Gold was about to hit a record high after the US imposed an embargo on Russian oil and Britain joined it. Despite the EU accounting for the lion's share of Russian oil supplies, it has not supported the import ban yet. However, this event is the reason for Brent crude oil price to rise. Besides, it increases the risks of the US inflation to 10% or higher in 2022. The current situation is beneficial to the precious metal, taking into account negative real US Treasury yields .

XAUUSD quotes went up almost 12% since early 2022 amid fears that soaring inflation would force the Fed to aggressively tighten monetary policy, turning into recession. The Russia-Ukraine conflict has added fuel to the fire as commodities are skyrocketing due to supply problems. Stocks of specialized exchange-traded funds focused on gold have increased by 152 tons since the beginning of 2022 and reached their highs since March 2021. At the same time, rumors about imposing sales bans on the precious metal by the Bank of Russia are favorable to XAUUSD bulls.

The Russian ruble hit hard due to Russia's military special operation in Ukraine. It has lost about 60% of its value since January. In some cases, losses have amounted to 85%. Russia's Central Bank raised its key rate to 20% and was willing to use foreign exchange reserves to support the ruble. However, it turned out to be very difficult to fulfill. Consequently, Elvira Nabiullina and her colleagues consider selling gold reserves estimated at $132.3 billion to support the ruble. According to Capital Economics, Moscow's large-scale sales of the precious metal may bring its prices down to $1600 per ounce. However, the US intends to ban the Central Bank of Russia from selling gold reserves.

Dynamics of Russian gold reserves

A bipartisan group of US senators has introduced a bill to impose secondary sanctions on buying Russian gold. It would ban any person from buying or transporting the precious metal from the Central Bank of Russia's reserves. Notably, some institutions have already declared their own embargo before this bill becomes a law. For example, the London Bullion Association excluded all six Russian refineries from their supply lists, which is tantamount to a ban on new bullion on the London market.

I believe the embargo on Russian gold is not comparable to the ban on Russian oil imports. Firstly, Moscow's influence on them is significantly different. Secondly, oil prices are much more dependent on the gold market than the value of the precious metal. The latter is more influenced by inflation and the Fed's monetary policy.

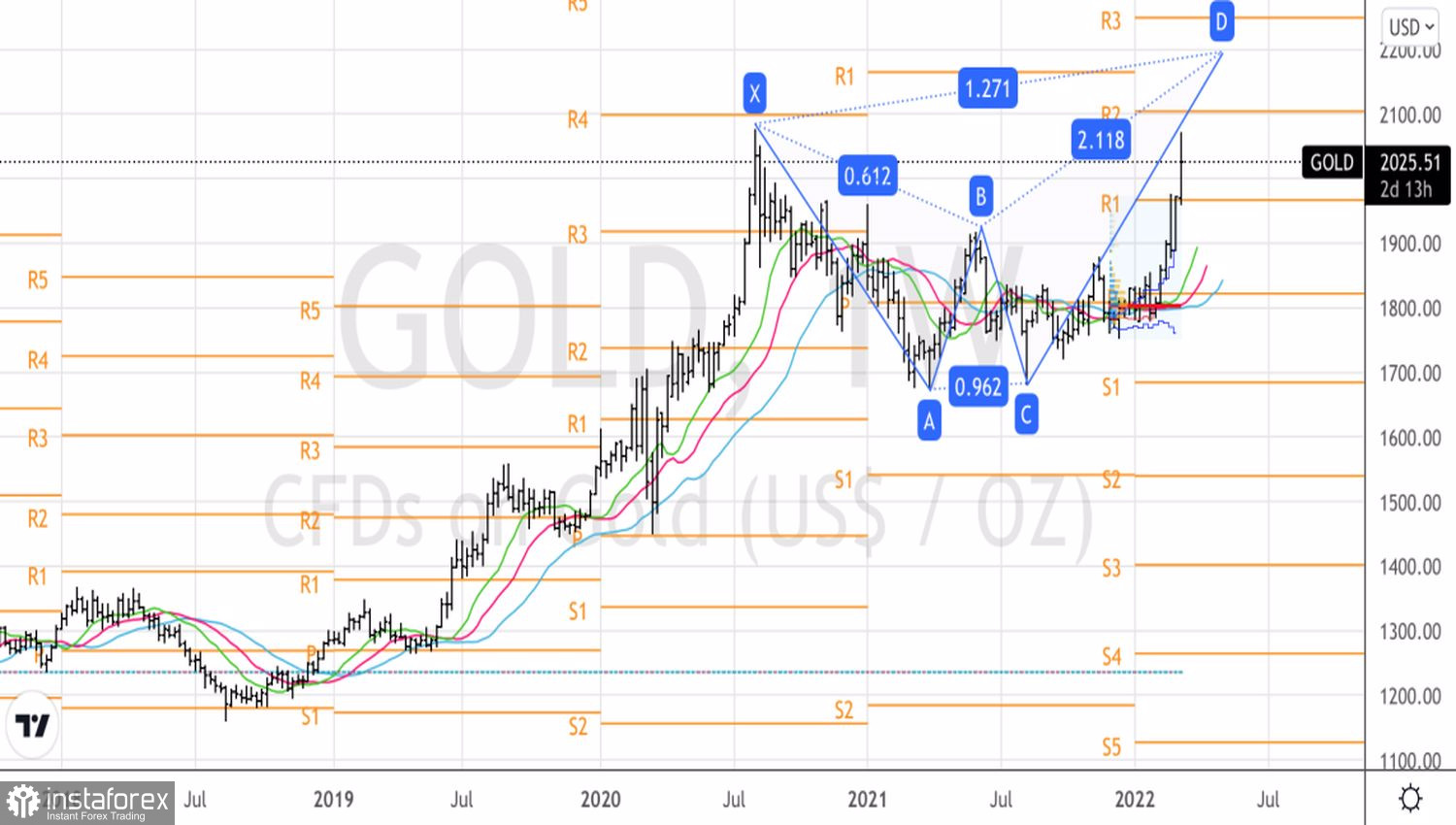

Technically, gold's ability to reach a new record high is significant. If it manages to hit new highs due to the double bottom pattern, the level of $2200 per ounce is likely. Overall, it is recommended to buy gold as long as it remains above $1970.

Gold, weekly chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română