The global stock market has experienced an unprecedented level of volatility over the past two weeks. Due to the Ukrainian crisis and sanctions against Russia, investment flows of capital have drastically changed. The crypto market is seriously harmed and its market capitalization barely reaches $1.7 trillion.

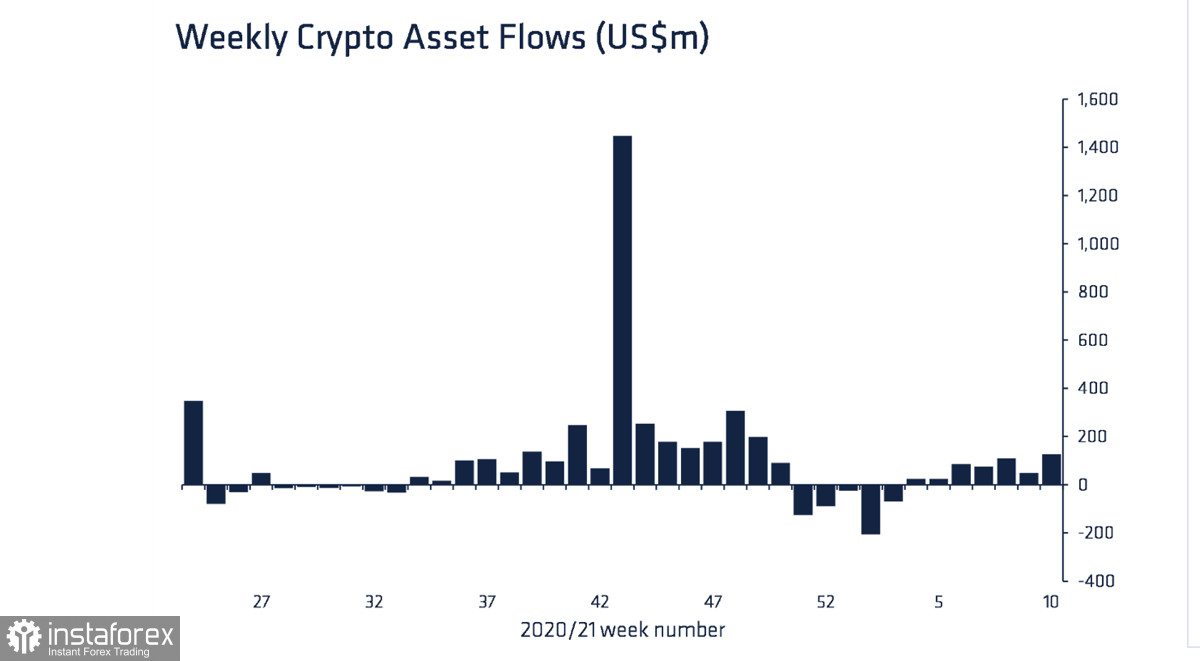

A fall in bitcoin has started due to the unexpected bull run triggered by panicking investors in the wake of the military conflict. Despite all the scepticism, CoinShares, an analytical company, reported on inflows of capital into crypto products last week. Investors put in about $151 million in crypto-related projects. Digital-asset investment funds attracted $124 million.

Bitcoin saw inflows of $95 million, the largest weekly inflow since 2021. Viewing flows on a geographical basis, North America saw inflows totalling $151 million, while Europe showed outflows of $24 million. In other words, the geopolitical situation seriously affects digital assets and bitcoin.

It is worth noting that despite outflows of capital in Europe, the armed conflict in Ukraine has had a significant impact on the adoption of cryptos. In the US, senators insist on a reasonable distribution of cryptocurrency sanctions. In Europe, officials have a different stance and bet on the precious metals market. In addition, the record volume of investments in several products was recorded in 2022.

It is about hedging risks and redistributing investment flows that harm BTC and the crypto market as a whole. The European market is one of the key pillars of the coin's bullish rally along with inflows in North American. In the US, they express a keen interest in bitcoin and other cryptocurrencies. However, geopolitical factors will not allow the asset to maintain a long-term bullish movement. The US is actively imposing new sanctions, and banning Russian commodities will lead to fluctuations in the dollar.

The US Fed is highly likely to announce a rate hike at the next meeting. Due to the current global situation and the subsequent market volatility, the world's largest cryptocurrency may sustain significant losses. With this in mind, bitcoin's hedge properties will be levelled because of greater confidence in precious metals. Generally speaking, the geopolitical situation has a direct impact on the fundamental factors driving BTC up, which means the coin is unlikely to show long-term growth until the military conflict in Ukraine is over.

What to expect from BTC in the coming months? The coin is moving within a wide range of $30K-$60K. This area could be divided into two narrow corridors: $45K-$57K and $32K-$45K. On March 8, BTC traded in the latter one.

The level of $45K serves as the mid-term resistance zone for the cryptocurrency. In case of a breakout there, the price may move towards the middle of the $45K-$56K range. The target is seen in the $40K-$42K area. Overall, investment activity and fundamental factors indicate that BTC will try to leave the $32K-$45K range in the coming months.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română