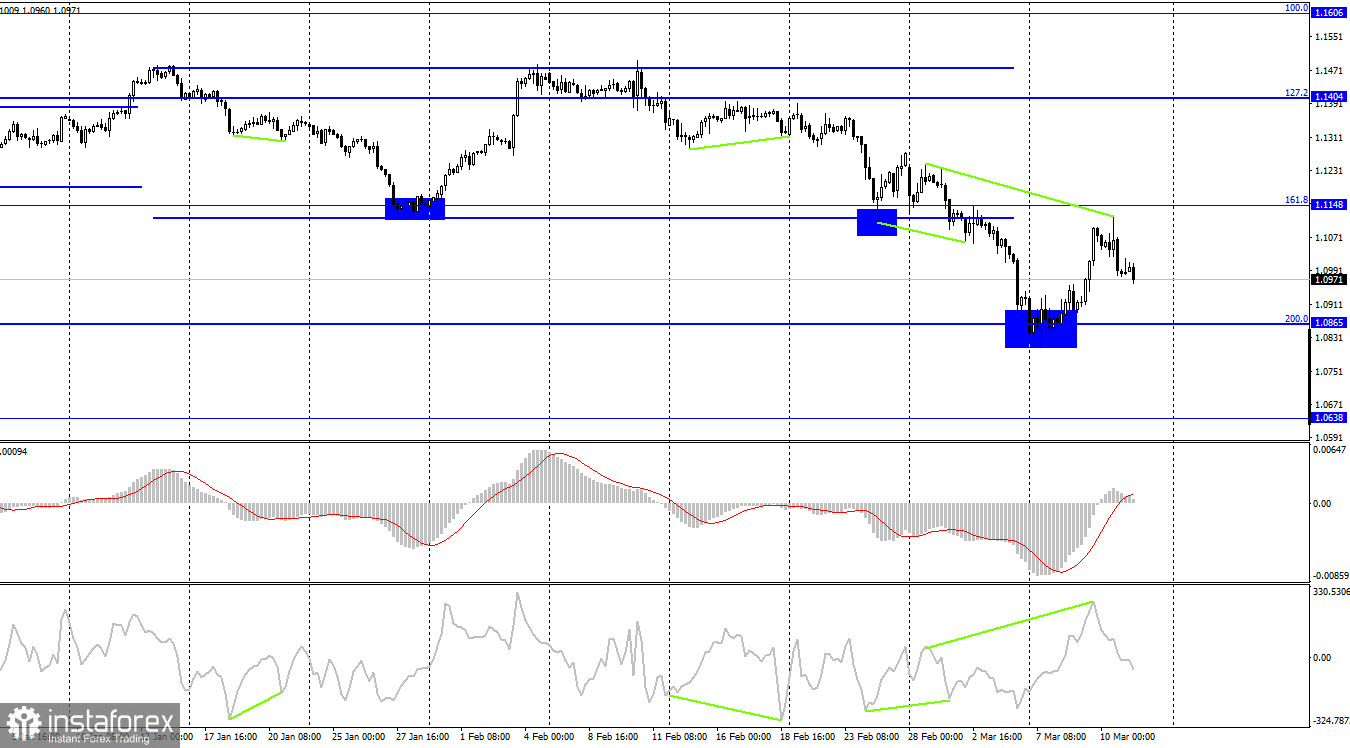

According to the H4 chart, the pair reversed downwards after forming a bearish divergence near the CCI indicator. EUR/USD is falling towards the retracement level of 200.0% (1.0865). The pair could rise if it bounces off that level. However, it is more likely to close below 1.0865 and slide down towards 1.0638.

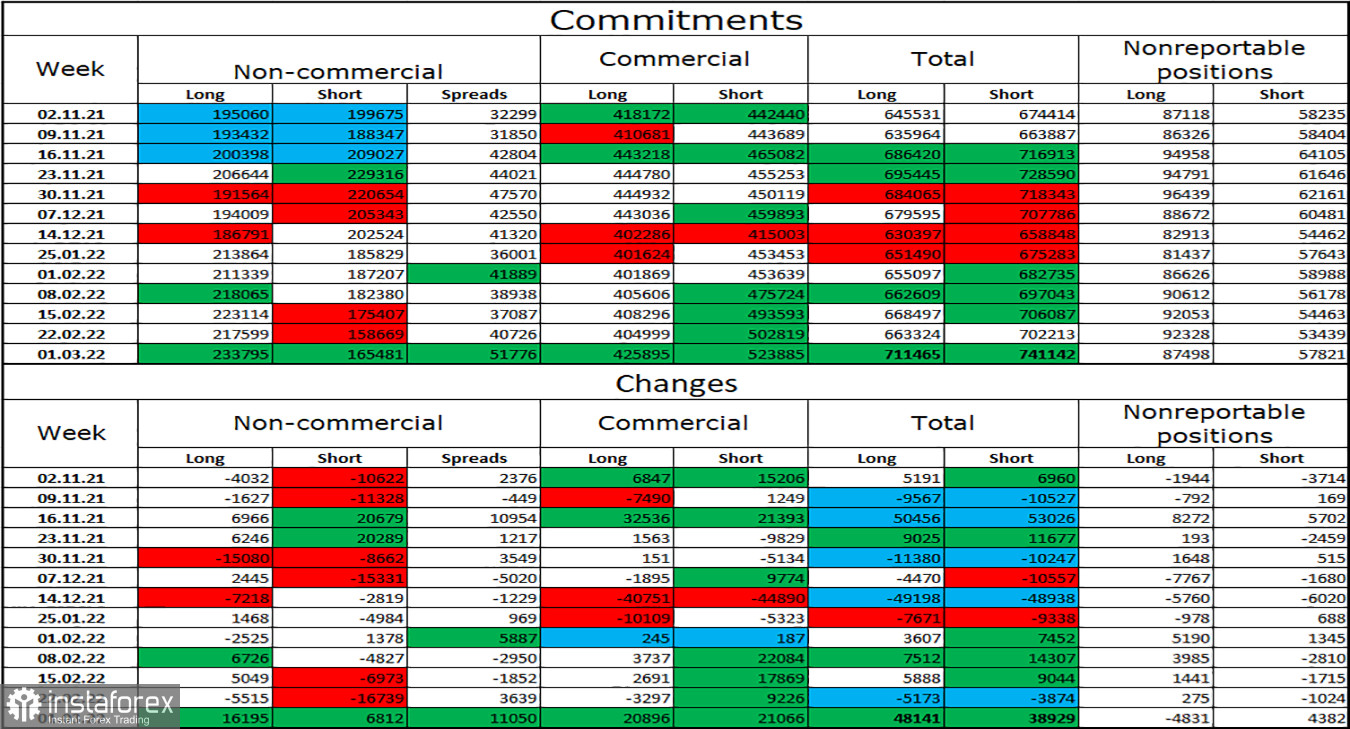

Commitments of Traders (COT) report:

During the last week covered by the report, traders opened 16,195 Long positions and 6,812 Short positions, indicating an increasingly bullish sentiment in the market. The total number of open Long positions is 223,000 against 165,000 Short positions. Overall, the sentiment of Non-commercial traders is also bullish. This would mean the pair could rise. However, the geopolitical situation favors the US dollar and not the euro. The pair is dropping sharply despite the bullish mood of major market players.

US and EU economic calendar:

US - UoM consumer sentiment index (13-30 UTC).

There are no events in the EU today, and the University of Michigan consumer sentiment index is unlikely to influence traders.

Outlook for EUR/USD:

Traders are recommended to open new short positions at this moment, with 1.0865 being the target. The pair has closed below 1.1050 earlier. EUR/USD is very likely to fall again – opening long positions is not recommended.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română