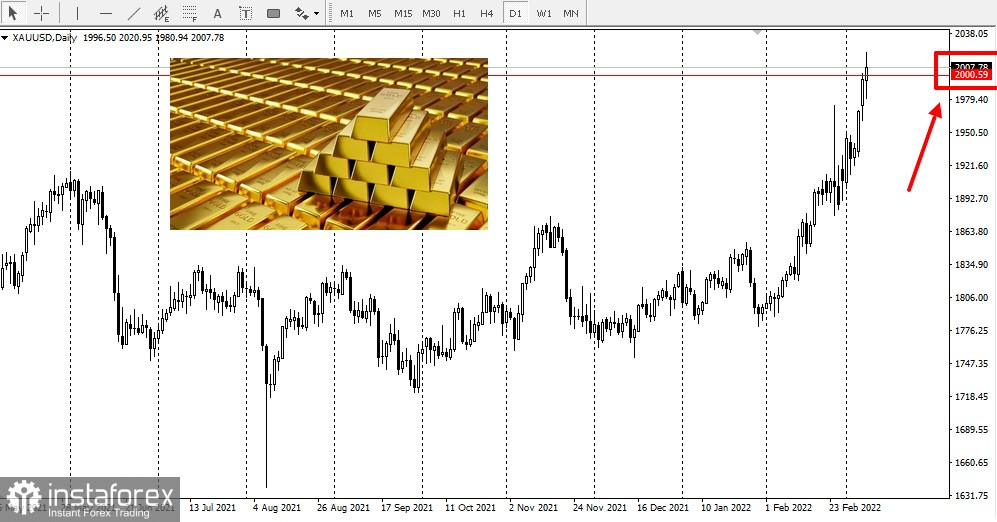

Gold prices continue to rise amid rising inflation and the current crisis in Ukraine. The combination of geopolitical tensions and high inflation is very conducive to higher gold and silver prices going forward as well.

In addition, strong selling pressure, leading to lower U.S. stock prices, is forcing market participants to shift dollars at risk to investments in safe-haven assets.

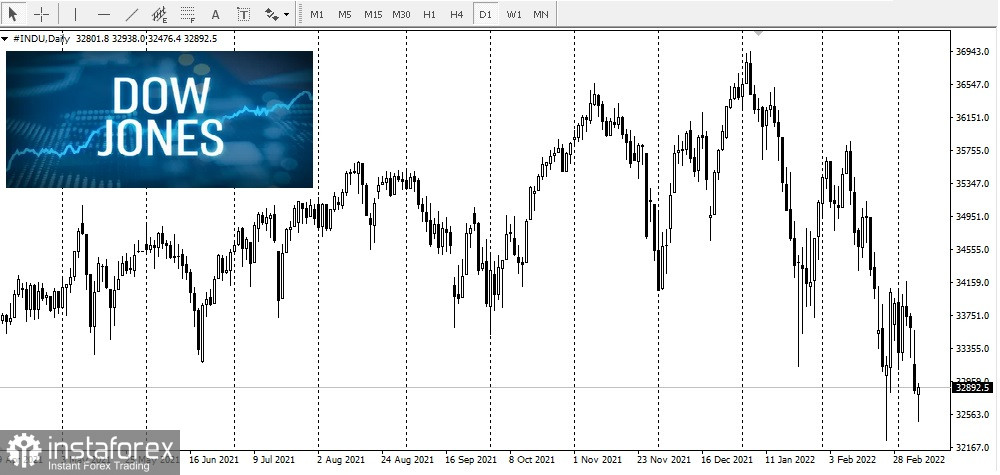

All three major indices fell sharply.

The NASDAQ Composite Index fell 3.21%:

Standard & Poor's 500 down 2.64%:

The Dow Jones Industrial Average fell 2.18%:

The consumer price index (CPI) showed that in January inflation rose to a 40-year high and amounted to 7.5%. Unlike the PCE index (the preferred index used by the Federal Reserve), the CPI includes the cost of energy and food.

Therefore, it is a much more realistic barometer of current inflationary pressures. With crude oil prices rebounding strongly, the CPI for February is likely to reflect higher food and energy prices, with inflation well above 7.5%. On March 10, the Bureau of Labor Statistics will release CPI data for February.

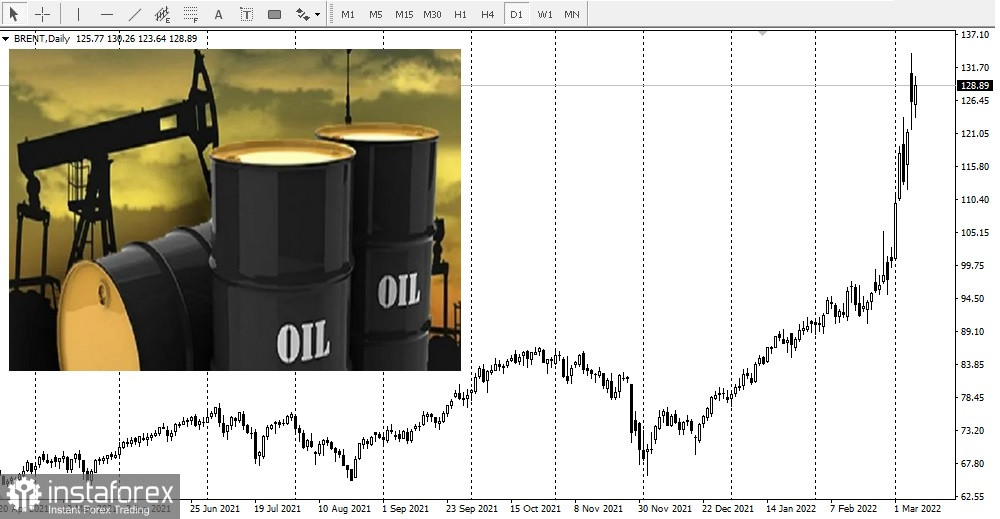

Crude oil futures continue to skyrocket. The most active crude light oil futures contract added 3.14%, or $3.63.

This will be reflected in rising gasoline prices, which can now cost up to five or six dollars a gallon in the United States.

Gold has already surpassed $2,000 an ounce:

The current inflation rate, coupled with the crisis in Ukraine, will continue to provide strong support for gold and lead to even more growth in the prices of the precious metal. Inflationary pressures continue to rise and the conflict in Ukraine continues to escalate, which will certainly continue to support higher gold prices.

Now that gold is trading above $2,000, it is highly likely that $2,000 will become a new support level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română