What is needed to open long positions on EUR/USD:

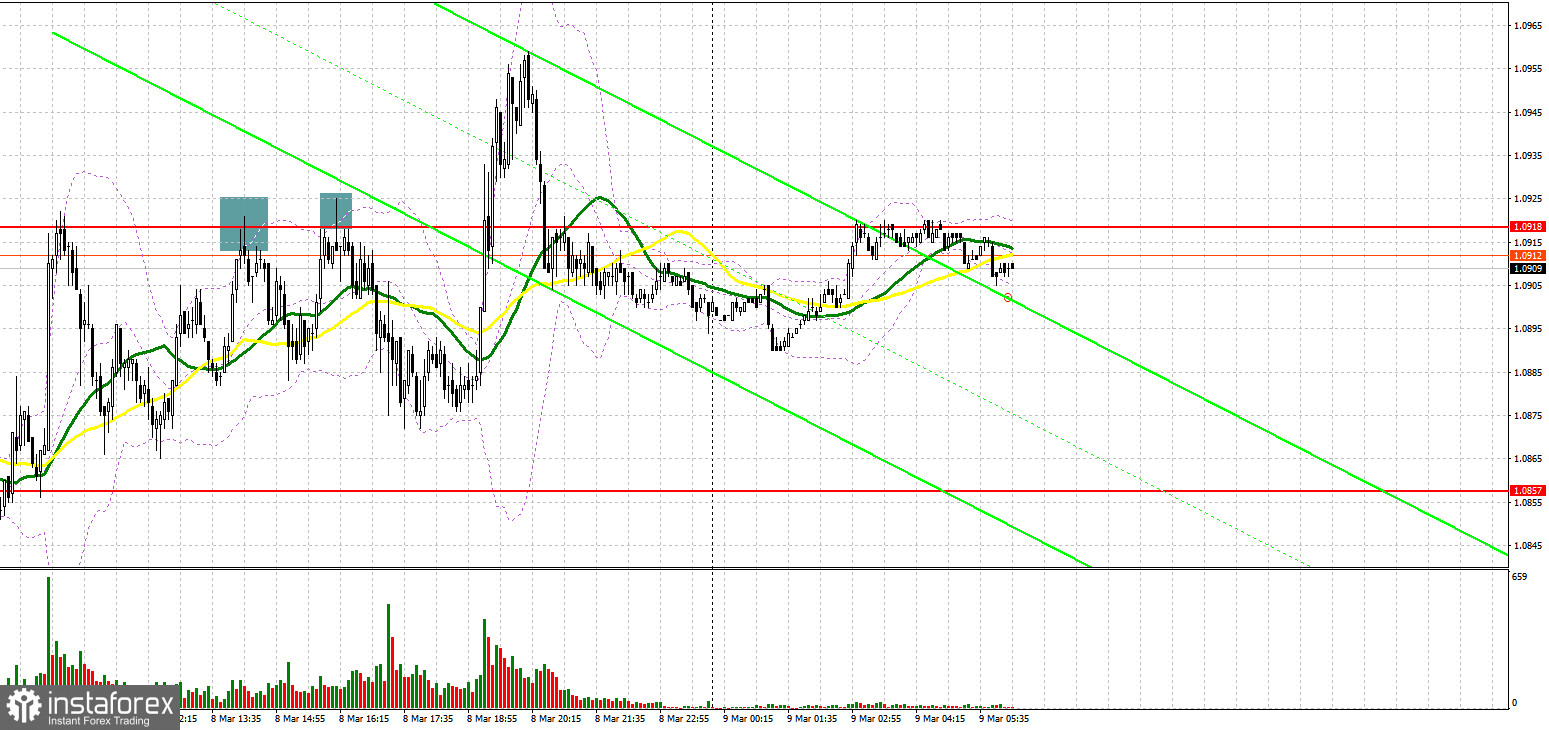

Some interesting and profitable market entry signals were generated yesterday. Let's take a look at the 5-minute chart and figure out what happened. In my morning outlook I drew attention to the 1.0884 level and recommended to make market entry decisions from it. Positive German statistics allowed euro buyers to stay within the sideways channel, while news from Ukraine led to a sharp rise of EUR/USD and a breakdown of 1.0884. However, after a reverse top-down test of this level, the bulls were unable to cope and failed to hold above 1.0884. For this reason, there was no buy signal. For the second half of the day the technical picture changed slightly. Two unsuccessful attempts to rise above 1.0918 resulted in signals to open short positions. The first move down was about 30 pips and the second about 50 pips.

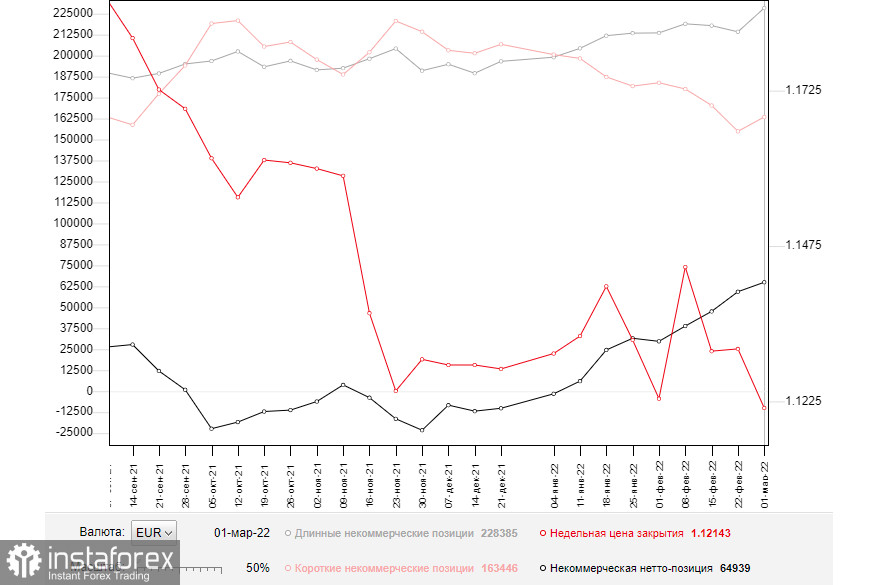

Before we talk about the outlook for EUR/USD, let's take a look at what was happening in the futures market and how the positions of traders have changed. The COT report (Commitment of Traders) for March 1 recorded an increase in both long and short positions. There were more longs, which led to an increase in positive delta. With the ongoing violent geopolitical conflict affecting almost the entire world, it makes no sense to say what position investors had a week ago, as things change at lightning speed. Those data from yesterday are no longer relevant today, as no one knows how the sanctions imposed by the US and EU countries will affect the Russian economy and what the military conflict between Russia and Ukraine will ultimately lead to. The main question is how long this will last. Against this background, it does not really matter what the policy of the European Central Bank or the Federal Reserve will be, because if the military conflict escalates, the markets will go down again. Russia and Ukraine have started talks and much will depend on the outcome of these meetings. This week will also see the European Central Bank meeting and important February US inflation data, which will lead to a spike in volatility but is unlikely to correct the situation in favour of buyers of risky assets. I recommend to keep buying the dollar. I advise to be quite cautious about risky assets and only buy Euros as tensions between Russia, Ukraine, the EU and the US subside. Any new sanctions against the Russian Federation would have serious economic consequences, affecting financial markets and also hitting not only the Russian rouble but also the European currency. The COT report shows that long non-commercial positions rose from 214,195 to 228,385, while short non-commercial positions increased from 154,163 to 163,446. At the end of the week, total non-commercial net positions climbed to 64,939 from 59,306. The weekly closing price dropped from 1.1309 to 1.1214.

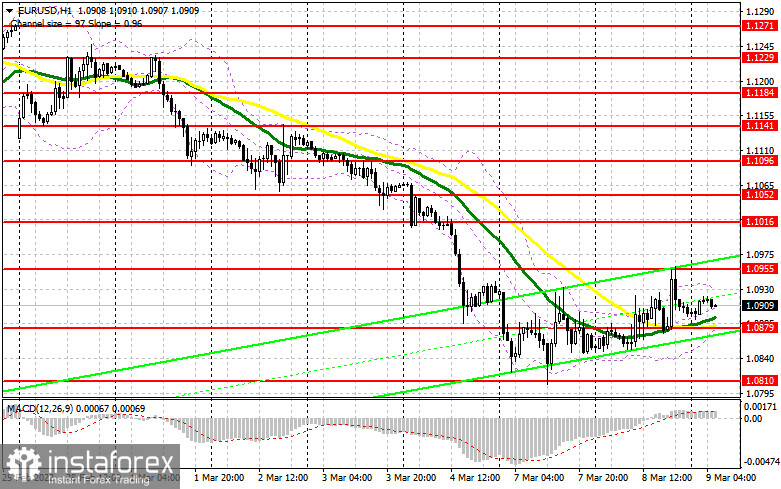

Today is likely to be a quiet day, as traders will be preparing for tomorrow's European Central Bank meeting, as well as US inflation data. Today, no interesting data on the European economy is being released. Thus, the risk of volatility is reduced. However, there is a clear threat of a further upward retracement on the chart and euro buyers need to be more aggressive to save the market from another major sell-off. No one is willing to do that in the current situation. The best scenario to open long positions, which I do not recommend in the current situation, is for the Euro to decline in the morning to 1.0879, where the moving averages are, supporting the buyers. Only the formation of a false breakdown there, together with very strong private sector employment change in France and the change in Italian industrial production, will signal an opening of long positions in anticipation of a further upward retracement of the pair. However, apart from a false-break, an active upward movement of the Euro is also needed. If the bulls do not manage to offer anything at 1.0879, it is better not to rush into long positions. A breakout of this level could lead to another major sell-off in risky assets, as the lower boundary of the technical flag pattern also passes just below this range. In that case, I would advise buying EUR/USD only after renewing the next support at 1.0810, which is this year's low. However, even there I would advise to start trading only if a false-break occurs. You may open long positions on a pullback from 1.0772, or around 1.0728, with the target of an upward correction of 20-25 pips intraday. An important challenge for the buyers will be to take control of 1.0955, which was formed yesterday afternoon. A breakout and consolidation above this range, along with good Eurozone data, is sure to boost risk appetite, which creates an excellent entry point to buy with the aim of a recovery to the highs of 1.1016 and 1.1052. A move out of this range would keep the bullish correction of the market and lead to a renewal of 1.1096, where I recommend a profit taking.

What is needed to open short positions on EUR/USD:

The bears have the market under their control and the current upward correction could end at any time. However, there are also some risks that EUR/USD sellers are taking on now. The euro is too oversold in the current conditions. The best scenario to sell the Euro in the morning today would be the formation of a false breakdown at 1.0955. This forms an excellent entry point into short positions with the prospect of further declines in EUR/USD to 1.0879, which was formed yesterday and where the big players were very active. The moving averages pass through there as well. Weak Eurozone data, which is not of high importance, could serve as a catalyst to increase short positions. A breakdown and a retest to 1.0879 from the bottom up will form an additional entry signal that will push the pair to 1.0810 low and open a direct road to 1.0772, where I recommend taking profits. A break-up of this level would only strengthen a new bearish trend in the Euro. A further target will be the area of 1.9728. In case the pair recovers during the European session and the bears are not active at 1.0955, the best scenario would be to sell on the formation of a false breakdown around 1.1016. Short positions in the EUR/USD can be opened immediately on a rebound from the highs 1.1052 and 1.1096 with a target of a downward retracement of 20-25 pips.

Indicators' signals:

Moving averages

Trading is carried out below the 30 and 50 daily moving averages. It confirms the ongoing bearish trend.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română