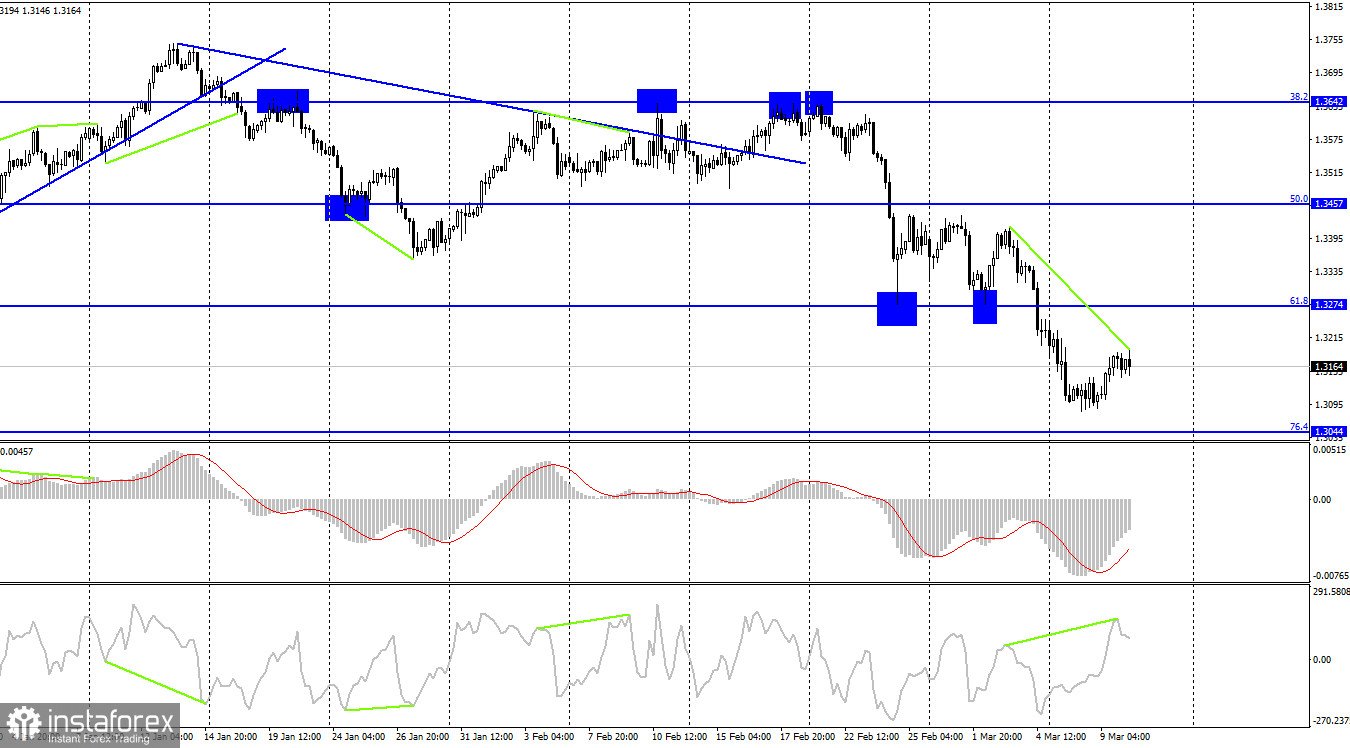

According to the hourly chart, the GBP/USD pair on Wednesday managed to perform an increase only to the corrective level of 161.8% (1.3181). The rebound of quotes from this level will work in favor of the US currency and the resumption of the fall in the direction of the corrective level of 200.0% (1.3071). Fixing the pair's rate above 1.3181 will increase the probability of further growth in the direction of the Fibo level of 127.2% (1.3279). I have already drawn the attention of traders to the fact that the euro currency grew much stronger than the British yesterday. Why did it happen if they were falling almost synchronously before? I believe that the matter may lie in oil and the attitude to the issue of oil supplies from the Russian Federation. Let me remind you that Boris Johnson announced the UK's rejection of Russian oil and gas in 2022. That is, by the end of this year, London is going to completely replace Russian oil. The EU countries have stated that such an option is unacceptable for them and they will completely abandon Russian oil, if they can, then not earlier than by 2030.

Thus, the European Union will continue to buy oil and gas from Russia, and the UK will refuse these purchases together with the United States. It was this news that could lead to an increase in demand for the euro currency and the absence of this growth in the pound sterling. At least, I don't see any other explanations. Perhaps today's ECB meeting also has an impact on traders. However, nowhere in the media has there been a hint that Christine Lagarde's rhetoric will tighten, and the bank itself will raise the interest rate. Therefore, based on what has the euro currency grown so much? In general, let me remind you that the key topic for markets and traders now is geopolitics, namely the military conflict between Ukraine and the Russian Federation. Negotiations between Sergey Lavrov and Dmitry Kuleba are due to take place today, and, according to my information, they have already begun in Antalya. It is reported that the issue of recognition of Crimea will not be discussed, and Ukraine is ready to refuse to join NATO, but only in exchange for security guarantees from the United States, Great Britain, and EU countries. Also, the LPR and the DPR must remain part of Ukraine, otherwise, there will be no agreement with Moscow.

On the 4-hour chart, the pair closed under the corrective level of 61.8% (1.3274). Thus, the fall in quotes can be resumed in the direction of the next Fibo level of 76.4% (1.3044). The rebound of quotes from this level will allow the pound to grow slightly, and closing below it will increase the chances of a new fall in the direction of the corrective level of 100.0% (1.2674). Bearish divergence also allows us to expect a resumption of the fall.

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts increased in the hands of speculators by 7,128, and the number of short contracts increased by 2,046. Thus, the general mood of the major players has become more "bullish", but at the same time, in the category of speculators, there is now equality in the number of long and short contracts. Thus, I conclude that the mood is now more neutral than "bearish" or "bullish". But even this does not matter much, since geopolitical factors can continue to have a very big impact on the British rate. Now it turns out that the mood is "neutral", and the Briton is falling.

News calendar for the USA and the UK:

USA - consumer price index (13:30 UTC).

On Thursday, the calendar of economic events in the UK is empty, and there will be only one important report in the US. The influence of the information background on the mood of traders will be average in strength today and will also depend on the results of negotiations between Kuleba and Lavrov.

GBP/USD forecast and recommendations to traders:

At this time, I would recommend selling the British with targets of 1.3071 and 1.3044, if a rebound from the level of 1.3181 is performed. I do not recommend buying a pound today, since all factors remain in favor of the dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română