Gold is trading in the green at 1,812 at the time of writing. You knew from my previous analysis that XAU/USD could only test and retest the near-term support levels before jumping higher again.

Fundamentally, the yellow metal is strongly bullish after the US CPI and Core CPI reported lower inflation in November. Today, the UK reported lower inflation as well which could be good for XAU/USD.

Later, the FOMC represents a high-impact event and could really shake the price. The FED is expected to deliver a 50 bps hike. Tomorrow, the ECB, SNB, BOE, and US retail sales data could move the price. The bias is bullish, so temporary retreats could bring new longs.

XAU/USD Retreat Seems Over!

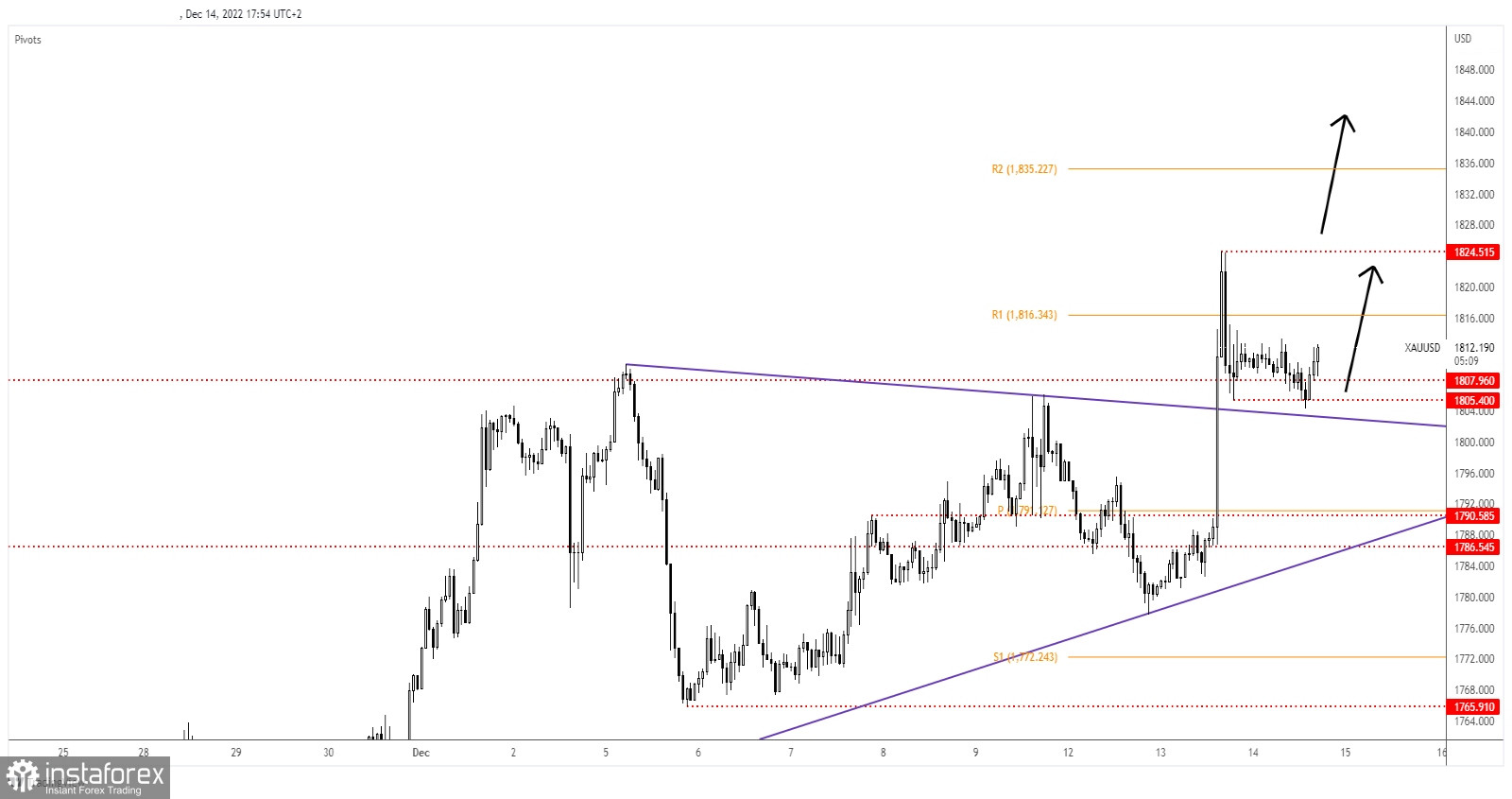

Technically, XAU/USD came back to retest the 1,807 broken resistance before resuming its growth. It has found support on the 1,805 and now it tries to come back higher. I've told you yesterday that the rate could retest also the broken downtrend line before jumping higher again.

The weekly R1 (1,816) represents a static resistance. Today, the price could register sharp movements around the FOMC, that's why you should be careful.

XAU/USD Outlook!

Dropping and retesting the 1,807 - 1,805 zone was seen as a new long opportunity. Registering new false breakdowns through this zone after the FOMC could bring new bullish signals.

Still, an upside continuation could be activated and confirmed by a valid breakout through the 1,824, by a new higher high.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română