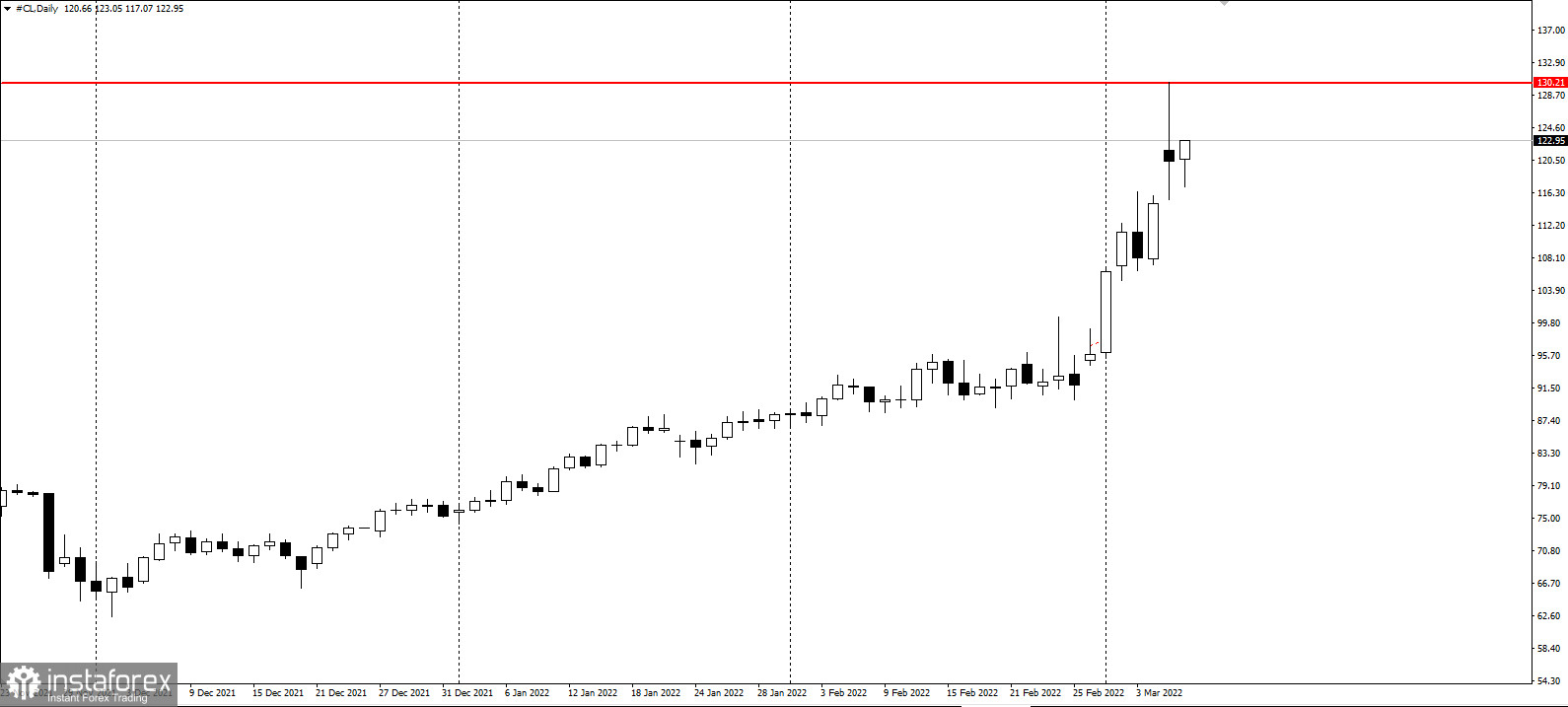

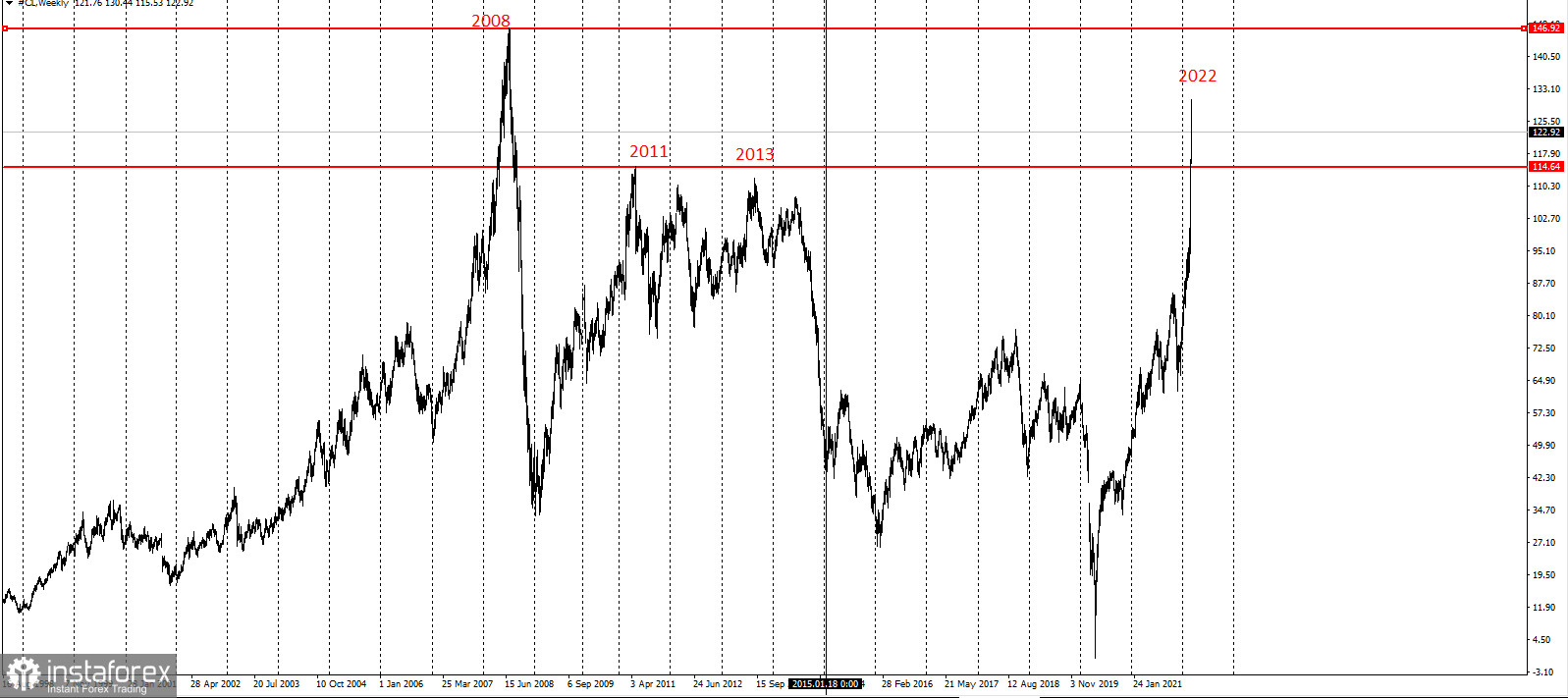

On Monday, oil prices skyrocketed to their highest levels since 2008 amid fears that the US and its European allies will ban Russia's crude imports, while the resumption of oil supply from Iran may take longer than expected.

Since the start of the session, Brent crude has reached $139.13 per barrel, while US West Texas Intermediate (WTI) oil has hit $130.50.

Europe is heavily dependent on Russian gas supplies and a bit less - on its crude oil.

Since early 2022, global oil prices have surged by about 60% along with other commodities, thus raising concerns over the recovery of the global economy and stagflation.

The world's second-largest economy, China, aims for modest economic growth this year at around 5.5%.

On Sunday, US Secretary of State Anthony Blinken said the United States and the European Union were discussing the possibility of banning oil imports from Russia.

At the same time, the US Congress is working on its own set of sanctions targeting Russian oil, even though the United States imports roughly 200,000 bpd of Russian crude and about half a million in refined products that may be difficult to replace because of sanctions against Venezuela and Iran.

According to UBS commodity analyst Giovanni Staunovo, a prolonged war in Ukraine could push Brent above $150 per barrel.

Analysts at Bank of America said if most of Russia's oil exports were cut off, there could be a shortfall of 5 million barrels per day or larger than that, pushing prices to as high as $200.

Experts at JP Morgan predict that oil will soar to $185 this year.

The head of Japan's largest business lobby said on Monday the country's imports of Russian crude could not be replaced immediately.

Analysts, meanwhile, are warning that a ban on Russian oil would push prices even higher.

Russia demanded that the US should guarantee that sanctions it faces over the conflict in Ukraine would not harm its trade with Tehran. Meanwhile, talks to revive Iran's 2015 nuclear deal with world powers came to a standstill.

According to Iranian Foreign Minister Hossein Amirabdollahian, Tehran will not allow "any foreign elements to undermine their national interests."

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română