To open long positions on GBP/USD, you need:

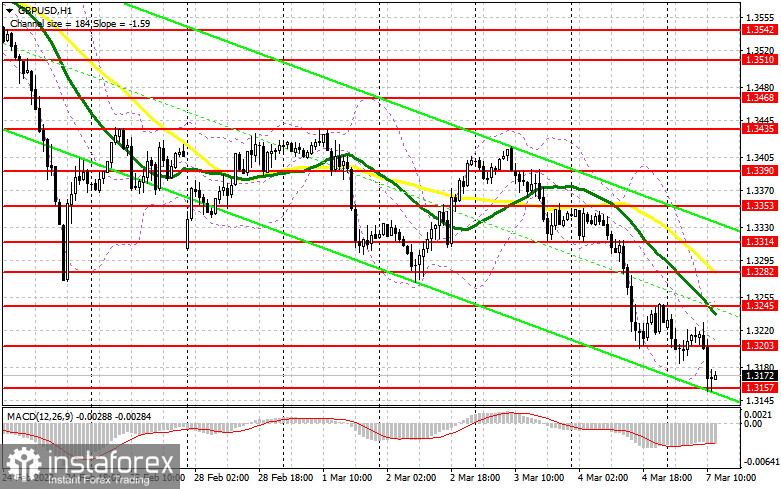

In my morning forecast, I paid attention to the levels of 1.3195 and 1.3157 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. We didn't have to wait long for the breakout of the morning support of 1.3195. Unfortunately, I did not wait for the reverse test from the bottom up, which I indicated on the chart, so I missed the entry point into short positions and fell to the area of 1.3157. After the first test of the new low, a false breakdown was formed, which gave a buy signal, after which the pair rebounded up by 20 points. However, it never came to a larger upward correction. Most likely, the bears will maintain their pressure on the pound in the afternoon. And what were the entry points for the euro this morning?

The lack of positive news continues to affect the mood of investors and traders, which pushes the pound lower. The meeting of Russia and Ukraine will not take place in the near future, which will put pressure on the GBP/USD pair. In the afternoon, a report on the volume of consumer lending in the United States is coming out, which will not play an important role in the future direction, so I advise you to stick to short positions due to the intensification of the geopolitical conflict. While trading will be conducted below 1.3203, we can count on a further fall of the pound on the trend and a breakdown of 1.3157, where the pair stopped today after another sell-off during the European session. Despite recent statements by the head of the Fed that the situation with inflation is under control, the demand for the US dollar continues to increase, as the data suggest the opposite. The labor market report convinced traders of the need for more aggressive actions by the Fed.

The initial task of the bulls this afternoon will be to protect the support of 1.3157. The best option would be to buy in the event of a decline and the formation of a false breakdown there during the release of data on lending in the United States. However, after a false breakdown, active growth of the pair should occur, since this level has already been tested several times during the European session and there is no special confidence in it anymore. If this does not happen, most likely, the pressure on the pound will remain. In this case, I advise you to postpone long positions to a minimum of 1.3111. Only the formation of a false breakdown there will give an entry point to long positions. You can buy the pound immediately on a rebound from 1.3070 or even lower - from a minimum of 1.3034, counting on a correction of 20-25 points within a day. To pause and wait for the formation of a side-channel, bulls need to try to close the day above 1.3203, which they missed in the first half of the day. However, in the current conditions, it will not be so easy to do this. A breakthrough and a test of 1.3203 after very weak US data will lead to an upward correction of the pound. In this case, we can count on further growth in the area of the highs: 1.3245 and 1.3282, where I recommend fixing the profits.

To open short positions on GBP/USD, you need:

The bears declared themselves after breaking another low and now the market is under their control. There is hope that the US data will come out quite well, which will only increase the pressure on the pair. Of course, it is quite dangerous to sell at the lows, so short positions will be the best option after the formation of a false breakdown at 1.3203 - the nearest resistance level. At the same time, the main goal remains the support of 1.3157, around which trading is conducted at the time of writing the forecast. The lack of activity on the part of buyers there, as well as a reverse test of this level from the bottom up, will give an additional entry point into short positions to fall to 1.3111 and 1.3070. A more distant target will be the 1.3034 area, where I recommend fixing the profits. If the pair grows during the American session, it is best to postpone sales. The demolition of 1.3203 may lead to a sharp increase in the pound against the background of sellers' stop orders. In this case, I advise you to open short positions of GBP/USD after a false breakdown in the area of 1.3245, there are moving averages that additionally play on the sellers' side. You can sell the pound immediately on a rebound from 1.3282, counting on a correction within the day by 20-25 points.

The COT reports (Commitment of Traders) for February 22 recorded a sharp increase in short positions and a reduction in long ones. This again led to the return of the negative value of the delta - the market continues to maintain equilibrium even in the conditions of military operations. In the context of a tough geopolitical conflict that has affected almost the entire world, it is not surprising that short positions on risky assets are only beginning to increase. This report has not yet affected the sell-off that was observed at the end of last week, so it's too early to talk about real figures. It also makes no sense to talk about what the policy of the Bank of England or the Federal Reserve System will be since, in the event of an aggravation of the military conflict, it will not matter at all. Now Russia and Ukraine have sat down at the negotiating table, and much will depend on the results of these meetings - there will be a lot of them. In the current conditions, it will not be too correct to consider the COT report, especially considering its secondary information for the trader. I advise you to be quite careful about risky assets and buy the pound only as the tense relations between Russia, Ukraine, the EU, and the USA weaken. Any new sanctions actions against the Russian Federation will have serious economic consequences, which will affect the financial markets. The COT report for February 22 indicated that long non-commercial positions decreased from the level of 50,151 to the level of 42,249, while short non-commercial positions increased from the level of 47,914 to the level of 48,058. This led to the formation of a negative value of the non-commercial net position from the level of 2,247 to the level of -5,809. The weekly closing price rose to 1.3592 against 1.3532.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates the continuation of the bear market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the lower limit of the indicator in the area of 1.3157 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română