Futures for major European and U.S. stock indices fell again yesterday, while the dollar strengthened: uncertainty over the events in Ukraine and the rapid rise in inflation continues to worsen investor sentiment.

Additional uncertainty is brought about by the results of the ECB meeting and the publication last Thursday of U.S. inflation indicators. On Thursday, the ECB left the current monetary policy unchanged but said it would be winding down its asset purchase program faster than planned, paving the way for higher interest rates this year. ECB President Christine Lagarde acknowledged that "economic activity could be dampened significantly" by military action in Ukraine. ECB leaders cut their 2022 growth forecast for the eurozone economy from 4.2% to 3.7% (a more negative scenario suggests growth of 2.3%).

Meanwhile, according to the U.S. Department of Labor, the consumer price index (CPI) in February showed an annual increase of 7.9% (against 7.5% in January and economists' forecast of growth of 7.8%), which is the most significant annual growth since January 1982.

The Fed is likely to tighten monetary policy less aggressively this year than expected, given the impact of events in Ukraine on the global economy. Fed Chairman Jerome Powell said during his speech to Congress last week that he would support raising interest rates by a quarter of a percentage point at the March 15-16 meeting. If before the start of the military special operation in Ukraine, the markets expected that rates would be raised seven times, now they predict four to five increases, and the Fed's rate hike by 25 basis points has already been taken into account in the quotes.

The increase in inflation increases the demand for gold, which investors consider as a hedging tool for risks associated with the depreciation of the dollar due to rising inflation in the United States and against the background of events in Ukraine. Yesterday's U.S. inflation report provides additional support for gold, while no easing of geopolitical tensions is expected yet. This tension in the short term will further fuel inflation in the eurozone, which in February was 5.8%, almost three times higher than the ECB's target level of 2%.

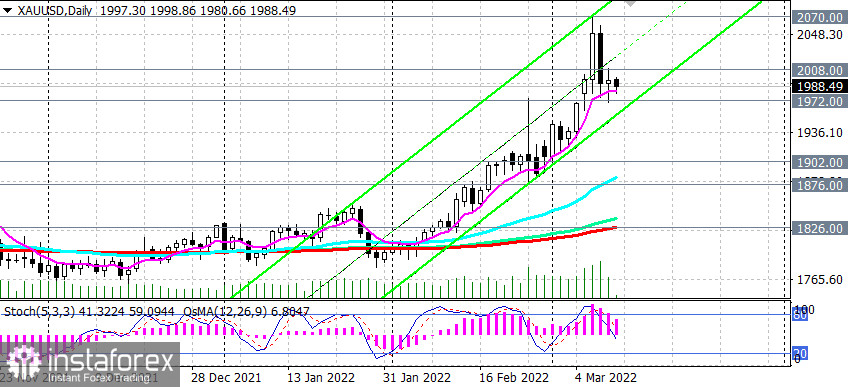

At the beginning of today's European session, the XAU/USD pair is trading near the important short-term support level of 1972.00, providing a good opportunity to increase long positions. As you know, gold is very sensitive to changes in the monetary policy of the world's leading central banks, especially the Fed. When it tightens, the quotes of the national currency (under normal conditions) tend to grow, while the price of gold falls.

However, geopolitical uncertainty and accelerating inflation around the world increase demand for gold, which is a popular defensive asset, creating prerequisites for further growth in its quotes.

Therefore, it is advisable to search for opportunities for the best entry into long positions. The current correction is one of them.

Technical analysis and trading recommendations

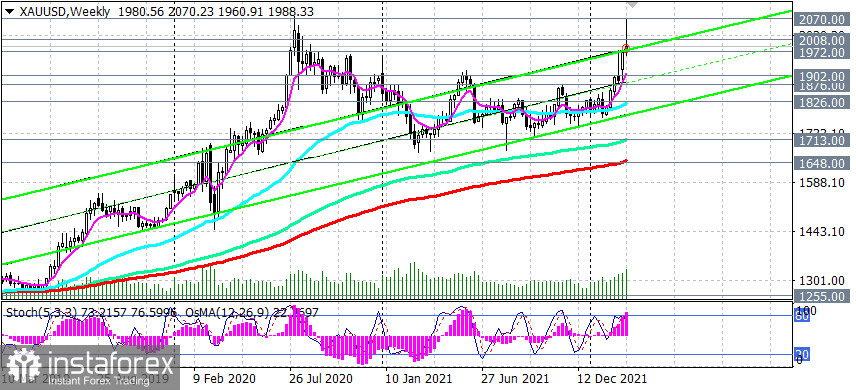

At the time of this writing, the XAU/USD pair is trading near the 1990.00 mark, just above the important short-term support level of 1972.00 (200 EMA on the 1-hour chart). At the same time, XAU/USD remains in the long-term bull market zone, above the key support level of 1826.00 (200 EMA on the daily chart). In our opinion, it is possible to enter long positions from the current levels, as well as with a decline to the support level of 1972.00. The confirmation signal will be a breakdown of the local resistance level of 2008.00. In this case, XAU/USD will continue to grow within the ascending channel on the daily chart. Its upper limit is above the 2070.00 mark (the recent local almost 2-year high), which will be the nearest target for the growth of XAU/USD.

In an alternative scenario, which looks like a theoretical one so far, XAU/USD will return to the zone of the key long-term support level of 1826.00. The first signal for the implementation of this scenario will be a breakdown of the short-term support level of 1972.00. But even a decline to the important support level of 1902.00 (200 EMA on the 4-hour chart) will be considered as corrective within the bullish trend.

Only a breakdown of the support levels of 1713.00 (144 EMA on the weekly chart and local lows), 1648.00 (200 EMA on the weekly chart) will increase the risks of breaking the long-term bullish trend of XAU/USD.

Support levels: 1972.00, 1902.00, 1876.00, 1826.00, 1800.00, 1713.00, 1700.00, 1648.00

Resistance levels: 2000.00, 2008.00, 2070.00

Trading recommendations

XAU/USD: Sell Stop 1967.00. Stop-Loss 2011.00. Take-Profit 1902.00, 1876.00, 1826.00, 1800.00, 1713.00, 1700.00, 1648.00

Buy by-market, Buy Limit 1973.00, Buy Stop 2011.00. Stop-Loss 1967.00. Take-Profit 2050.00, 2070.00, 2100.00, 2200.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română