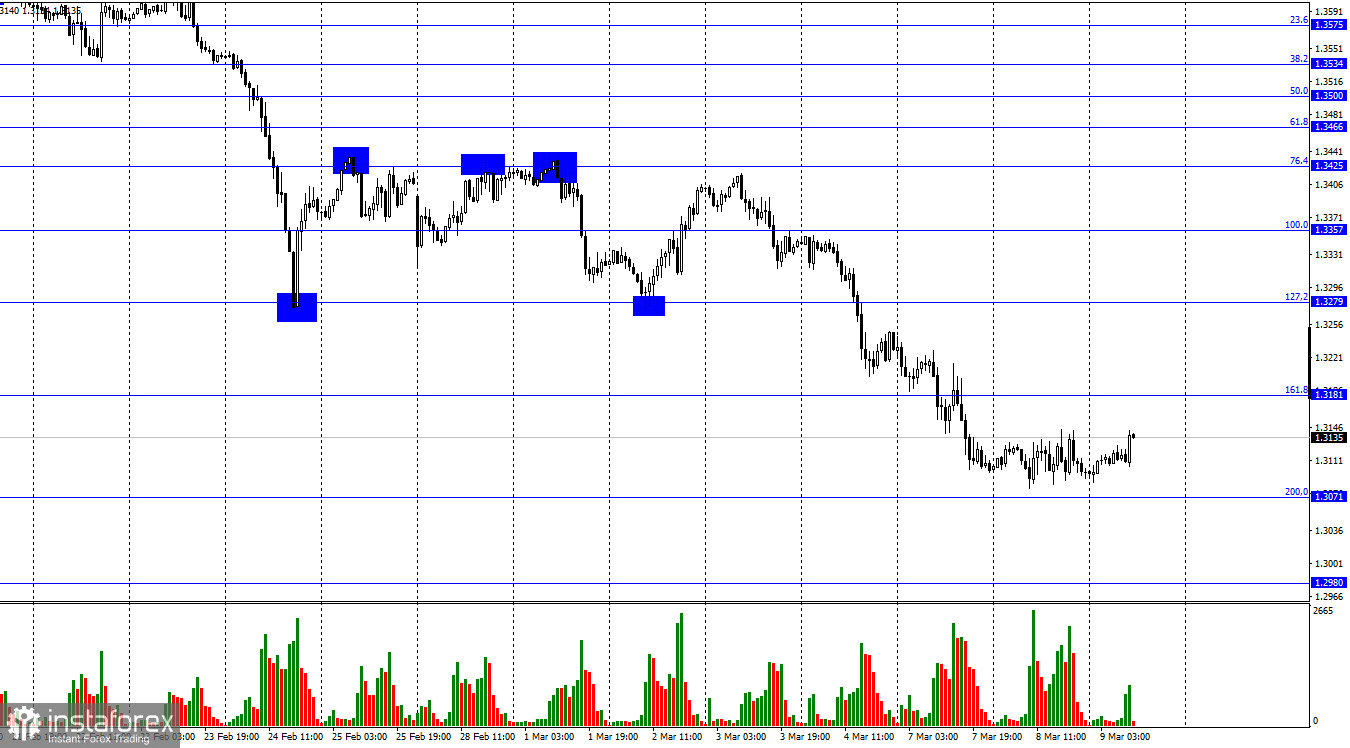

Hello, dear traders! According to the H1 chart, GBP/USD was flat on Tuesday. Any movement stopped near the 200.0% Fibonacci level (1.3071). Uncertainty is now weighing on the market. All reports that come from the UK and the US right now are related to geopolitics. So, both countries have banned imports of Russian oil and gas and are calling on Europe to stop buying Russian energy products. This triggered a sharp rise in oil and gas prices. The oil and gas markets are now in a state of shock. Both assets have shown steep growth as traders are spooked prices may rise even further and are now investing in oil, while it still costs less than $300 per barrel. However, this is unlikely to be an indefinite rise. Even if oil hits $200, for instance, it does not mean it is going to trade at this level for a long time.

Washington is now holding consultations with the countries of the Middle East and Venezuela so that they increase production and supplies to the EU. Venezuela and Iran are promised to lift economic sanctions if they substitute Russian oil. The countries are definitely interested in both expanding oil sales and lifting sanctions. So, we may expect their decisions in the next few days. Perhaps the talks will be held for a month or no agreement will be reached at all. Nevertheless, negotiations have begun. The world cannot afford to buy oil at $200-300. The same goes for gas. Banning Russian energy, the EU and the US understand they will have to substitute oil and gas. Otherwise, they risk facing a trajectory of double-digit inflation. The countries have surely come up with a plan but haven't announced it officially yet.

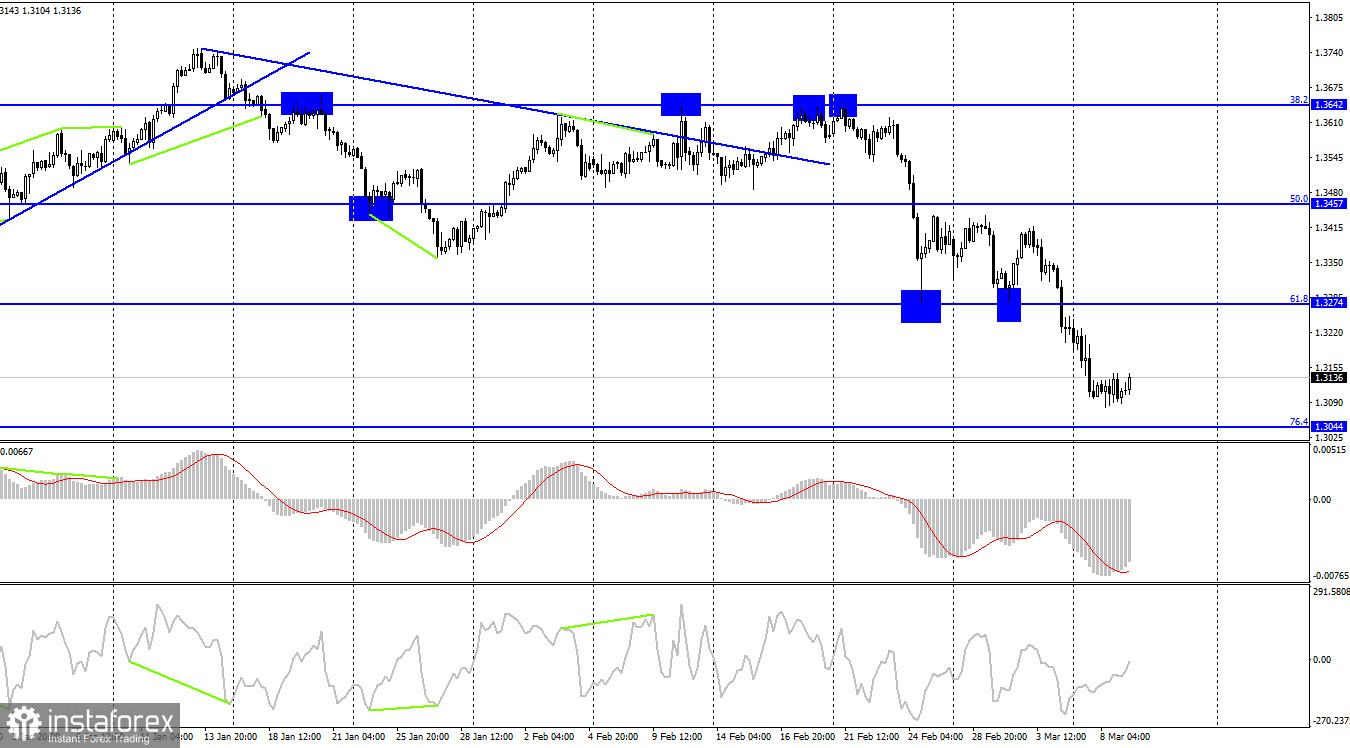

The pair closed below the 61.8% retracement level (1.3274) on the H4 chart. The bear trend may extend to the 76.4% Fibonacci leve (1.3044). The pound may somewhat advance in case of a rebound. Otherwise, if the price closes below the mark, the pair may fall to the 100.0% retracement level (1.2674). There is no divergence today whatsoever, and the pound is unlikely to show growth today.

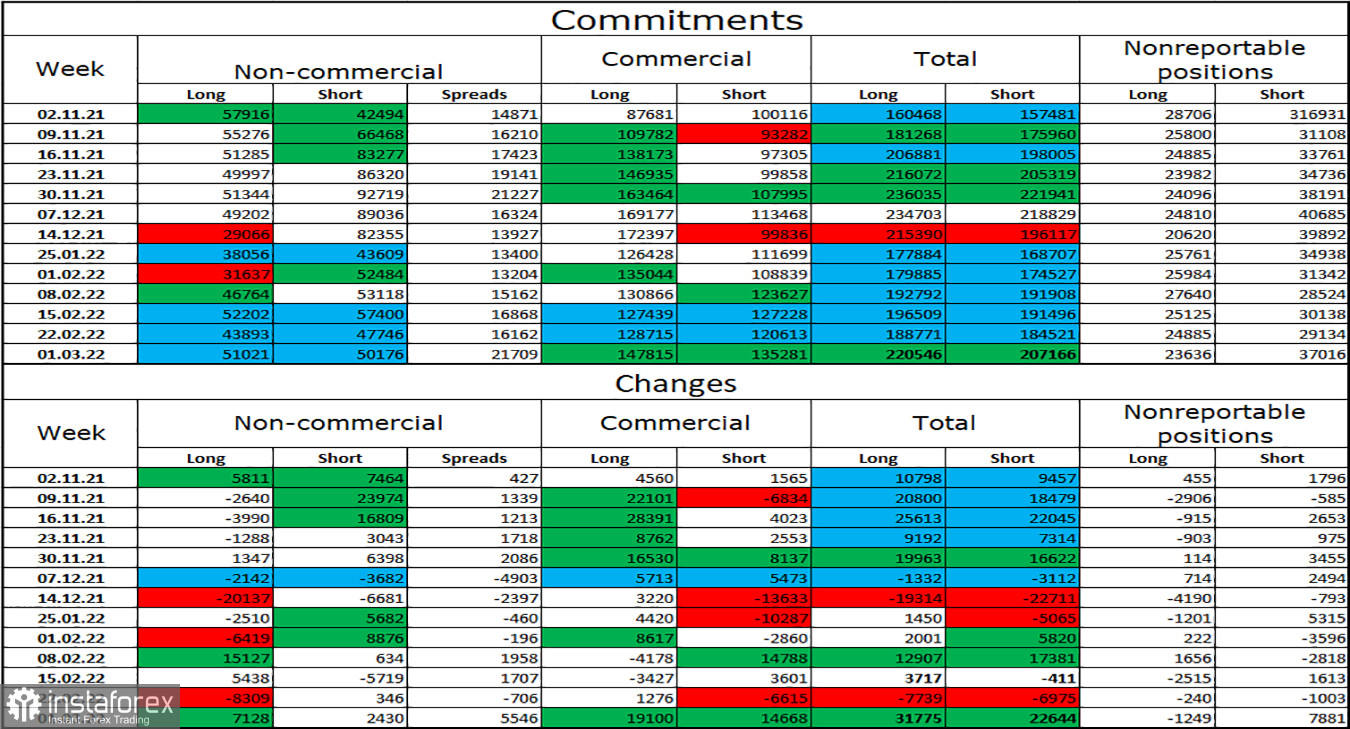

Commitments of Traders (COT):

The sentiment of non-commercial traders has reversed over the reporting week. The number of long positions increased by 7,128 and short ones rose by 2,046. Overall, bullish sentiment grew, but the number of long positions is now equal to the number of short ones. Therefore, sentiment is now more neutral than either bullish or bearish. Anyway, geopolitical factors are likely to continue weighing on the pound. In general, the pound is now getting weaker despite neutral sentiment.

Macro events in the United States and the Kingdom:

The macroeconomic calendars are empty in the US and the UK. The fundamental background will unlikely affect the market.

Outlook for GBP/USD:

Shorp positions could be opened with targets at 1.3071 and 1.3044 as the price has closed below 1.3181. The quote is now approaching the first target. It would be wise to go short after consolidation below 1.3044 on the H4 chart. Long positions should be postponed today due to a stronger dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română