Details of the economic calendar of March 9:

Data on open vacancies in the U.S. labor market (JOLTS) were published, the volume of which decreased in January, but this did not play any role in the market. The main driver in the market is still the information and news background related to the current situation in the world.

Analysis of trading charts from March 9

The technical correction from the support level of 1.0800 managed to return the EURUSD quote above 1.1050. This movement has led to a fairly strong strengthening of the euro in recent days, which removed the oversold status.

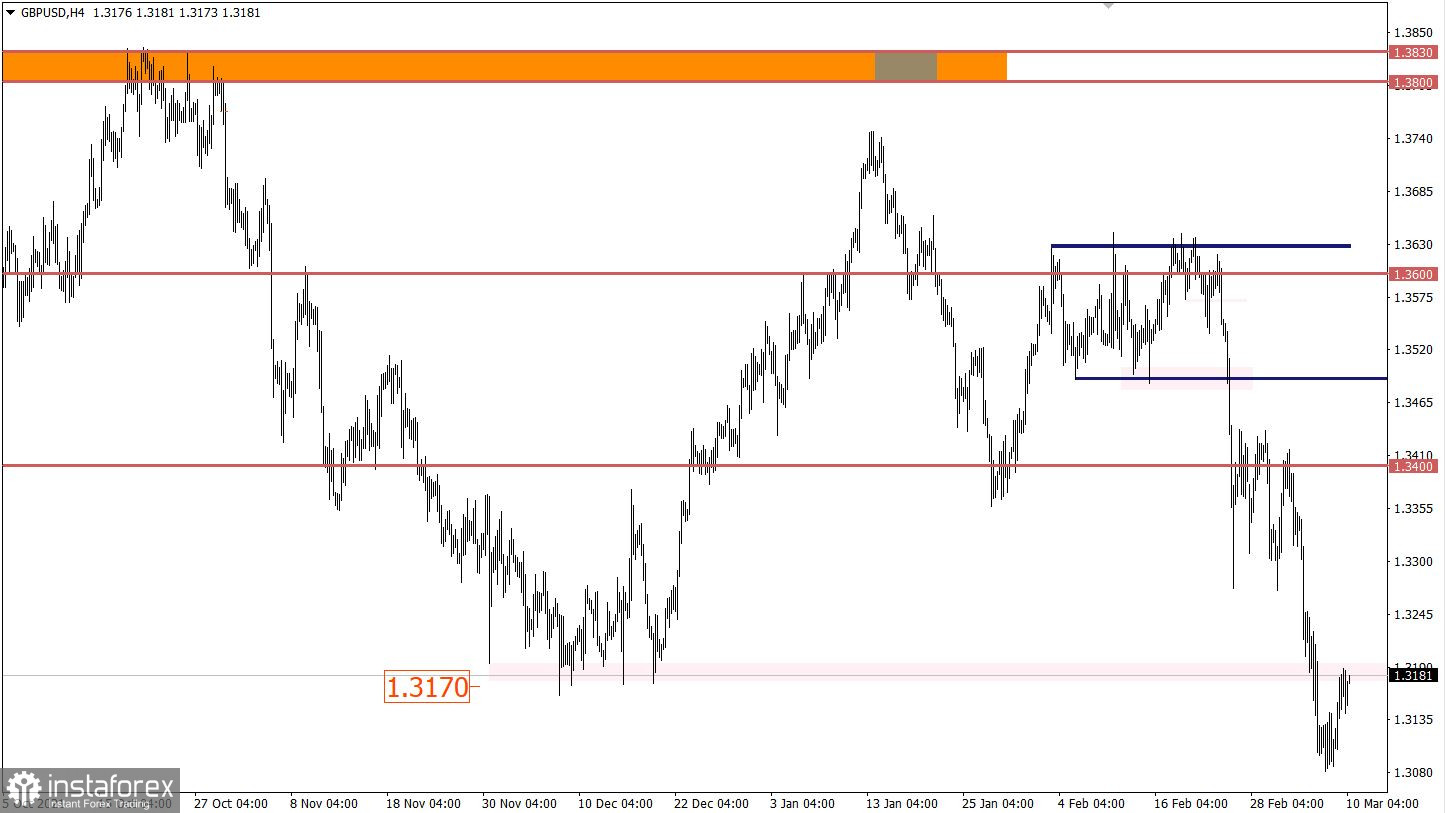

During the downward movement, the GBPUSD currency pair found a foothold near the upper border of the psychologically important level 1.2950/1.3000/1.3050. As a result, there was a stagnation followed by a price rollback.

March 10 economic calendar:

The ECB Governing Council is scheduled for a meeting today, where, given the rapid growth of inflation, it is quite possible to expect a decision to raise the refinancing rate. This step would be logical, however, due to the current situation in the world, the regulator can be expected to be even more cautious in terms of actions. Thus, it will turn out that the ECB will refuse to tighten monetary policy, as a result, this will put even more pressure on the euro.

During the American trading session, data on inflation in the United States will be published, which may again reflect an increase in consumer prices from 7.5% to 7.9%. This once again confirms the words of Fed Chairman Jerome Powell that there is no need to expect any slowdown in inflation this year.

Time targeting

Results of the ECB meeting - 12:45 Universal time

ECB press conference - 13:30 Universal time

U.S. inflation - 13:30 Universal time

Trading plan for EUR/USD on March 10:

It can be assumed that the corrective move has already reached the desired scale and soon the market will again see an increase in the volume of short positions. This move will lead to the recovery of the U.S. dollar, followed by an update of the local minimum. Traders consider the price area 1.1120/1.1180 as resistance on the way to correction.

Trading plan for GBP/USD on March 10:

A price pullback is seen as a temporary movement in the market. The general mood of traders indicates the prevailing interest in short positions. Thus, holding the price below 1.3100 will most likely lead to a continuation of the downward trend and touching the level of 1.3000.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română