EUR/USD

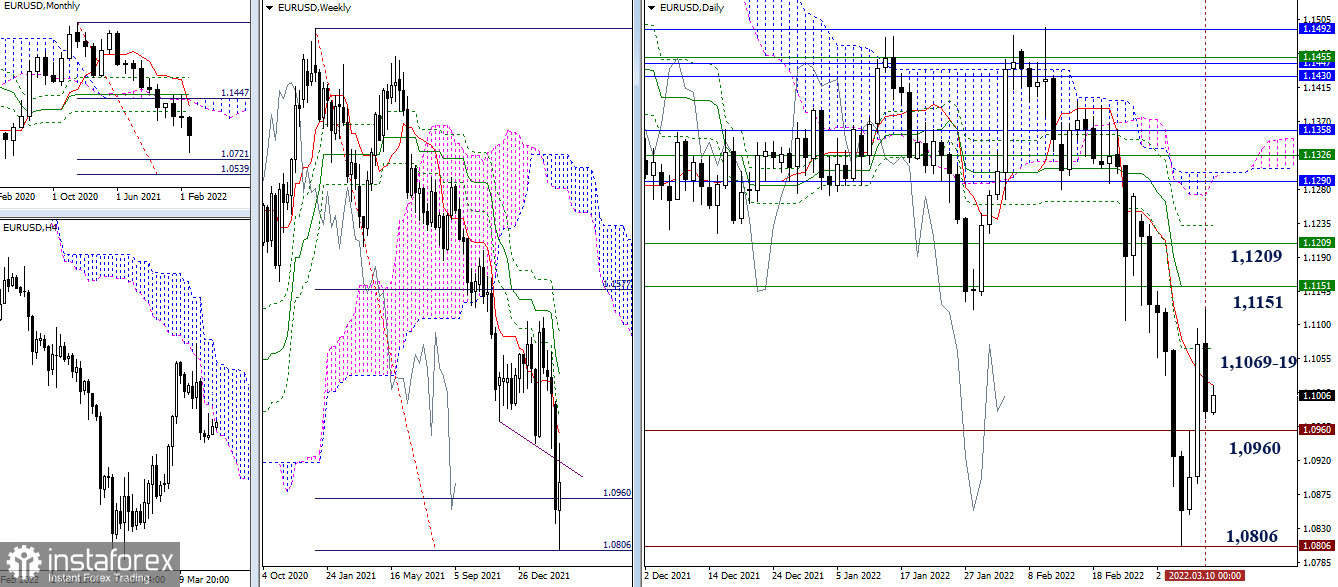

Having met the daily levels, the euro took a break and showed some decline. We are closing the week today. The result will be important and interesting. Will the bulls be able to identify themselves in the weekly format as optimistically as possible? It is possible that the week will end with clear uncertainty, or the bears will seek to complete the corrective rise and return to bearish benchmarks. The current attraction and influence are now exerted by the daily levels 1.1069 - 1.1019, the targets for the downside are the daily target levels 1.0960 - 1.0806, and the upward targets today are located in the area of the weekly resistances 1.1151 - 1.1209.

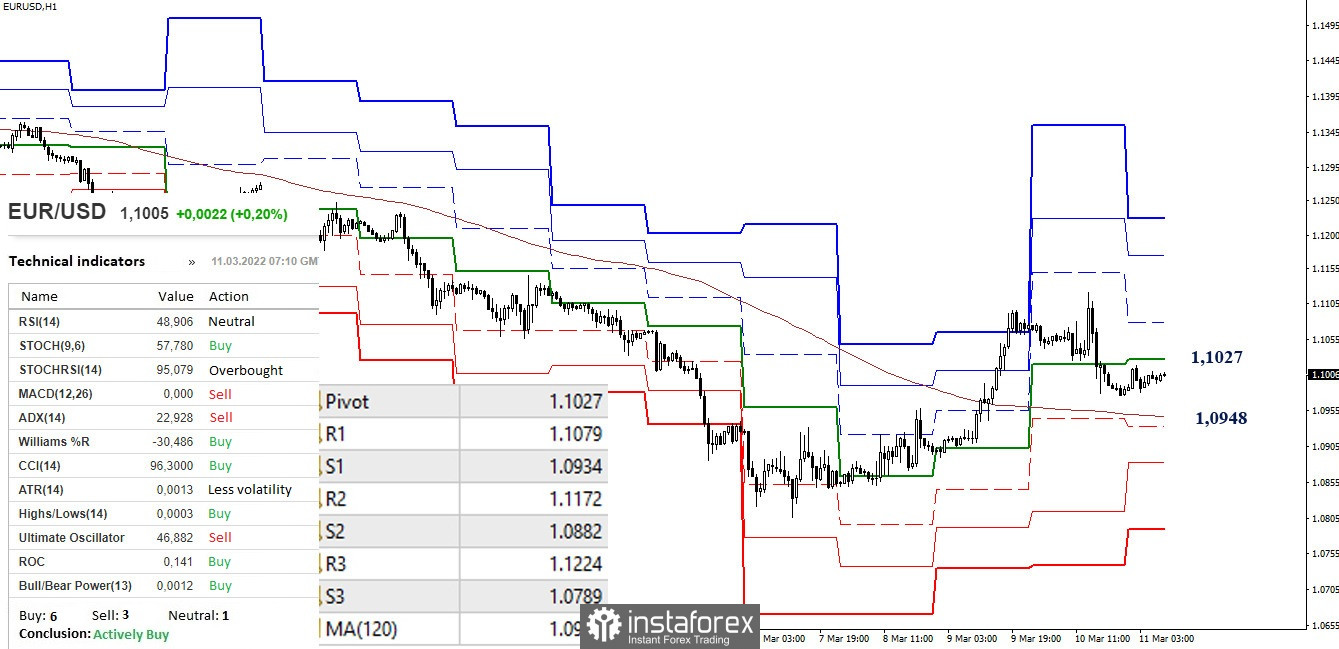

In the lower timeframes, the main advantage at the moment belongs to the bulls. Nevertheless, the situation on H1 makes it difficult to stay in the downward correction zone for a long time. Key levels today are located at 1.1027 (central pivot point) and 1.0948 (long-term weekly trend). Upward references within the day can be noted at 1.1079 – 1.1172 – 1.1224 (resistance of classic pivot points). Downside targets today are at 1.0934 - 1.0882 - 1.0789 (support of the classic pivot points).

***

GBP/USD

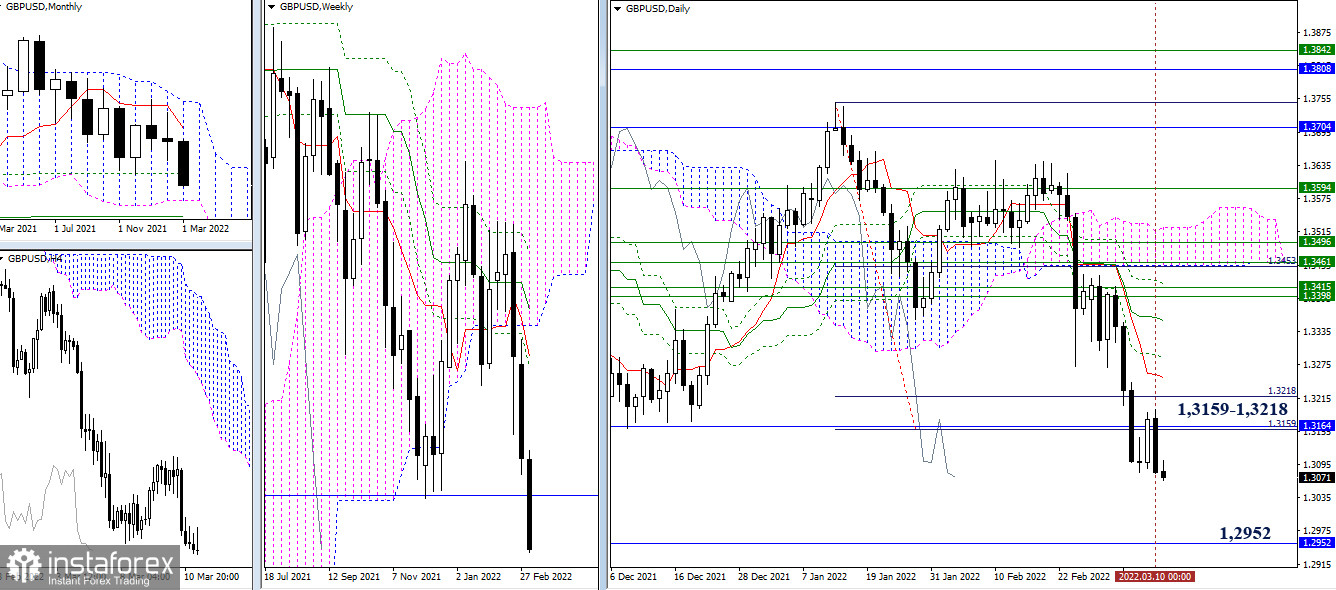

The slowdown of the last days ended with a new low. As a result, by the end of the week, the bears are again close to being able to close with the most optimistic mood. The next downward reference in the current situation is the lower boundary of the monthly cloud (1.2952). The nearest resistances now are the levels of the target for the breakdown of the daily cloud (1.3159 – 1.3218) passed the day before, strengthened by the monthly Fibo Kijun (1.3164).

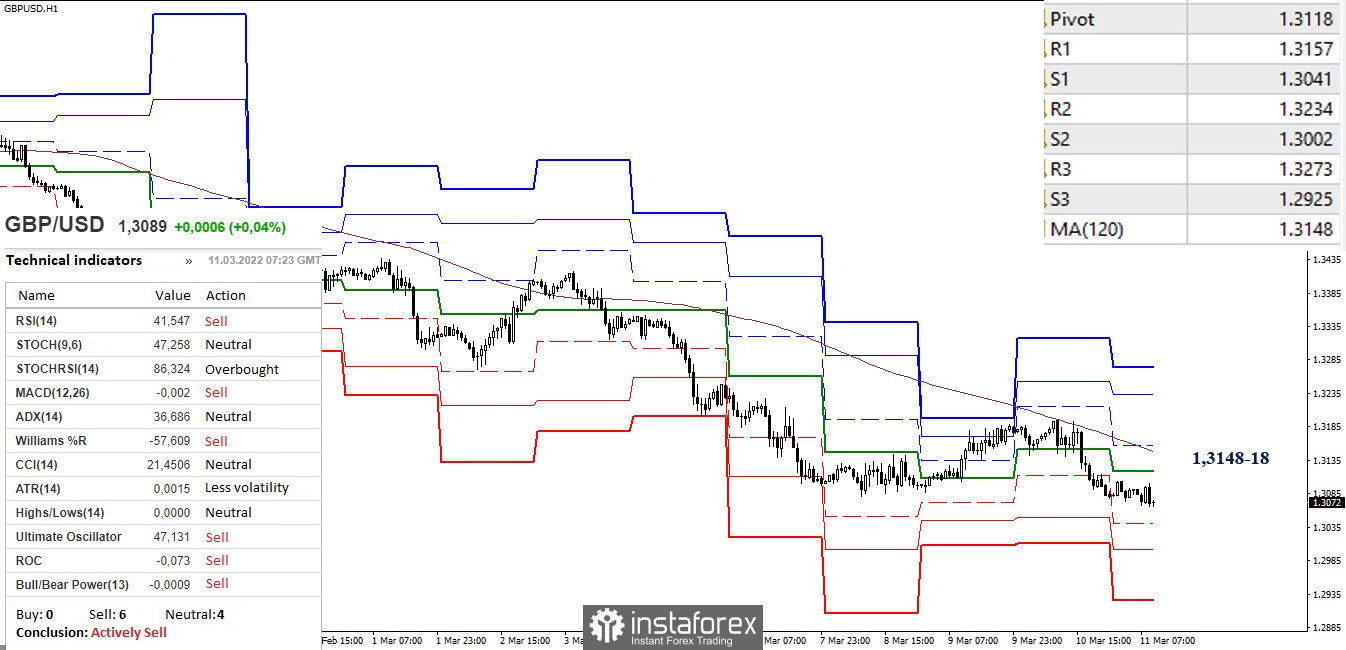

In the lower timeframes, we observe the development of a downward trend. Downward reference points within the day are the support of the classic pivot points (1.3041 – 1.3002 – 1.2925). In the meantime, key levels hold the line at the resistance zone of 1.3118 (central pivot point) and 1.3148 (long-term weekly trend). Consolidation above and reversal of the moving average can change the current balance of forces. In this case, the interests of bulls will rush to more distant reference points - 1.3234 and 1.3273 (resistance of the classic pivot points).

***

Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as Classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română