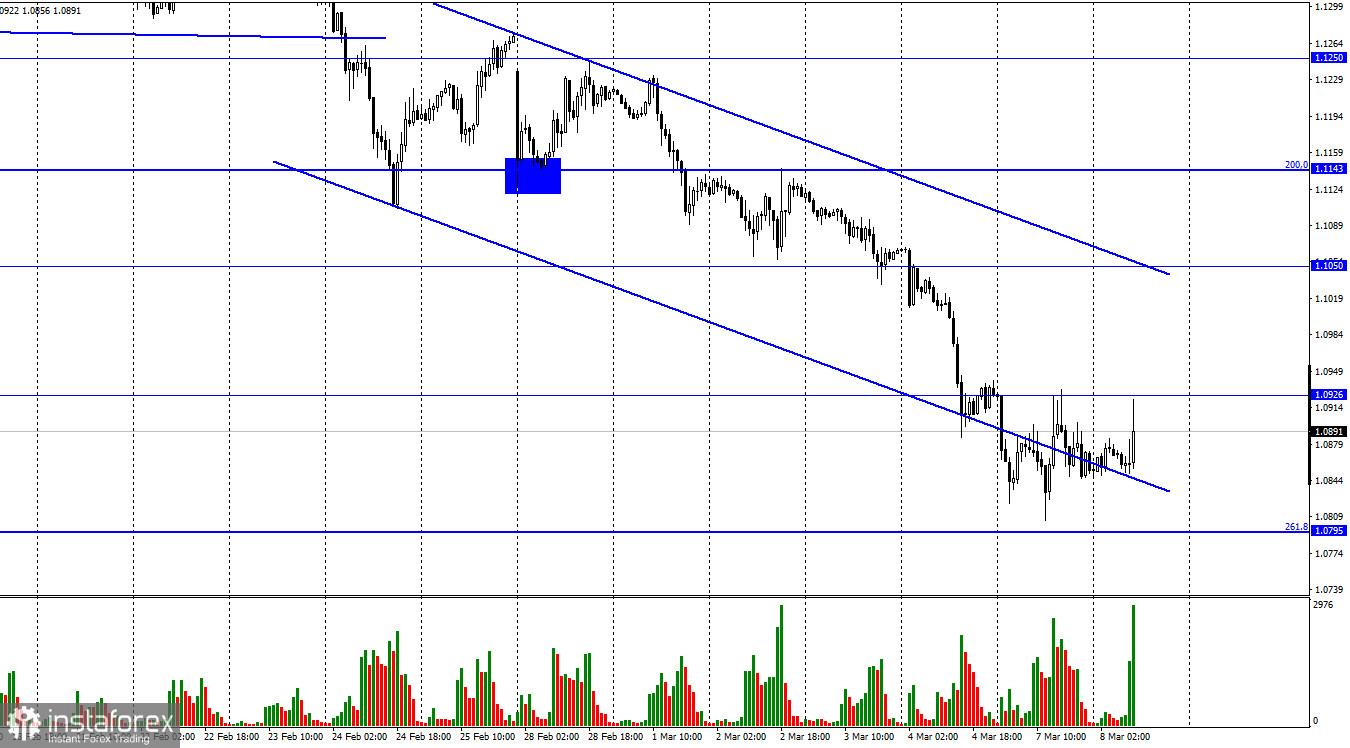

The EUR/USD pair tried to continue falling on Monday, but in the afternoon, there was still a pullback to the top. However, the rebound from the level of 1.0926 worked yesterday in favor of the US currency and the resumption of the fall. Today, the pair is slowly growing, but for stronger growth, it is necessary to gain a foothold above the same level of 1.0926. If this happens, then it will be possible to count on further growth in the direction of the upper boundary of the descending corridor, which continues to characterize the current mood of traders as "bearish". On Monday, there was no background information from the US and the EU. Even without "almost". It simply did not exist, so perhaps the European currency refrained from a new fall. Traders have now switched to such a mode of operation when even important economic reports cease to matter. Now everyone is monitoring how much oil costs, how much a particular stock market has fallen, what is happening in Ukraine, and what new sanctions have been introduced or are about to be introduced against Russia.

And there are very few reasons for optimism here. Oil and gas continue to rise in price, and against the background of talk about the embargo of Russian oil and gas, prices may rise even more. Much stronger. For the whole world, this will mean that inflation will only accelerate, and let me remind you that the issue of inflation is very acute both in the United States and in the European Union. How they will deal with rising prices if they accelerate their growth, even more, is still completely unclear. The Fed's plan to gradually raise the rate already does not look working. Inflation may rise to 8% in February, and this is still without taking into account the new increase in oil and gas prices. The European Union may also face a stronger price increase, and, in addition, more expensive heating. Negotiations are also underway to lift the oil embargo with Iran so that it completely replaces Russian oil on the market. However, there are many pitfalls in this issue, and in any case, redirecting the market to Iranian oil will take a long time. Such news does not calm traders, so I think that those falls and collapses of the currency and even individual markets are not the last.

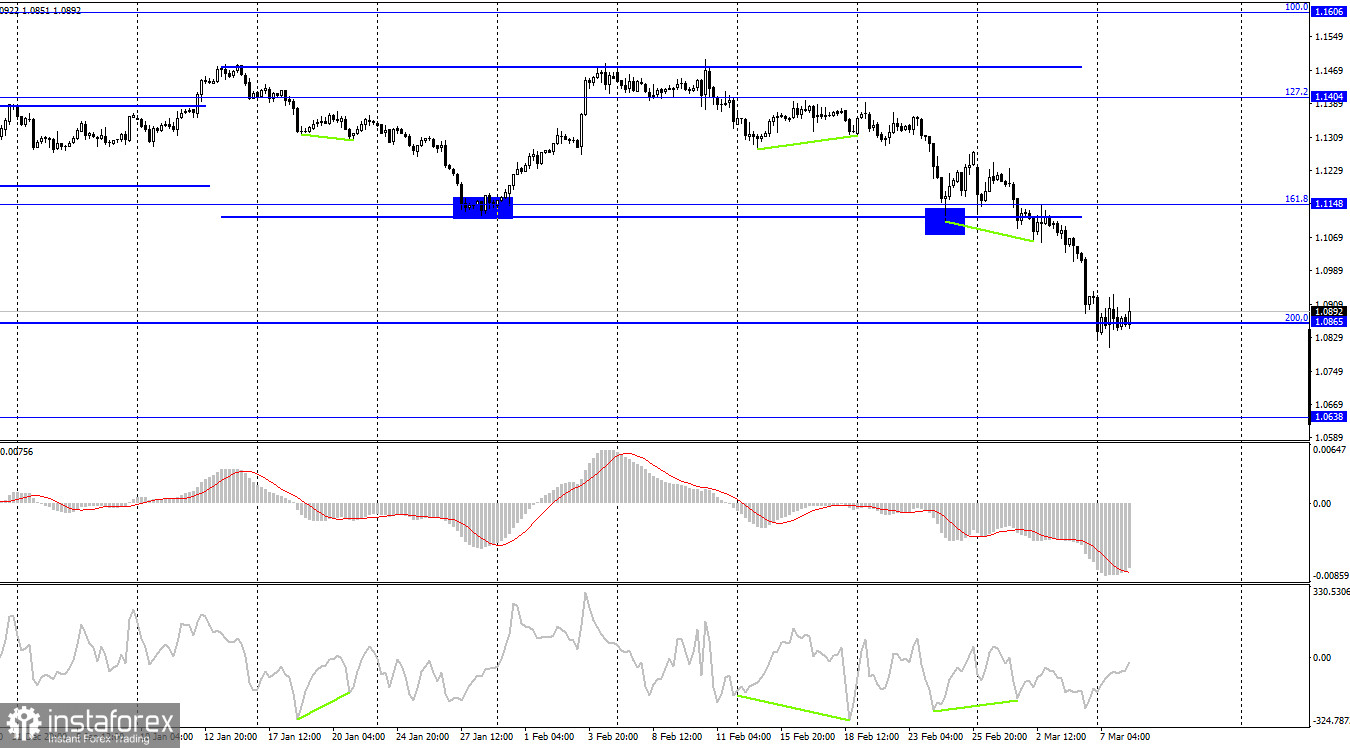

On the 4-hour chart, the pair performed a drop to the corrective level of 200.0% (1.0865) and stopped. The rebound of quotes from this level will allow traders to count on a reversal in favor of the EU currency and some growth of the pair in the direction of the corrective level of 161.8% (1.1148). Closing at 1.0865 will only increase the likelihood of a further fall towards the next level of 1.0638. There are no brewing divergences today.

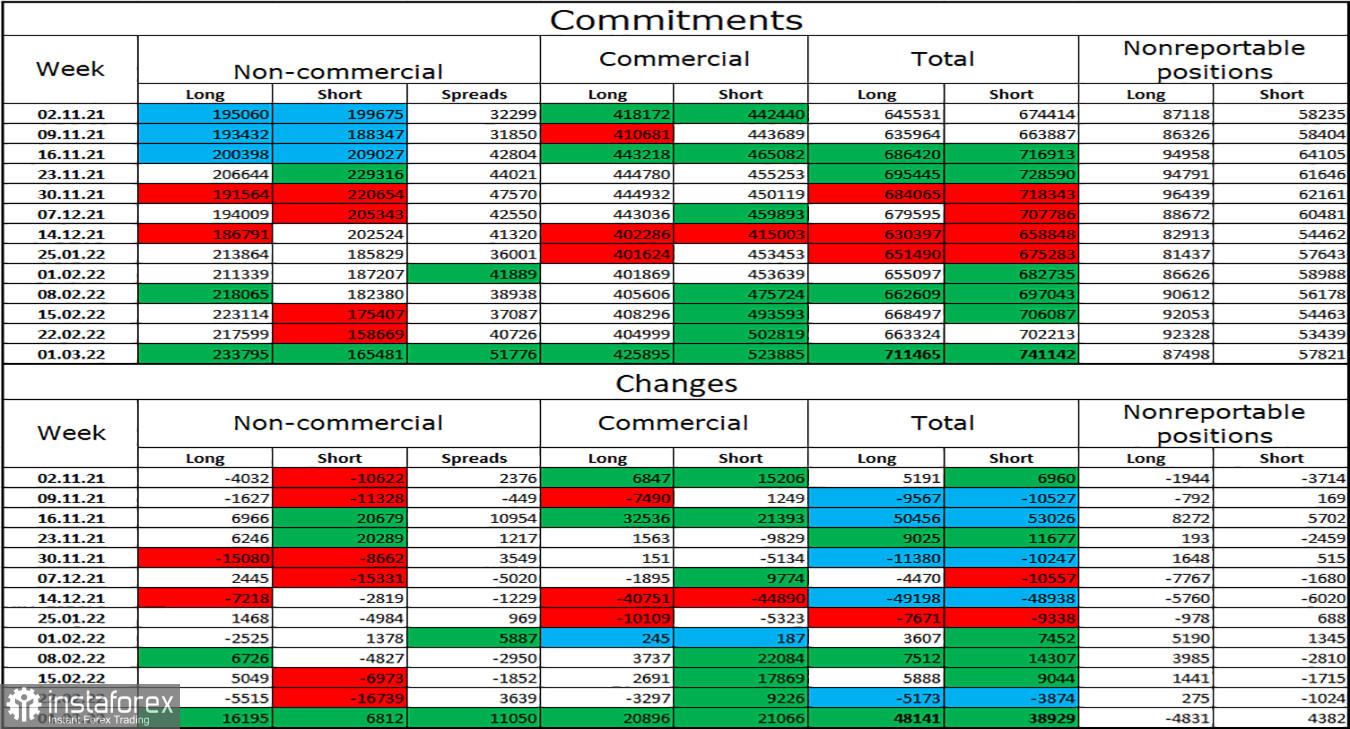

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 16,195 long contracts and 6,812 short contracts. This means that the bullish mood has intensified. The total number of long contracts concentrated on their hands now amounts to 233 thousand, and short contracts - 165 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is also characterized as "bullish". This would allow the European currency to count on growth, if not for the information background, which now supports only the American currency. We are now witnessing a paradoxical situation: the bullish mood of major players is increasing, while the currency itself is falling. And it falls very much. Thus, only geopolitics matters now.

News calendar for the USA and the European Union:

EU - Change in GDP (10:00 UTC).

On March 8, the calendar of economic events of the European Union and the United States contains one interesting entry for two. The GDP report is considered important, but in the current conditions and not at this time. I believe that the influence of the information background will be absent today. Not to be confused with geopolitical news!

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair with targets of 1.0926 and 1.0850 if the closing is performed under the side corridor on the 4-hour chart. Both goals have been achieved. Those who are still in sales can stay in them with a target of 1.0795. New sales - when rebounding from the level of 1.0926. I do not recommend buying a pair, as the drop is too strong now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română