The dollar continues to dominate the market. Investors give preference to it against the background of ongoing military operations in Ukraine. Last Monday, the dollar index (DXY) exceeded 99.41, hitting a 21-month high. Commodity currencies also show positive dynamics against the background of rising prices for energy and other commodities.

Investors fear the deterioration of the situation in the economy. Large-scale sanctions against Russia also threaten to have a negative impact on the entire global economy. The United States said yesterday that they are considering a complete ban on the import of Russian oil in the event of a deterioration of the situation in Ukraine.

However, this approach further strengthens the dollar's position as the national currency of the United States, whose economy does not depend as much on Russian gas and oil as Europe. European countries that are heavily dependent on Russian energy supplies may face a third recession in two years, economists say, and the situation there threatens to escalate into stagflation. It is characterized by a combination of high inflation and low growth rates.

Now central banks may abandon plans to raise interest rates that have been lowered during the pandemic. The U.S. economy is in more favorable conditions, given its role as a major oil producer and the high level of household savings. As expected before the outbreak of the military conflict in Ukraine, the ECB and the Fed had to move to a rapid curtailment of stimulus measures. Now, both central banks are likely to act cautiously, given the new risks.

"We need to be alert and nimble as we make decisions in what is quite a difficult environment," said Fed Chairman Jerome Powell, speaking to lawmakers last week. The ECB also signaled that they will be cautious at the meeting on Thursday, despite the acceleration of inflation in February to 5.8% against the target level of 2%.

Amid threats that the global economy is facing, the demand for defensive assets is growing significantly. Yesterday, gold broke through the psychologically significant mark of $2000.00 per ounce, and today it is trading above this mark, while the yen and franc compete with the dollar in priority.

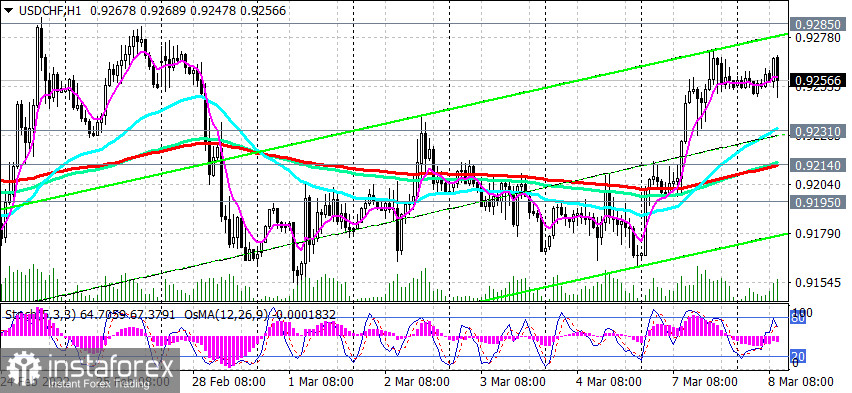

Meanwhile, the USD/CHF pair has been trading in ranges since last June - in a wider one, between the levels of 0.9410 and 0.9000, and in a less wide one, between the levels of 0.9360 and 0.9100. A kind of balance line here is the 200-day moving average on the daily chart, which is currently passing through the 0.9195 mark.

The franc received some support from the optimistic macroeconomic statistics from Switzerland, published on Monday. The unemployment rate in Switzerland decreased in February to 2.2% from 2.3% in January and the same forecast.

However, the main support for the franc comes from its status as a defensive asset.

Following the results of the meeting that ended in December, the Swiss National Bank kept its current policy unchanged, leaving the key interest rate on demand deposits at -0.75%. The target range for the 3-month Libor rate was also left unchanged at -1.25% / -0.25%. The SNB statement once again, traditionally, said that the central bank is still ready for foreign exchange interventions with the sale of the franc, if necessary, in order to withstand upward pressure on its rate.

According to SNB executives, the franc remains highly overvalued. Swiss National Bank Chairman Thomas Jordan said "inflation in Switzerland has peaked and will now decline next year," and "forecasts for inflation in the country remain within the range of price stability."

The threat of foreign exchange intervention, which the SNB does not report either before or after, is certainly a strong deterrent for the strengthening of the franc, although it will retain its safe-haven status, which will support demand for it.

Technical analysis and trading recommendations

As we noted above, the USD/CHF pair has been trading in ranges since last June - in a wider range, between the levels of 0.9410 and 0.9000, and in a less wide one, between the levels of 0.9360 and 0.9100. A kind of balance line here is the 200 EMA on the daily chart, which is currently passing through the level of 0.9195.

At the time of this writing, USD/CHF is trading near 0.9260, staying above the important support levels of 0.9214 (200 EMA on the 1-hour and 4-hour charts, 50 EMA on the daily chart), 0.9195 (200 EMA on the daily chart).

Above these support levels, long positions remain preferable, and in case of a breakdown of the resistance level of 0.9285 (the upper limit of the range located between the levels of 0.9100 and 0.9285), the growth of USD/CHF will continue with targets at the resistance levels of 0.9360 (the upper limit of the range located between the levels of 0.9360 and 0.9100 and local highs ), 0.9410 (200 EMA on the weekly chart). A breakdown of the resistance level of 0.9410 will indicate the return of USD/CHF to the zone of a long-term bull market.

In an alternative scenario, the first sell signal will be a breakdown of the short-term support level of 0.9231 (200 EMA on the 15-minute chart), and the confirming signal will be a breakdown of the support level of 0.9214. The breakdown of the key support level 0.9195 may push USD/CHF into the bearish market.

In the current situation, the main scenario for further growth of USD/CHF is preferable. But – only after a confirmed breakdown of the resistance level of 0.9285.

Support levels: 0.9231, 0.9214, 0.9195, 0.9150, 0.9100

Resistance levels: 0.9285, 0.9300, 0.9360, 0.9410

Trading recommendations:

USD/CHF: Sell Stop 0.9250. Stop-Loss 0.9310. Take-Profit 0.9230, 0.9215, 0.9195, 0.9150, 0.9100, 0.9000

Buy Stop 0.9310. Stop-Loss 0.9250. Take-Profit 0.9360, 0.9400, 0.9470, 0.9500

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română