EUR/USD

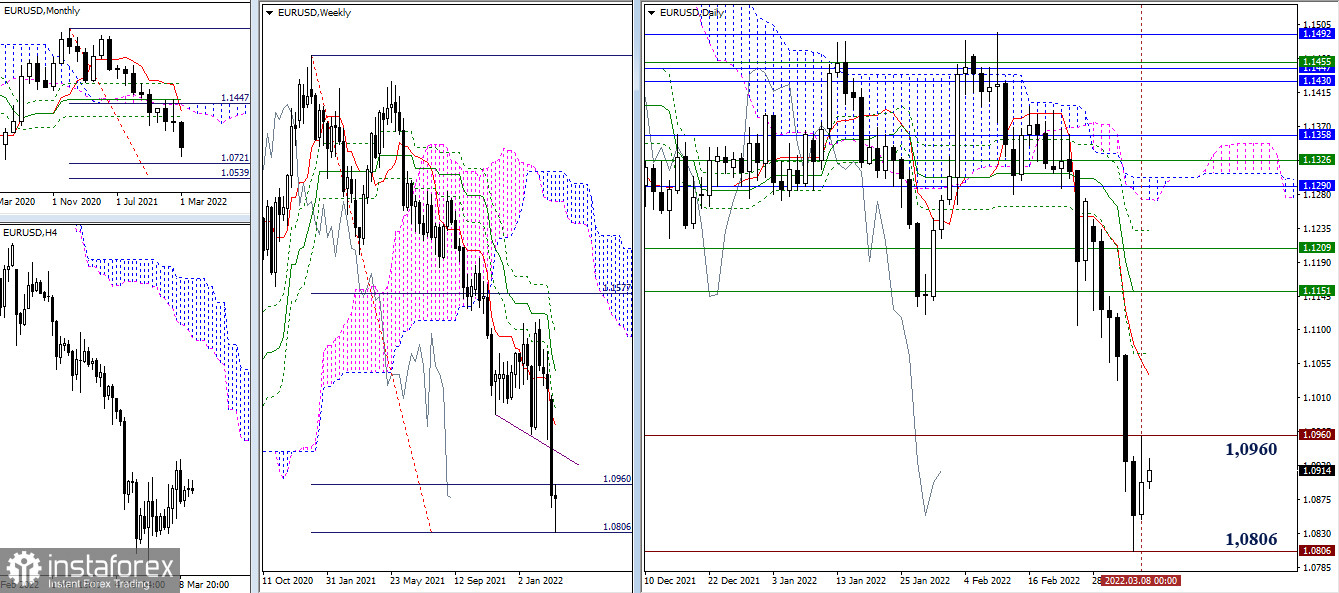

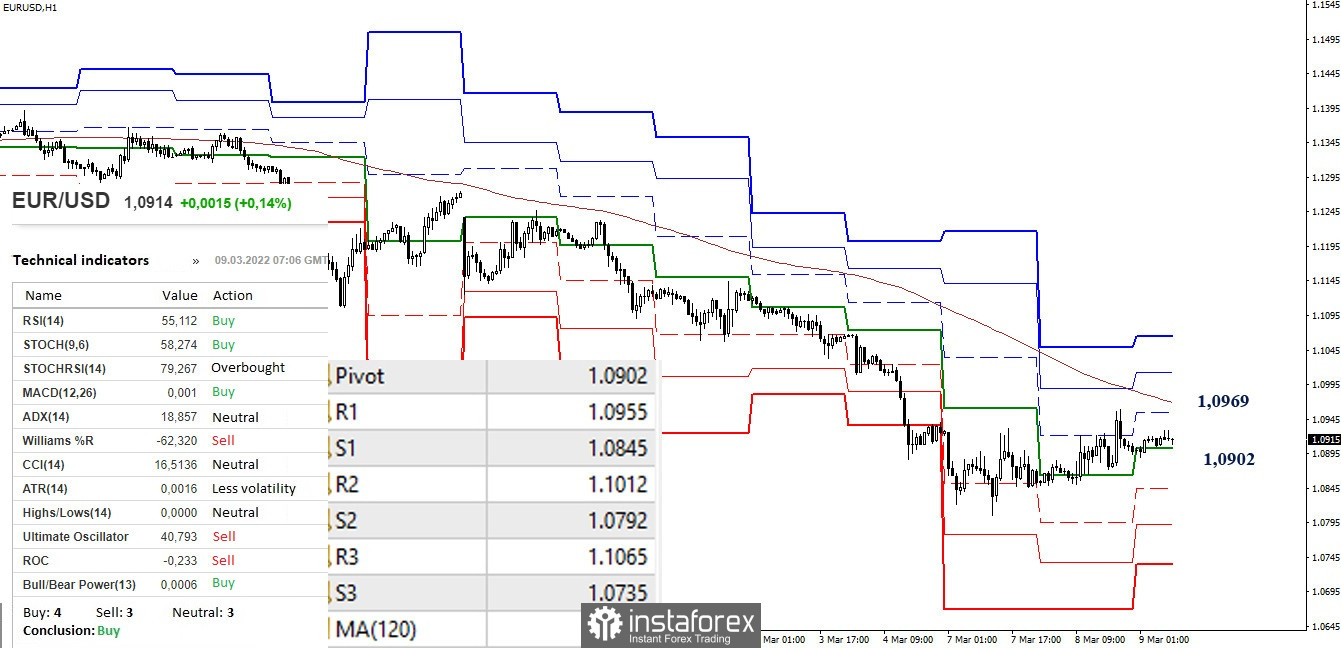

The decline continued. As a result, bears worked out point by point the weekly target for the breakdown of the Ichimoku cloud (1.0806). After that, we observe deceleration and retest of the broken first target (1.0960). These levels now limit the current movement. The next immediate resistances include 1.1040-69 (daily levels) and 1.1151 (daily medium-term trend + weekly short-term trend). In case of a breakdown of the weekly target (1.0806) and continued decline, the attention of the bears will shift to the benchmarks of the monthly target for the breakdown of the Ichimoku cloud (1.0721 – 1.0539).

The deceleration of the higher timeframes allowed the development of a corrective rise in the lower timeframes. The key levels today are at 1.0902 (central pivot point of the day) and 1.0969 (long-term weekly trend). A reliable consolidation above and a reversal of the moving average may raise the question of changing the priority and the leader of the movement. If the correction is completed and the downward trend is restored (1.0806), then the support of the classic pivot points (1.0792 – 1.0735) can serve as reference points in the lower timeframes.

***

GBP/USD

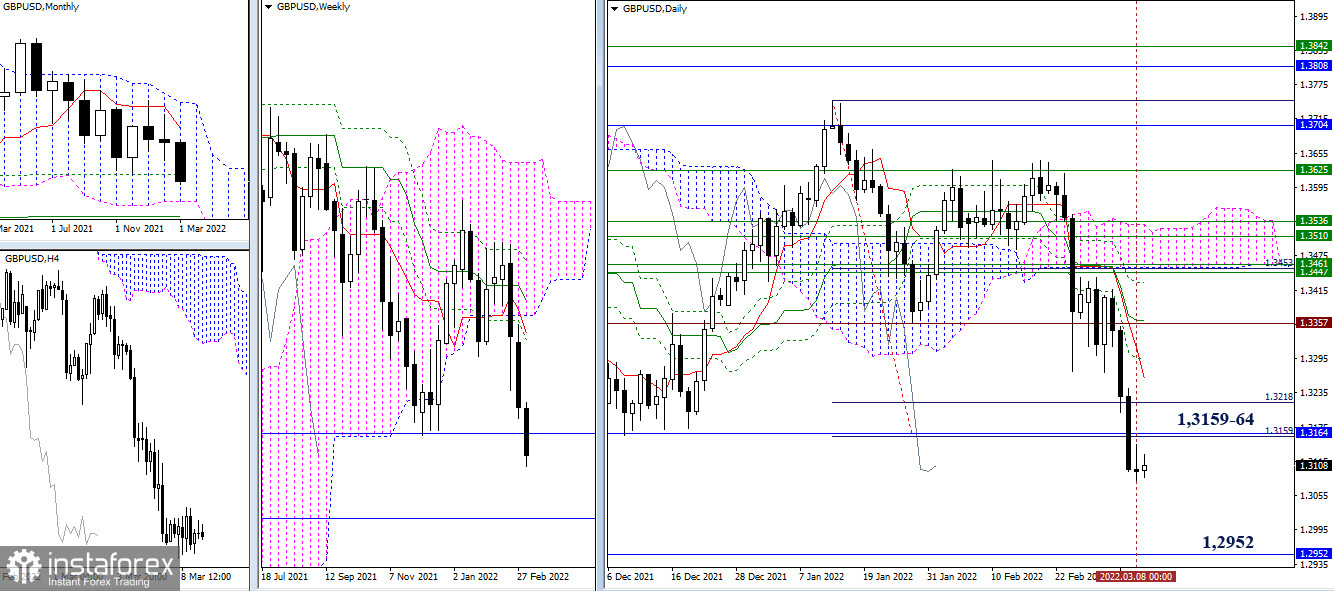

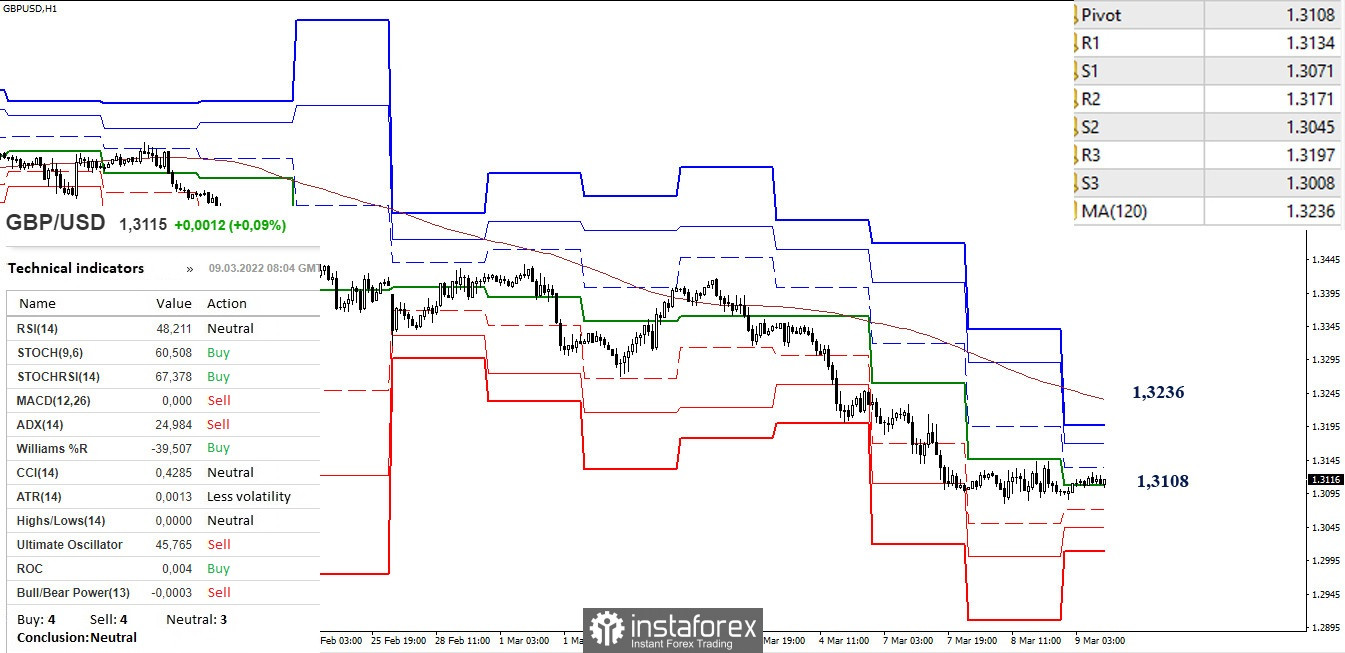

The pair left the consolidation area and began to decline. The daily target (1.3218 – 1.3159), reinforced by the support of the monthly Fibo Kijun (1.3164), is left behind. These boundaries will resist the implementation of an attempt to restore the positions of the bulls. The next downward reference now is the lower boundary of the monthly cloud (1.2952).

In the lower timeframes, braking is currently in effect, while the central pivot point of the day (1.3108) exerts an attraction. Braking can lead to the development of a corrective lift. The main reference point for an upward correction in the current situation will be the weekly long-term trend (1.3236), intermediate resistance will be provided by the classic pivot points (1.3134 - 1.3171 - 1.3197). An update of the low (1.3081) and a return to the market of bearish sentiment will bring back the relevance of support, today they are the support of the classic pivot points (1.3071 - 1.3045 - 1.3008).

***

Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as Classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română