The economic confrontation between Russia and the West is intensifying. The United States and its allies, primarily the United Kingdom, have decided to stop buying energy resources from the Russian Federation. This is yet another measure, as it seems to the consolidated West, capable of inflicting a blow on the Russian economy and forcing it to retreat from solving its tasks in Ukraine.

The oil and gas market reacted to this news with another rise in prices. North Sea Brent jumped on this news to a new all-time high of $139.13 per barrel, while U.S. WTI rose to $130.50 per barrel.

It is clear that speculators reacted to this news by buying futures contracts, arguing that Russia's share in the global energy market is significant. In fact, it is the second exporting country in the world after Saudi Arabia. It has an export share of about 40% in the gas market.

So far, the West seems to be counting on the fact that the cessation of purchases of energy resources from the Russian Federation will deal a colossal blow to the country's economy, which will lead to social upheavals and, ultimately, to the collapse of the country. In reality, the West will not be able to compensate for the shortage of oil in a short time after Russia's "shutdown," but will rely on the fact that it will be able to sit out this short period of time, as they say, until Moscow gets bogged down in the territory of the former Ukraine and during this time receives the strongest economic blow. At the same time, the West itself, especially Europe, is extremely vulnerable to these restrictions.

So what can the U.S. and Europe's decision to refuse to buy Russian energy resources lead to?

Russian Deputy Prime Minister Alexander Novak said on Monday that Russia could cut off gas supplies to Germany and warned of a likely rise in crude oil prices to $300 per barrel. This state of affairs is unlikely to be sustained for long by the European economy, where inflation has reached new highs in recent decades. But for now, in the short term, the reality is that prices for oil and gas, as well as industrial metals, will continue to rise, which opens up excellent promising opportunities for speculators.

Strengthening geopolitical confrontation will only contribute to rising prices. It is likely that we will see quotes in the region of $200 per barrel not far off. In addition, the desire of investors to move away from risk may continue to support gold prices. Under these conditions, as well as the influx of capital into America and the expected decision of the Fed to raise interest rates, the dollar will receive support against major currencies and not only against them.

Forecast:

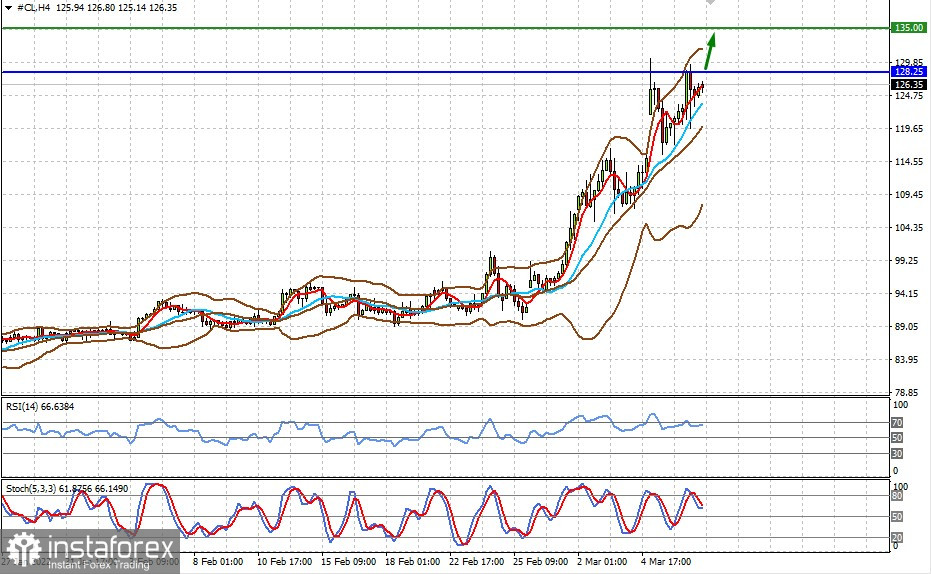

Quotes of WTI crude oil are consolidating after reaching a historical maximum. We believe that overcoming the price of 128.25 may lead to growth to the level of 135.00 in the near future.

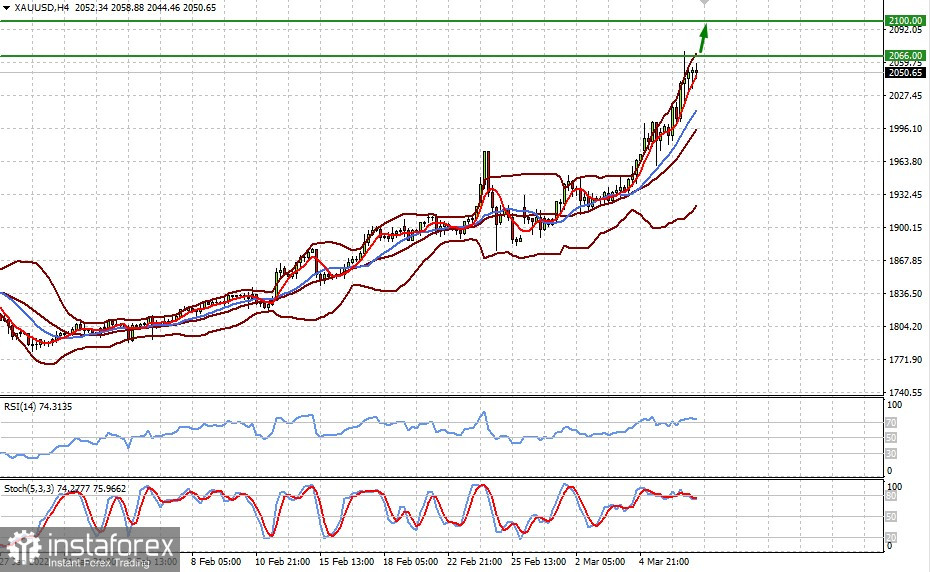

Spot gold has reached our target mark of 2066.00, continued geopolitical tensions will push the price further towards 2100.00 after rising above 2066.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română